Understanding HMRC’s Simple Assessment

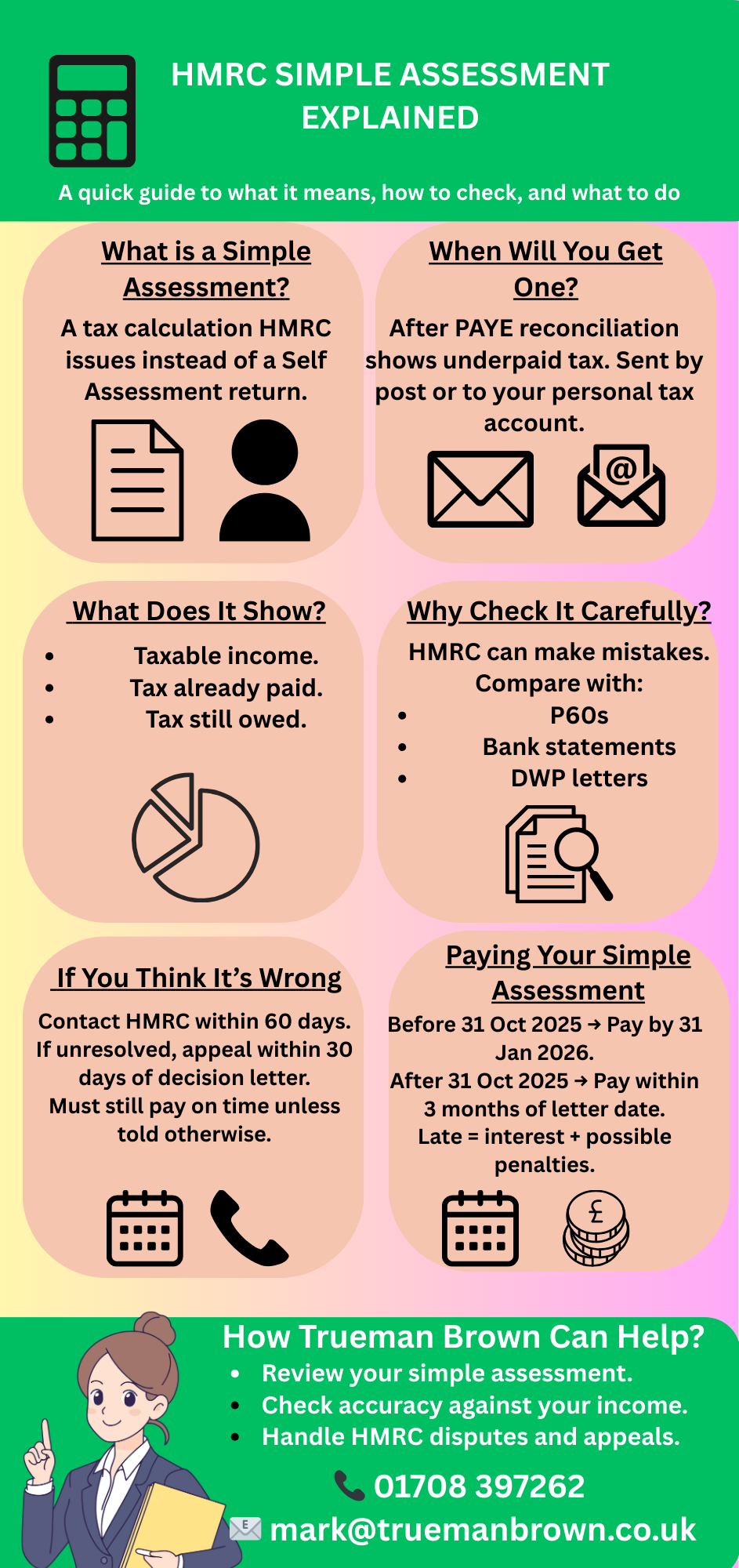

HMRC introduced the simple assessment system to make it easier for taxpayers with straightforward tax affairs to settle underpayments of tax. Instead of having to complete a full Self Assessment tax return, a simple assessment allows HMRC to directly notify you of what you owe, based on information they already hold.

This is particularly useful where underpaid tax cannot be collected through PAYE.

When is a Simple Assessment Issued?

Each year HMRC carries out a PAYE reconciliation. If this shows you owe tax that cannot be collected through your code, HMRC may issue a simple assessment.

The notification is sent either by post or via your personal tax account. The simple assessment will detail your income, tax already paid, and the additional amount due.

Why You Must Check a Simple Assessment Carefully

Although the simple assessment process is designed to be straightforward, HMRC can and do make mistakes.

You should always check the figures in the letter against your own records, such as P60s, bank statements, or Department for Work and Pensions correspondence.

If you are unsure about the numbers, seek professional advice to avoid overpaying.

Challenging a Simple Assessment

If you believe the simple assessment is incorrect, you must contact HMRC within 60 days of the date on the letter.

You can do this in writing or by phone, explaining which figures you think are wrong and providing the correct details.

HMRC will then either send you a revised simple assessment or issue a decision letter if they disagree. If you still don’t agree, you can appeal within 30 days of the decision letter being issued.

It’s important to note that you must still pay the amount shown on the simple assessment by the due date, even if you are appealing, unless HMRC tells you otherwise.

Paying Your Simple Assessment

Tax owed under a simple assessment can be paid online, by bank transfer, or by cheque. The deadline depends on when you received the assessment:

-

If the letter for the 2024/25 tax year is issued before 31 October 2025, payment must be made by 31 January 2026.

-

If the letter is received after 31 October 2025, payment is due within three months of the date on the simple assessment letter.

Late payments attract interest, and HMRC may also charge penalties if the balance remains unpaid.

How Trueman Brown Can Help

Understanding and dealing with a simple assessment can be stressful, particularly if the figures don’t match your records.

At Trueman Brown, we can review your simple assessment, check it against your income details, and liaise with HMRC on your behalf.

We can also assist if you need to challenge or appeal an incorrect assessment.

For personalised help, call us on 01708 397262 or email mark@truemanbrown.co.uk today.

Simple Assessment FAQs

What is a simple assessment?

A simple assessment is a calculation from HMRC showing underpaid tax without the need for a full Self Assessment return.

How do I pay a simple assessment?

You can pay online, by bank transfer, or by cheque, using the payment details in your HMRC letter.

Can I appeal a simple assessment?

Yes, you must first contact HMRC within 60 days. If you disagree with their response, you can appeal within 30 days of their decision letter.

What happens if I ignore a simple assessment?

Ignoring a simple assessment can result in interest, late payment penalties, and HMRC pursuing collection through enforcement action.

Recent Comments