Understanding Capital Allowances for Cars: A Complete Guide

When running a business, the rules on capital allowances for cars can feel confusing compared to other types of assets.

Cars are treated differently, and the tax relief available depends on whether you’re a company, sole trader, or partnership.

Knowing the rules can help you decide the most tax-efficient way to deal with business car expenses.

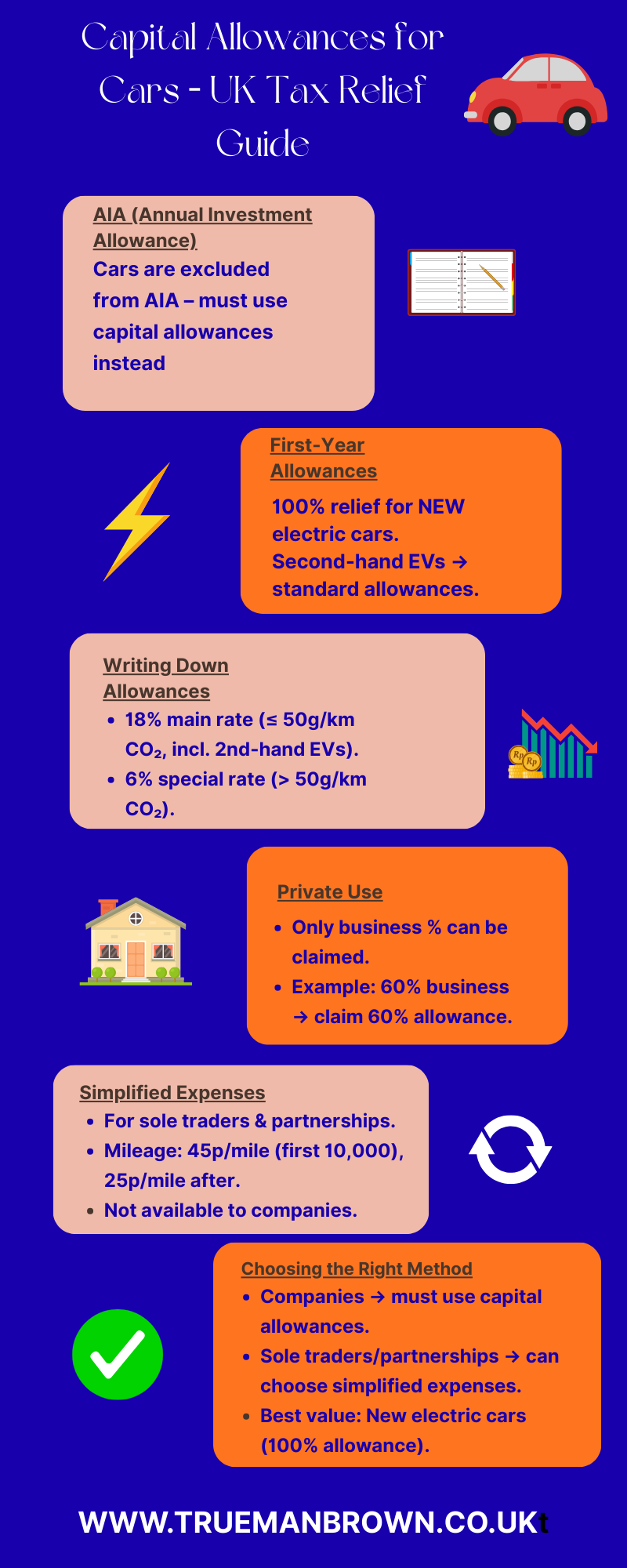

Annual Investment Allowance vs. Capital Allowances for Cars

The Annual Investment Allowance (AIA) allows businesses to deduct the cost of many assets immediately.

However, cars are excluded, which means they must be treated under the rules for capital allowances for cars.

Unless a car qualifies for a first-year allowance, the cost is written off gradually instead of being fully deducted in the year of purchase.

First-Year Allowances and Electric Cars

One of the most attractive aspects of the current rules is the 100% first-year allowance available for new electric cars.

This allows businesses to deduct the full cost in the year of acquisition.

However, the relief is limited to brand-new electric cars—second-hand electric cars must be claimed under standard capital allowances for cars rules, which means spreading the cost over several years.

Writing Down Allowances and Capital Allowances for Cars

For cars that do not qualify for the first-year allowance, businesses rely on writing down allowances. The percentage rate is determined by CO₂ emissions:

-

18% main rate: cars with emissions of 50g/km or less (including second-hand electric cars).

-

6% special rate: cars with emissions above 50g/km.

This system ensures that capital allowances for cars provide tax relief over time rather than upfront.

Private Use Adjustments

Where cars are used for both business and personal purposes, capital allowances must be reduced.

For example, if a sole trader drives a car 60% for business, only 60% of the allowance can be claimed.

The remaining 40% is treated as private use and disallowed under the rules for capital allowances for cars.

Simplified Expenses vs. Capital Allowances for Cars

Sole traders and partnerships may instead choose simplified expenses. This system gives a fixed mileage deduction—45p per mile for the first 10,000 miles and 25p per mile thereafter.

While simple, it cannot be combined with capital allowances for cars. Companies do not have access to this method and must rely solely on capital allowances.

Capital Allowances for Cars: Choosing the Right Method

In summary, the best method depends on your circumstances:

-

Companies must claim capital allowances.

-

Sole traders and partnerships can choose simplified expenses or capital allowances.

-

New electric cars are highly tax-efficient, thanks to the 100% first-year allowance.

-

Other cars will qualify for writing down allowances, based on their CO₂ emissions.

How Trueman Brown Can Help

At Trueman Brown, we specialise in helping businesses navigate complex tax areas such as capital allowances for cars.

Whether you are a company, sole trader, or partnership, our experienced advisors can guide you on the most effective method—be it writing down allowances, simplified expenses, or taking advantage of electric car incentives. To discuss your situation, contact us today at mark@truemanbrown.co.uk or call us on 01708 397262.

FAQs on Capital Allowances for Cars

Q1. Do cars qualify for the Annual Investment Allowance?

No, cars do not qualify for the AIA. Relief is available only through first-year allowances or writing down allowances.

Q2. Can I claim 100% relief on an electric car?

Yes, but only for new electric cars. Second-hand electric cars must be claimed under writing down allowances.

Q3. What if I use my car for both business and personal purposes?

You can only claim for the business portion of the use. For example, if 70% of the mileage is for business, only 70% of the allowance is deductible.

Q4. Can sole traders use mileage instead of capital allowances for cars?

Yes, sole traders and partnerships can use the simplified expenses system. This is based on mileage rates instead of capital allowances.

Q5. Are companies allowed to use simplified expenses?

No, companies must rely solely on capital allowances for cars.

Recent Comments