Loans to Participators: Lending from a Family Company to a Family Member

Making a loan from a personal or family company to a family member may seem straightforward, but it comes with potential tax implications.

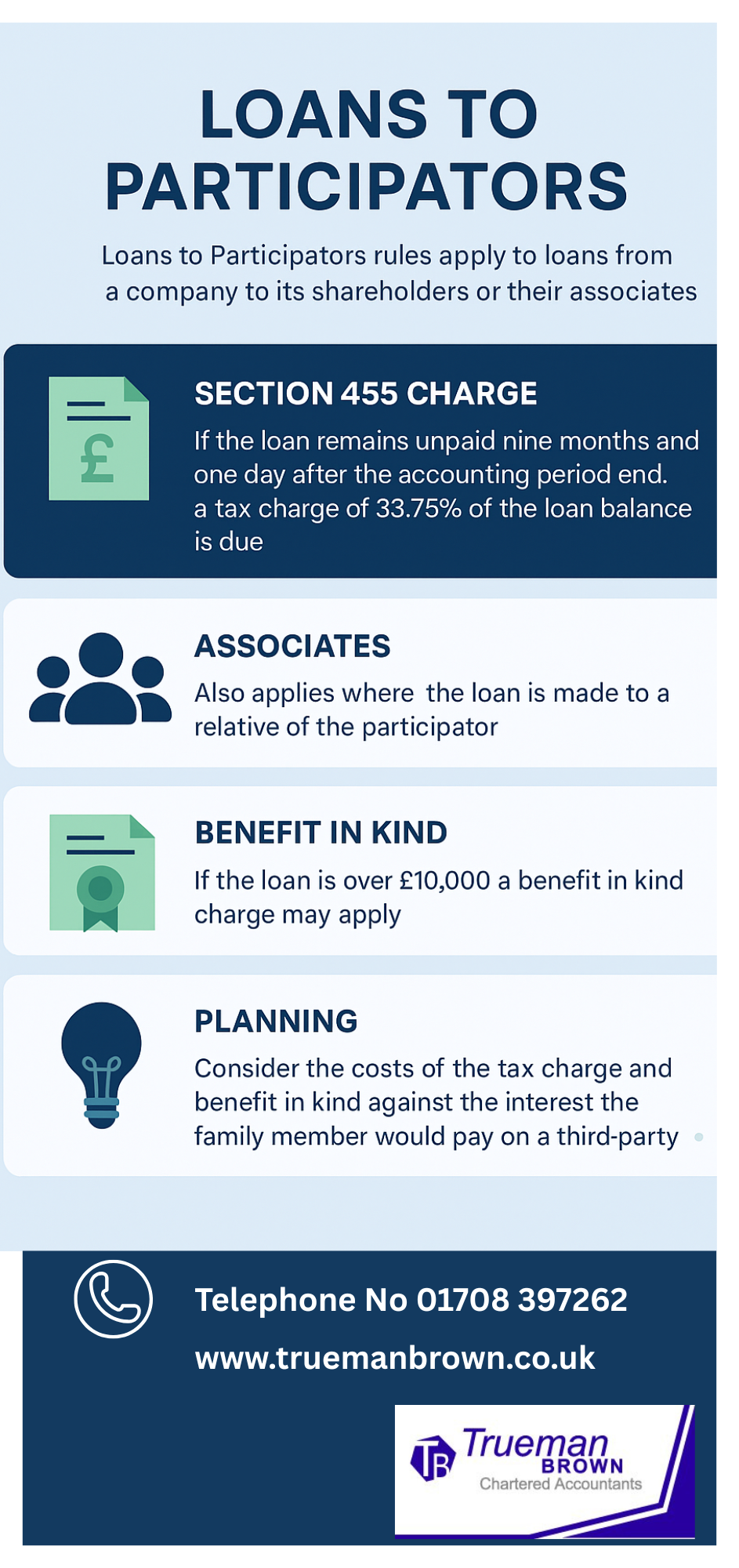

One of the key rules to be aware of is Loans to Participators, which governs loans made by close companies to shareholders or their associates.

Understanding these rules is crucial before lending company funds to relatives, as ignoring them can result in significant tax charges.

What Are Loans to Participators?

Loans to Participators apply to close companies—typically companies controlled by five or fewer people—which includes most personal and family companies.

Under these rules, any loan to a shareholder (participator) or their associate that remains unpaid nine months and one day after the end of the company’s accounting period triggers a tax charge.

This charge, known as the section 455 charge, is 33.75% of the outstanding loan amount and is similar to the top dividend tax rate.

Who Counts as an Associate?

The reach of Loans to Participators is broad.

It doesn’t just apply to shareholders but also to their associates, which include spouses or civil partners, parents, grandparents, children, grandchildren, siblings, and partners of shareholders.

For example, a loan made by a company to a director’s child still falls under these rules, even if the child is not a shareholder.

Example of Loans to Participators in Practice

Consider Louise, the director and sole shareholder of her personal company, L Ltd.

The company loans £100,000 to Louise’s daughter Sophie to help her get on the property ladder.

The loan is interest-free and made on 1 January 2025. I

f the loan remains outstanding on 1 January 2026, Loans to Participators rules mean the company must pay section 455 tax of £33,750, even though Sophie is not a shareholder.

The tax will be repaid once the loan is fully repaid, but in the meantime, it represents a significant cost to the company.

Benefit in Kind and Loans to Participators

If a loan under Loans to Participators exceeds £10,000 at any point in a tax year, a benefit in kind (BiK) charge may arise.

This is based on the difference between the official HMRC interest rate and any interest actually charged, and it can also trigger Class 1A National Insurance contributions.

Companies must report the benefit on a P11D form, adding further administrative responsibilities.

Planning Considerations for Loans to Participators

While loans up to £10,000 for a period of up to 21 months can be made tax-free, larger or longer loans bring tax consequences.

When considering a loan to a family member, weigh the cost of the section 455 charge and any BiK against the interest they would pay on a third-party loan.

The section 455 tax is reclaimable once the loan is repaid, whereas interest on an external loan is a permanent cost.

Planning the loan structure carefully can minimize unnecessary tax exposure.

How Trueman Brown Can Help

At Trueman Brown, we specialise in guiding family and personal companies through the complexities of Loans to Participators.

Our experts can help structure loans to family members in a tax-efficient manner, manage the section 455 implications, and ensure compliance with benefit in kind rules.

For personalised advice, contact us at mark@truemanbrown.co.uk or call 01708 397262.

FAQ: Loans to Participators

Q1: What is a Loan to a Participator?

A loan to a participator is a loan made by a close company to a shareholder or their associate, subject to potential tax charges under section 455 if not repaid within the specified period.

Q2: Who counts as an associate?

Associates include a shareholder’s spouse, civil partner, parents, grandparents, children, grandchildren, siblings, and partners.

Q3: What is the section 455 charge?

It is a temporary tax of 33.75% on any outstanding loan amount nine months after the company year-end.

Q4: Are there other tax implications?

Yes. If the loan exceeds £10,000, a benefit in kind charge and Class 1A National Insurance may also apply.

Q5: Can Trueman Brown help?

Yes. Trueman Brown provides expert guidance on structuring loans efficiently, managing tax exposure, and ensuring compliance. Contact us at mark@truemanbrown.co.uk or 01708 397262.

Recent Comments