Understanding VAT Payback and Clawback Rules: What Businesses Need to Know

Even the best-laid business plans can change, and when they do, your VAT position might change too.

The VAT payback and clawback rules are designed to reflect this reality.

They ensure that VAT recovered on purchases continues to match the actual use of those purchases — particularly when your intentions or business activities shift after the original claim was made.

These rules apply only to input VAT, not output VAT, and determine when you may need to repay or reclaim additional input tax based on how goods or services are ultimately used.

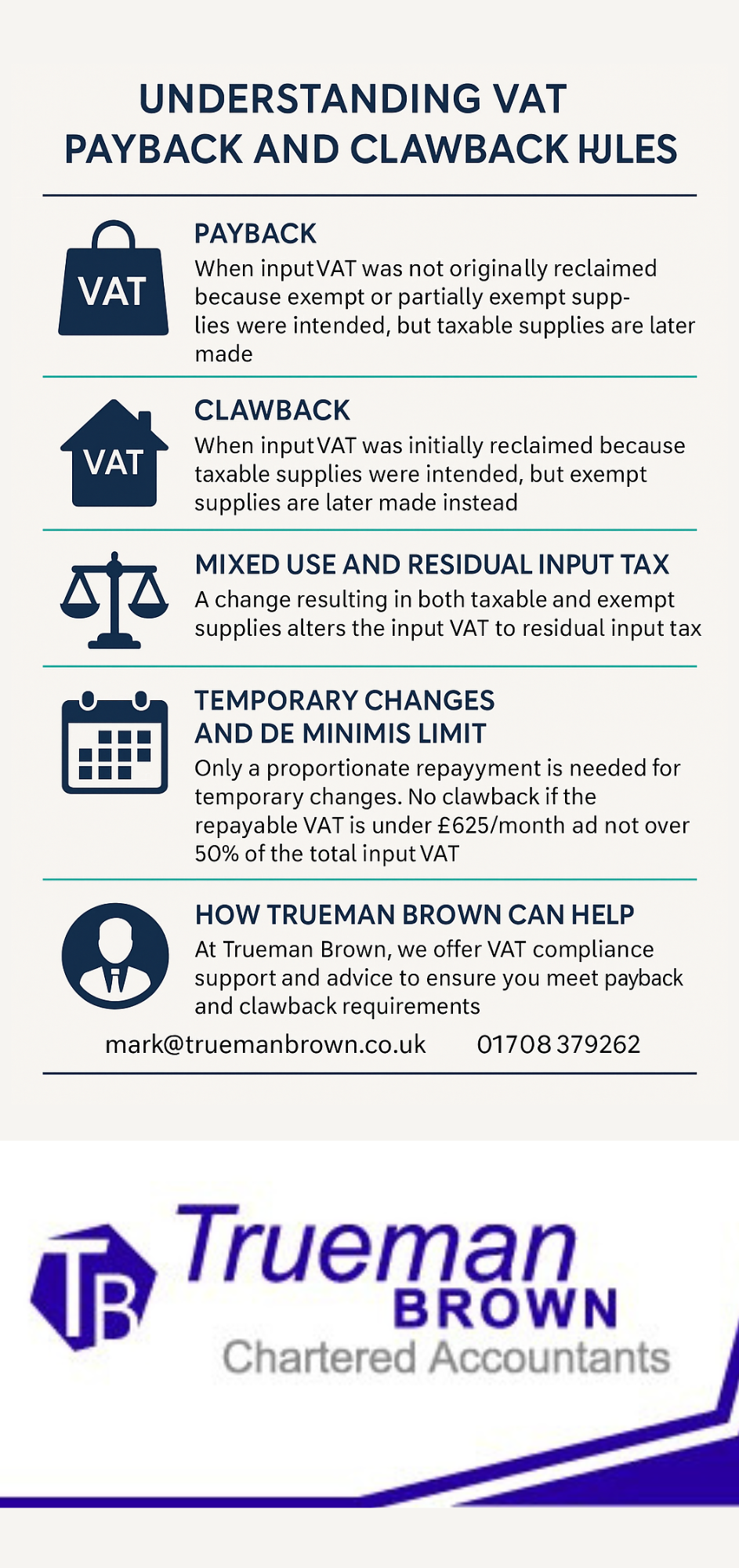

What Are VAT Payback and Clawback Rules?

The payback and clawback rules come into play when there’s a change in the intended use of goods or services after input VAT has been claimed (or not claimed).

In short:

-

Payback allows you to claim extra VAT that you couldn’t initially reclaim because your intention was to make exempt or partially exempt supplies — but you later make taxable supplies instead.

-

Clawback requires you to repay VAT that was previously reclaimed because your intention was to make taxable supplies, but you later make exempt supplies.

Let’s break that down with examples.

The “Payback” Rule Explained

Payback occurs when you initially couldn’t reclaim VAT, but later circumstances change in your favour.

Example:

A VAT-registered business buys office equipment for £1,200 (including £200 VAT). Initially, it plans to use the equipment 50% for business and 50% for personal use, so only £100 VAT is reclaimed.

If the business later increases its business use to 70%, it can reclaim an additional £40 of input VAT. This extra £40 is known as a payback adjustment under the VAT payback and clawback rules.

This ensures the VAT recovered accurately reflects the proportion of business use over time.

The “Clawback” Rule Explained

Clawback works in the opposite direction. It applies when you originally claimed input VAT expecting to make taxable (including zero-rated) supplies — but later switch to making exempt supplies instead.

Example:

A property developer builds a new home intending to sell it (a zero-rated supply) and correctly claims VAT on building costs.

However, due to a downturn, the developer decides to rent the property long-term, generating exempt rental income.

HMRC will then require repayment of the VAT initially claimed, as the actual use has become exempt.

This is a one-off adjustment, and a second clawback would only arise if the building’s use changes again in the future.

Mixed Use and Residual Input Tax

Sometimes, the change in intention leads to mixed use — where an item is used to make both taxable and exempt supplies.

In these cases, the VAT becomes residual input tax, which must be apportioned according to the business’s partial exemption calculation.

This ensures that only the correct proportion of input VAT is recovered, reflecting the actual split of taxable and exempt use.

Temporary Changes and De Minimis Limits

If a change in intention is temporary, only a proportionate repayment is required — often spread over a ten-year adjustment period for property.

There’s also a de minimis rule that can prevent unnecessary clawbacks. No repayment is required if:

-

The repayable VAT averages less than £625 per month, and

-

The amount does not exceed 50% of total input VAT.

A Real Example: Briararch Ltd and Curtis Henderson Ltd [1992] STC 732

This court case illustrates how intention plays a crucial role in the VAT payback and clawback rules.

The developers built a property intending to sell it (a zero-rated supply) and reclaimed input VAT.

When the property market collapsed, they were forced to let the property instead (an exempt supply).

HMRC sought to recover all the VAT through clawback.

However, the High Court ruled that since the developers still intended to sell when the market improved, only partial clawback was appropriate — the underlying intention to make a taxable supply remained.

Timing and Practical Application

If your change of intention occurs after the financial year-end but within six years of the VAT period in which you made the original claim:

-

The adjustment (either repayment or payback) should be made in the VAT return covering the period when the change occurred.

-

The original claim remains valid, as it reflected the correct position at the time.

This approach helps maintain fairness — recognising that intentions were genuine and correct when the VAT was first recovered.

🤝How Trueman Brown Can Help With VAT Payback And Clawback Rules

Navigating the VAT payback and clawback rules can be complex, especially when business activities, property intentions, or use of assets change over time.

At Trueman Brown, we help businesses ensure their VAT position stays compliant while optimising their cash flow.

Whether you’re a property developer, service provider, or business with mixed supplies, our VAT specialists can:

-

Review your VAT recovery and identify potential payback or clawback adjustments

-

Assist with partial exemption calculations and HMRC compliance

-

Provide proactive VAT planning to minimise risks and avoid unexpected repayments

📧 Email: mark@truemanbrown.co.uk

📞 Phone: 01708 397262

❓Frequently Asked Questions About The VAT Payback And Clawback Rules

(FAQ)

1. What triggers VAT payback or clawback?

A change in the intended or actual use of goods or services after VAT has been claimed or not claimed.

2. Are payback and clawback adjustments one-off events?

Usually, yes. However, further adjustments can arise if the business use changes again in the future.

3. How long after the original claim can adjustments be made?

Adjustments can be made within six years of the VAT period in which the input VAT was first claimed.

4. What if the change in use is temporary?

Only a proportionate adjustment is needed, often spread over the ten-year adjustment period (mainly for property).

5. Do the rules apply to output VAT?

No — they apply only to input VAT, affecting how much VAT you can reclaim or must repay.

Recent Comments