Understanding Pre-letting Property Expenses

When you purchase a property to let, you may incur pre-letting property expenses before the first tenancy begins.

It’s important to know how these costs are treated for tax purposes, because the relief available depends on whether the expenditure is revenue or capital in nature, and whether the letting business has officially started.

1. When Does Your Property Business Start?

The concept of pre-letting property expenses matters most when assessing when your property rental business begins.

In most cases, a property letting business starts on the date when the first tenancy begins and rental income arises.

Until that point, any costs incurred are classed as pre-commencement.

For your first let property, the business commencement date is typically the date you first receive rent from the tenant.

Any pre-letting property expenses incurred before that date may still qualify for relief, but they must meet specific conditions.

2. Relief for Pre-commencement Pre-letting Property Expenses

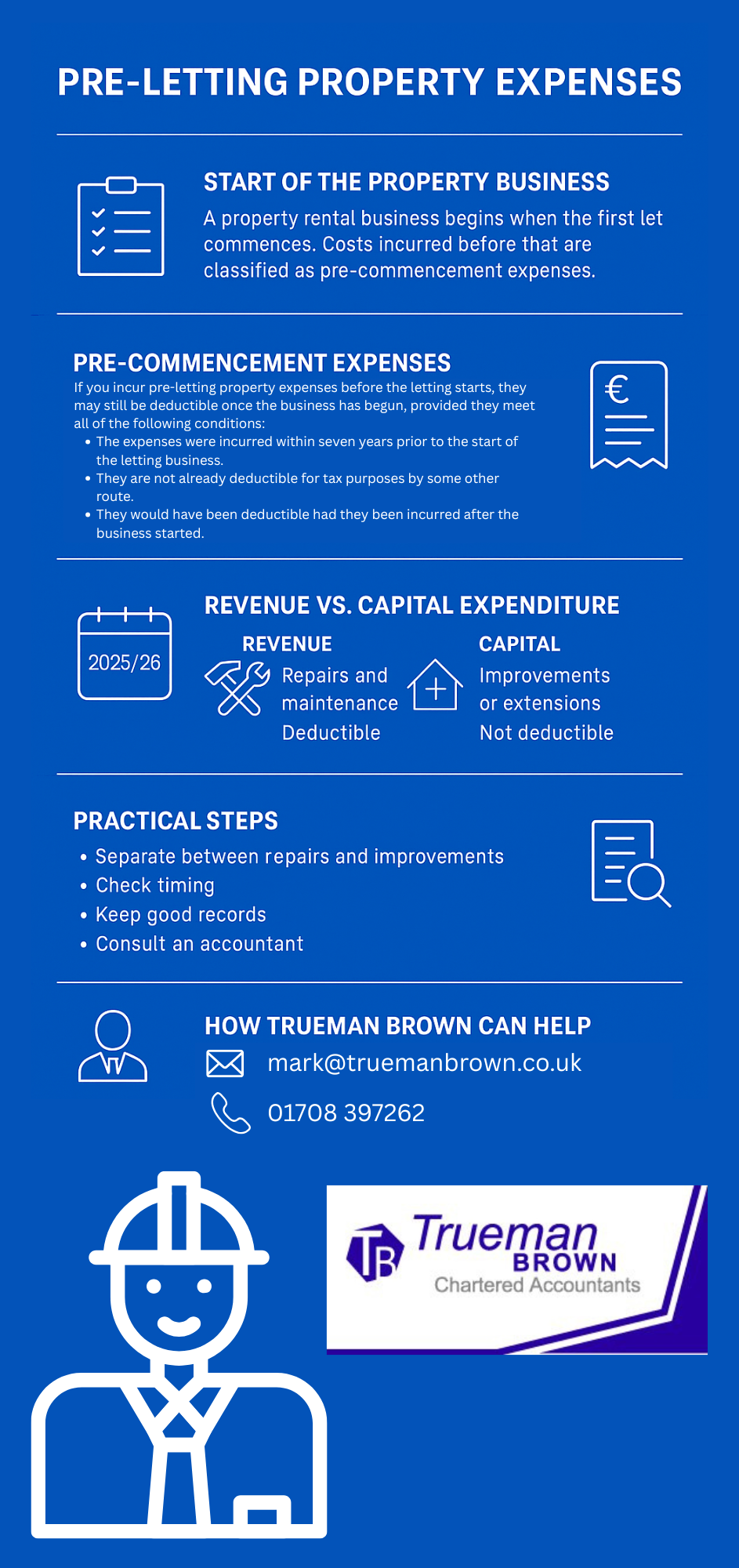

If you incur pre-letting property expenses before the letting starts, they may still be deductible once the business has begun, provided they meet all of the following conditions:

-

The expenses were incurred within seven years prior to the start of the letting business.

-

They are not already deductible for tax purposes by some other route.

-

They would have been deductible had they been incurred after the business started.

When those conditions are satisfied, HM Revenue & Customs treats the pre-commencement expenditure as if it were incurred on the first day of the business, enabling deduction against rental profits once letting begins.

3. Distinguishing Revenue vs Capital Expenditure in Pre-letting Property Expenses

A key part of assessing your pre-letting property expenses is determining whether the cost is an ordinary repair (revenue) or a capital improvement.

-

Revenue expenditure is deductible against rental profits. This includes tasks such as redecorating, making good wear and tear, replacing like-for-like items. If your pre-letting costs are of this nature, relief may be available.

-

Capital expenditure is not deductible against rental income. This would include works that improve the property, extend it, or upgrade assets beyond their previous standard. Those costs cannot be deducted as part of the property business’s income tax calculation; they must instead be considered for capital gains tax when you dispose of the property.

For example, replacing a kitchen with a similar specification might be revenue, but installing a high-end designer kitchen or adding an extension would be capital.

4. How the 2025/26 Tax Year Rules Affect Pre-letting Property Expenses

It’s essential to consider how recent tax changes affect your pre-letting property expenses for 2025/26:

-

The general rules on allowable expenses remain: you must incur costs wholly and exclusively for the letting business.

-

The tax rates for 2025/26 remain broadly as previously: landlords will pay 20% on rental profits between £12,571 and £50,270, 40% between £50,271 and £125,140, and 45% above that.

-

For capital allowances and plant & machinery relief, from April 2025 it is no longer possible for furnished holiday lets (FHL) landlords to claim new capital allowances on plant and machinery.

-

Record-keeping and the rollout of digital tax reporting (“Making Tax Digital” for Income Tax) remain important considerations for landlords, particularly in relation to tracking your pre-letting property expenses.

-

The distinction between repairs and improvements remains critical for classifying your pre-letting property expenses correctly.

5. Practical Steps for Claiming Pre-letting Property Expenses

To maximise relief for your pre-letting property expenses, follow these steps:

-

Separate items that are repairs/maintenance (likely revenue) from items which constitute improvements (capital).

-

Ensure timing: if the letting business hasn’t started yet, check that the costs were incurred within the seven-year window and meet the “would have been deductible” test.

-

Keep detailed records: invoices, receipts, dates incurred, purpose of the work, description of whether it was to prepare the property for letting, condition before and after.

-

Use the correct basis: if you use the cash basis for rental income, check whether these costs fall within cash basis allowable expenditure rules for capital items.

-

Consult your accountant: especially if you’re unsure whether something is capital or revenue, or if it’s your first property letting and you have significant pre-letting costs.

6. How Trueman Brown Can Help

If you’d like support with determining which of your pre-letting property expenses are allowable, and how to claim them correctly for the 2025/26 tax year, our team at Trueman Brown is ready to assist.

You can contact us at mark@truemanbrown.co.uk or call 01708 397262 for expert advice.

We can review your property business start date, assess your pre-letting costs, classify them correctly (revenue vs capital), advise on record-keeping, and help prepare your tax return so you maximise relief and minimise risk.

7. Frequently Asked Questions

Q1. What counts as a “pre-letting property expense”?

A: These are costs you incur before the official start of your property letting business (i.e., before first rent is achieved) to prepare the property for letting — for example, decorating, minor repairs, cleaning, replacing carpets.

Q2. Can I deduct pre-letting costs if I already have other rental properties?

A: Yes — but if you already have an existing property rental business, you cannot treat the cost as pre-commencement for a new business. Instead the costs tie into the existing business and must be revenue expenses (if maintenance) or capital improvements (if upgrades) to be deductible accordingly.

Q3. What types of pre-letting property expenses are not deductible?

A: Costs that are capital in nature — such as extensions, significant improvements, installing a superior kitchen, or refurbishments that enhance value rather than maintain condition — cannot be deducted against rental income. They would instead be considered when calculating capital gains on sale.

Q4. If I incur pre-letting expenses and then never let the property, what happens?

A: If the letting business has not commenced, and you never start letting, you cannot treat those costs as deductible against rental income because the business never began. You may need to treat the costs as capital (part of your cost base) if you sell the property.

Q5. Are there any recent rule changes I should know about for 2025/26?

A: Yes. Notably: the continued restriction of mortgage interest relief (tax credit basis) for buy-to-let landlords; the removal of new plant and machinery capital allowances for FHLs from April 2025; and the increased emphasis on digital record-keeping and potential implementation of Making Tax Digital for Income Tax for landlords. You must ensure your pre-letting property expenses are properly documented and classified.

Q6. How soon after incurring pre-letting property expenses can I claim them?

A: Once the letting business begins (i.e., first rent), you can treat qualifying pre-commencement pre-letting property expenses as if incurred on that start date — subject to the seven-year window and “would have been deductible” test.

Recent Comments