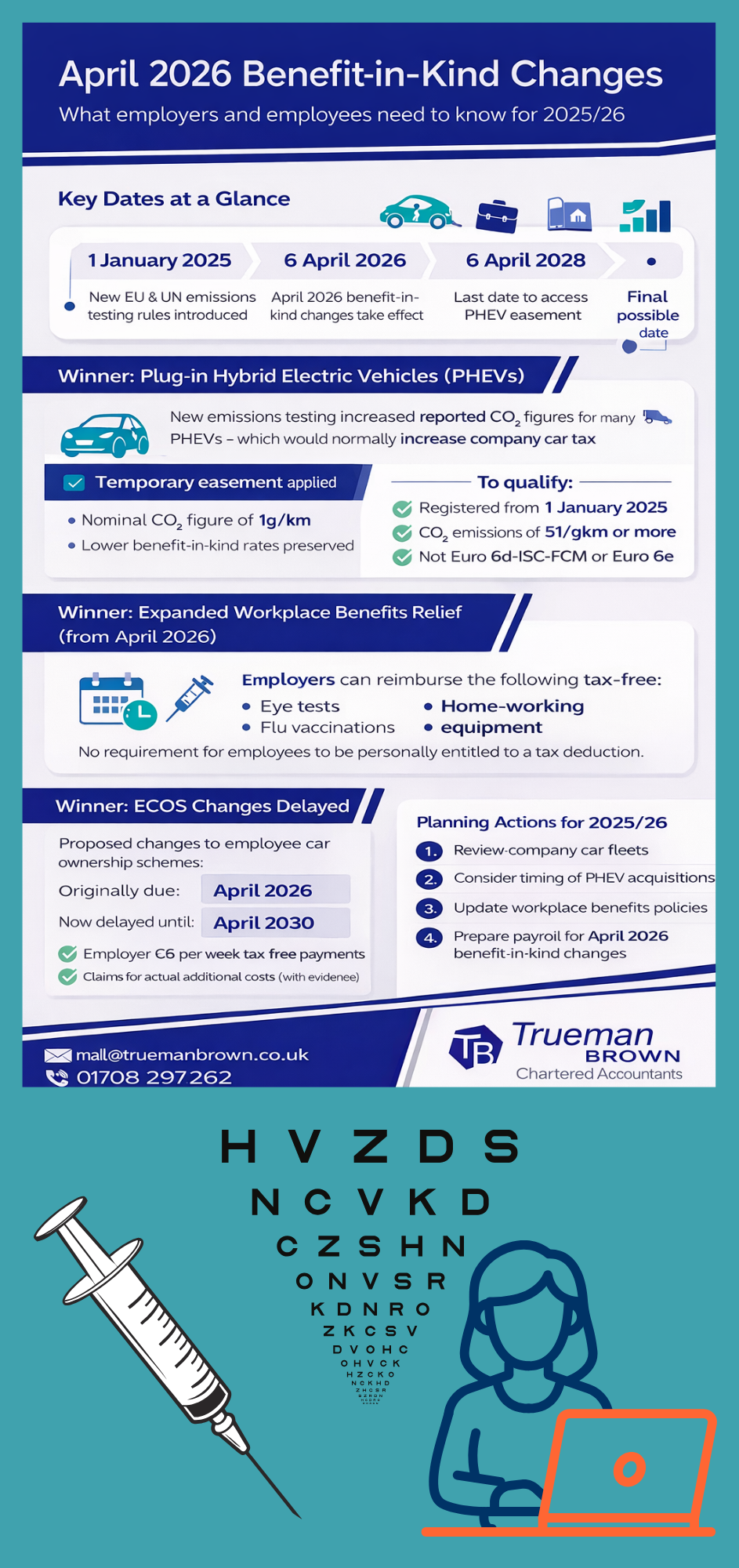

April 2026 benefit-in-kind changes: winners, losers and planning points for 2025/26

The April 2026 benefit-in-kind changes introduced in the Budget represent one of the most significant shake-ups to employee taxation in recent years.

While some measures will increase costs for employees, others offer valuable opportunities for employers to improve tax efficiency, particularly around company cars, workplace benefits and homeworking arrangements.

With the 2025/26 tax year acting as a crucial transition period, understanding these April 2026 benefit-in-kind changes now is essential for effective planning.

April 2026 benefit-in-kind changes: plug-in hybrid electric vehicles (PHEVs)

Under the benefits in kind rules, company car tax is calculated mainly by reference to a vehicle’s list price and its CO₂ emissions.

From 1 January 2025, new EU and UN emissions testing standards came into force, increasing the reported CO₂ emissions for many plug-in hybrid electric vehicles (PHEVs).

Ordinarily, this would have resulted in higher taxable benefits under the company car tax changes.

Temporary easement for PHEVs

As part of the wider April 2026 benefit-in-kind changes, the government introduced a temporary easement.

For qualifying vehicles, the taxable benefit will be calculated using a nominal CO₂ figure of 1g/km, rather than the higher tested emissions.

Where emissions fall between 1g/km and 50g/km, the applicable benefit percentage continues to depend on the vehicle’s electric-only range.

Conditions for eligibility

To qualify for the easement:

-

the car must be first registered on or after 1 January 2025;

-

the official CO₂ emissions must be 51g/km or above;

-

the vehicle must not be registered under Euro 6d-ISC-FCM or Euro 6e standards; and

-

the electric range must be at least one mile.

The easement applies retrospectively from 1 January 2025. Any employee provided with an eligible PHEV before 6 April 2028 can continue to benefit until:

-

the arrangement is varied or renewed, or

-

5 April 2031, if earlier.

This is a key planning opportunity ahead of the April 2026 benefit-in-kind changes.

Workplace benefits relief under the April 2026 benefit-in-kind changes

Currently, reimbursed employee expenses are only tax-free if the employee would have been entitled to claim a deduction had they paid the cost personally.

From 6 April 2026, the April 2026 benefit-in-kind changes significantly widen workplace benefits relief.

Employers will be able to reimburse the following tax-free, regardless of deductibility:

-

flu vaccinations, and

-

homeworking equipment.

This reform simplifies compliance, reduces payroll administration and supports employee wellbeing, particularly in hybrid and remote working environments.

Delayed ECOS reforms and April 2026 benefit-in-kind changes

Legislation had been expected to bring certain vehicles provided under employee car ownership schemes (ECOS) within the company car tax regime from 6 April 2026.

As part of the revised April 2026 benefit-in-kind changes, these reforms have now been delayed until 6 April 2030. This gives employers additional time to:

-

review existing ECOS arrangements,

-

assess long-term fleet strategies, and

-

plan for future company car tax changes.

Homeworking expenses and April 2026 benefit-in-kind changes

Not all of the April 2026 benefit-in-kind changes are favourable. A key withdrawal affects homeworking expenses tax relief.

From 6 April 2026, employees will no longer be able to claim the flat-rate £6 per week deduction for additional homeworking costs under the administrative easement.

This relief was worth:

-

£124.80 per year to higher-rate taxpayers, and

-

£62.40 per year to basic-rate taxpayers.

What relief remains?

Despite the April 2026 benefit-in-kind changes:

-

-

employers may still pay £6 per week tax-free for homeworking costs, and

-

employees can still claim relief for actual additional costs incurred, although this requires detailed records and evidence.

-

How Trueman Brown can help with the April 2026 benefit-in-kind changes

The April 2026 benefit-in-kind changes present both risks and opportunities for employers and employees. Early advice is critical to avoid unnecessary tax costs and to take full advantage of the available reliefs during the 2025/26 tax year.

Trueman Brown can help you:

-

review company car and PHEV arrangements,

-

assess exposure to benefit-in-kind charges,

-

structure tax-efficient workplace benefits,

-

prepare for the withdrawal of homeworking expense relief, and

-

plan ahead for future company car tax changes.

📧 Email: mark@truemanbrown.co.uk

📞 Phone: 01708 397262

April 2026 benefit-in-kind changes: FAQs

When do the April 2026 benefit-in-kind changes take effect?

Most changes take effect from 6 April 2026, with some measures (such as the PHEV easement) applying earlier from 1 January 2025.

Are PHEVs still tax-efficient after April 2026?

Yes, provided they qualify for the temporary easement. The April 2026 benefit-in-kind changes preserve favourable treatment for many PHEVs until at least 2031.

Can employees still claim homeworking expenses?

The flat-rate claim ends from April 2026, but claims for actual additional costs remain available.

Do employers need to change payroll processes?

Yes. Expanded workplace benefits relief and withdrawn easements mean payroll and expense policies should be reviewed during 2025/26.

Should businesses act now?

Absolutely. The April 2026 benefit-in-kind changes make the 2025/26 tax year a key planning window.

Recent Comments