Have you overpaid under the VAT flat rate scheme?

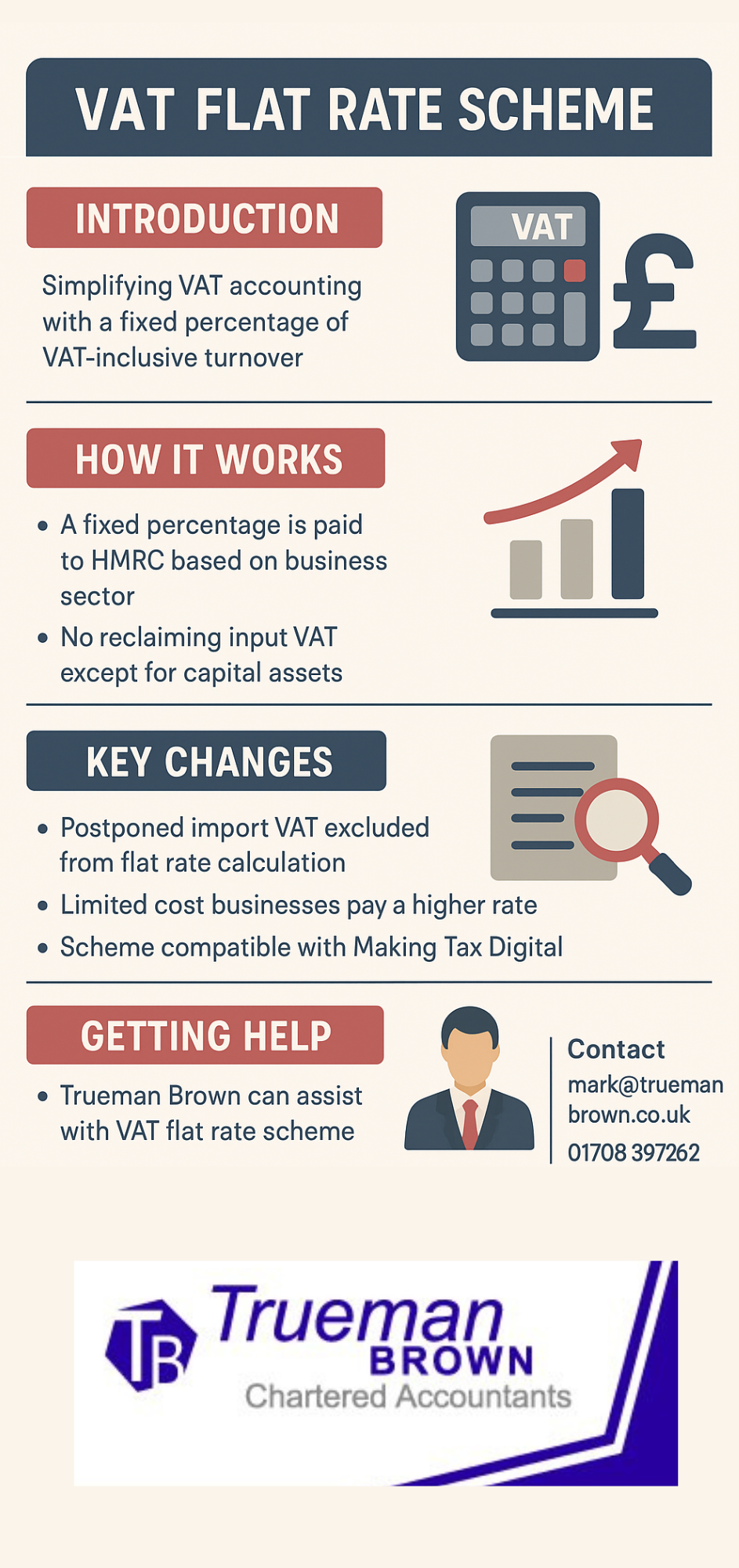

Many small businesses consider the VAT flat rate scheme to simplify their VAT accounting: under it, you pay a fixed percentage of your VAT-inclusive turnover to HMRC rather than tracking input VAT on purchases. But changes over time – and occasional tribunal rulings – mean that some businesses might have been paying too much.

This article explains the scheme, the major legal updates, how past mis-applications might be corrected, and how VAT flat rate scheme overpayments claims may still be possible.

What is the VAT flat rate scheme?

Under normal VAT accounting, a trader charges VAT on sales (output tax) and claims back VAT on allowable purchases (input tax), paying or reclaiming the difference.

Under the VAT flat rate scheme, a business instead pays HMRC a fixed percentage of its VAT-inclusive turnover. In return, it generally cannot reclaim VAT on its purchases (except for capital assets over a threshold).

This trades off record-keeping simplicity against possible loss of input VAT recovery.

That fixed percentage depends on the business sector, though limited cost businesses pay a higher “special” rate.

You’re eligible to use the VAT flat rate scheme if (among other criteria) your VAT taxable turnover (excluding VAT) is expected to be £150,000 or less in the next 12 months.

If your turnover exceeds certain thresholds (e.g. £230,000 including VAT) or other conditions change, you must leave the scheme.

You get a 1 % discount from your flat rate percentage in your first year of being VAT-registered (not necessarily your first year under the scheme) — for example, you might use 9 % instead of 10 %.

How HMRC treats import VAT since June 2022

From 1 June 2022, import VAT accounted for via postponed import VAT accounting should be excluded from your flat rate turnover and dealt with outside the scheme (recorded in box 1 of your VAT return). Previously, imports had to be included in turnover for the flat rate calculation; that is no longer correct.

Key legislative changes and tribunal decisions affecting the VAT flat rate scheme

Over the years, a number of adjustments and tribunal rulings have reshaped how the VAT flat rate scheme must be applied.

Tribunal rulings on business classification and industry categories

A long-running issue has been how businesses classify themselves for choosing the correct flat rate percentage. For example, HMRC had been insisting on strict industry categories (e.g. “civil engineers”, “management consultants”) even where the business’s actual activity differed. Two cases (SSL Subsea Engineering Ltd and Idess Ltd) successfully challenged HMRC’s forced classification.

Following these, in March 2016, VAT Notice 733 was amended to require the use of “ordinary English” to interpret which trade category most closely describes the business, rather than seeking to shoehorn into rigid labels.

A further case involved JKK Engineering, which challenged HMRC’s refusal to allow retrospective correction. The tribunal allowed retrospective amendment in certain cases.

These rulings suggest that some businesses might have been paying under an incorrect flat rate percentage and may have a basis to claim refunds for past overpayments (within time limits).

The introduction of “limited cost businesses” (from 1 April 2017)

From 1 April 2017, HMRC introduced a new rule: if a business’s expenditure on “goods” is low (below 2 % of turnover, or less than £1,000 per year), then it is classed as a limited cost business and must pay a flat rate of 16.5 %, rather than its sector-specific lower rate.

The aim was to counter perceived abuses of the scheme, by preventing low-cost businesses from gaining too large a margin under flat rates.

Making Tax Digital and digital record requirements

Although the initial blog referenced fears that Making Tax Digital (MTD) would affect the flat rate scheme, as of now the flat rate scheme is compatible with MTD for VAT.

Businesses using the flat rate scheme must use MTD-compliant software and maintain digital records in line with MTD rules.

Thus the flat rate scheme hasn’t been abolished, but its operation must now coexist with digital record keeping requirements.

Can you recover overpaid VAT under the VAT flat rate scheme?

If you believe you have been applying the VAT flat rate scheme incorrectly — for example, using a wrong industry percentage, misclassifying yourself, or ignoring the limited cost business rules — you might have a claim for retrospective correction, subject to time limits (usually up to 4 years for VAT overpayments).

Tribunal precedents (e.g. the JKK case) show that retrospective claims are possible in certain circumstances.

However:

-

You will need good supporting records (sales invoices, classification rationale, calculations showing what you should have paid).

-

HMRC may resist if it believes earlier returns were accepted as valid.

-

You must check specific time-limit rules and whether relief is still allowable under current VAT law.

It is not guaranteed that all businesses will have overpaid or be eligible for a refund — but it is worth a professional review to see if a claim is viable.

How Trueman Brown can help you with the VAT flat rate scheme

If you suspect you’ve overpaid VAT under the VAT flat rate scheme or want to ensure your current usage is correct and optimised, Trueman Brown can assist you every step of the way.

We can:

-

review your historical VAT returns under the flat rate scheme;

-

advise whether your business classification or choice of flat rate percentage was correct;

-

prepare and submit correction claims (subject to time limits);

-

advise whether continuing under the flat rate scheme is still beneficial (or whether another VAT scheme would be better);

-

ensure your VAT records and digital systems comply with MTD requirements.

To discuss your case, you can contact Mark at mark@truemanbrown.co.uk or call 01708 397262.

We’ll provide a tailored assessment and recommend the best approach for your business.

FAQ — VAT flat rate scheme

Q1: Who can use the VAT flat rate scheme?

You must be VAT registered, and your VAT taxable turnover (excluding VAT) should be expected to be £150,000 or less over the next 12 months. You cannot join if you left the scheme within the last 12 months, or if you are ineligible due to using margin or capital goods schemes, or other restrictions in VAT Notice 733.

Q2: How much do you pay under the VAT flat rate scheme?

You pay a fixed rate percentage (based on your business sector) multiplied by your VAT-inclusive turnover. You keep any difference between what you charge customers and what you owe HMRC under that rate. If you’re classed as a limited cost business, you must use the higher 16.5 % rate.

Q3: Can I reclaim VAT on purchases?

Under the flat rate scheme you generally cannot reclaim input VAT on purchases — except for single capital assets costing £2,000 or more (including VAT), which are dealt with outside the scheme.

Q4: What about import VAT?

Since 1 June 2022, import VAT accounted under postponed import VAT accounting must be excluded from your flat rate turnover and handled separately on your VAT return.

Q5: Can I get a refund if I overpaid under the VAT flat rate scheme?

Yes — if you can demonstrate you mis-classified your business, used the wrong flat rate, or failed to apply correct rules, you may be able to claim a retrospective correction (typically up to 4 years). Tribunal precedent supports this in certain cases. But you’ll need solid evidence and to act within time limits.

Q6: When must I leave the scheme?

You must leave the scheme if, at your anniversary of joining, your turnover exceeds £230,000 (including VAT), or you expect your turnover in the next 12 months will exceed £230,000 (including VAT). You also must leave if you become ineligible or if your circumstances change (e.g. you join a margin scheme).

Q7: Does the 1 % discount still apply for new registrants?

Yes. New VAT-registered businesses still qualify for a 1 % reduction in their flat rate percentage (for the first 12 months of VAT registration).

If you’d like us to prepare a bespoke version of this blog (or to run your specific figures), I’m happy to help.

Recent Comments