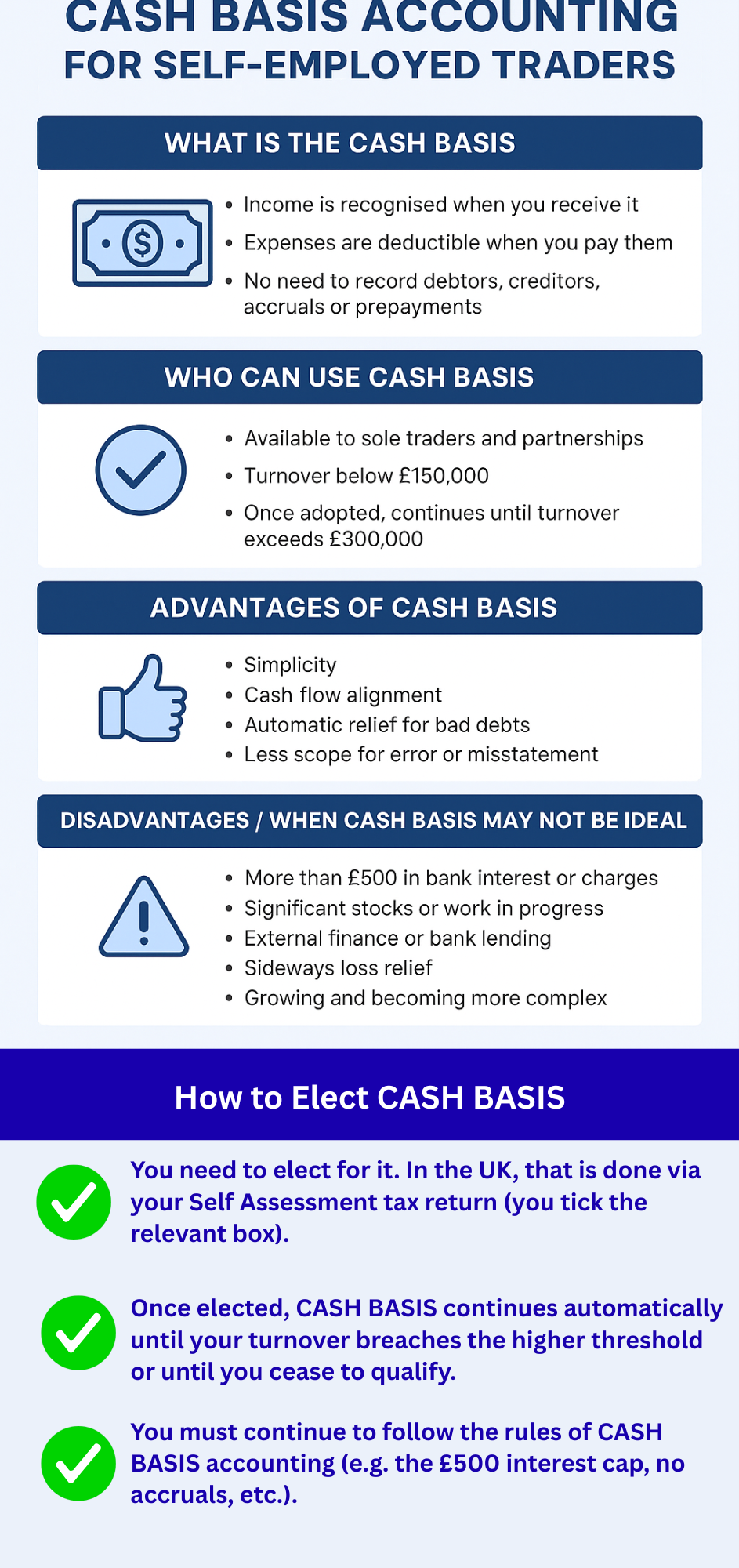

What Is the CASH BASIS?

Under the CASH BASIS, your taxable profit is determined by considering only cash in and cash out:

-

Income is recognised when you receive it (not when invoiced).

-

Expenses are deductible when you pay them (not when incurred).

-

You do not need to record debtors, creditors, accruals or prepayments under this method.

Because of its simplicity, many small businesses find it more accessible than the accruals basis, especially when transactions are relatively few or small.

Who Can Use CASH BASIS?

Not every business can use CASH BASIS, but many small ones can.

Here are the conditions (and updated limits as of 2025):

-

It is available to sole traders and partnerships (but not limited companies or LLPs).

-

You can use it if your business turnover (on a cash basis) is below £150,000.

-

Once you adopt this method, you may continue to use it until your turnover exceeds £300,000 (or falls below that threshold) in a later period.

-

The limits may also interact with Universal Credit rules if you are a claimant.

If your business is more complex, or you need to raise finance, the accruals basis may still be more suitable.

Advantages

Switching to this method can bring several benefits:

-

Simplicity: You don’t have to deal with accruals, prepayments, debtors or creditors—bookkeeping is more straightforward.

-

Cash flow alignment: You pay tax only on money you have actually received, not on invoices left unpaid.

-

Automatic relief for bad debts: Since you only recognise income when received, there’s no need to make separate claims for bad debt relief under this method.

-

Less scope for error or misstatement of accruals and timing adjustments when the business is small or straightforward.

Disadvantages

While CASH BASIS is attractive for its simplicity, it’s not always the best choice. You might want to avoid it under these circumstances:

-

If you pay more than £500 in bank interest or charges: the deductible limit for interest/finance costs is capped at £500.

-

If your business holds significant stocks or work in progress: the absence of accruals and inventory adjustments may distort profit.

-

If you need external finance or bank lending: many lenders expect accruals-based accounts.

-

If you want to use sideways loss relief (i.e. setting trading losses against other income): this is generally not allowed.

-

If your business is growing and becoming more complex: the advantages of accruals accounting may more than offset the simplicity of this method.

How to Elect CASH BASIS

If you decide CASH BASIS is right for you:

-

You need to elect for it. In the UK, that is done via your Self Assessment tax return (you tick the relevant box).

-

Once elected, CASH BASIS continues automatically until your turnover breaches the higher threshold or until you cease to qualify.

-

You must continue to follow the rules of CASH BASIS accounting (e.g. the £500 interest cap, no accruals, etc.).

If in any year you decide to switch back to accruals accounting, you may need to make transitional adjustments.

How Trueman Brown Can Help You with CASH BASIS

If you’re unsure whether CASH BASIS is right for your business, or want help making the election, managing the bookkeeping, or preparing your accounts, Trueman Brown can assist.

We routinely advise self-employed clients in Aveley, Thurrock, and across Essex and the UK.

-

Email: mark@truemanbrown.co.uk

-

Phone: 01708 397262

We can review your business circumstances, run comparative illustrations (CASH BASIS vs accruals), and help you file properly with HMRC.

Frequently Asked Questions (FAQ)

Q: Can a limited company or LLP use the CASH BASIS?

A: No. Only sole traders and partnerships may use CASH BASIS. Limited companies and LLPs must use accruals (traditional accounting) methods.

Q: What happens if my turnover exceeds £300,000?

A: You may no longer continue to use CASH BASIS, and you’ll need to switch to accruals accounting. There may be transitional adjustment requirements.

Q: Can I claim all types of expenses under CASH BASIS?

A: Most normal business expenses can be claimed, but finance costs and bank interest deductions are capped at £500 under CASH BASIS.

Q: Are there tax advantages if I switch to accruals from CASH BASIS?

A: Possibly. If accruals accounting better matches income and expenditure, or if you have large stocks or receivables, accruals may give a more accurate profit figure (which may reduce tax in some years). But extra complexity and administrative cost must be considered.

Q: Do I need to do anything special when switching between CASH BASIS and accruals?

A: Yes — typically, you must make opening balance and transitional adjustments to bring your accounts into alignment. It may require estimating or valuing items like debtors, creditors, stock, and work in progress.

Q: How difficult is it to maintain accounts under CASH BASIS?

A: It is generally simpler than accruals because you don’t deal with accruals, prepayments, debtors or creditors. That said, you still need to maintain good bookkeeping (records of receipts and payments, supporting invoices, etc.).

Q: Can I revert back to CASH BASIS if I move away from it?

A: Only if you still qualify under the turnover limits. Reversion isn’t automatic—you may need to make an election or certain adjustments when switching.

Recent Comments