Tax-free Taxis: How Employers Can Offer Staff a Ride Without the Tax Bill

Local accountants and tax advisers, Trueman Brown, explain how employers can take advantage of HMRC’s rules on Tax-free Taxis for their employees.

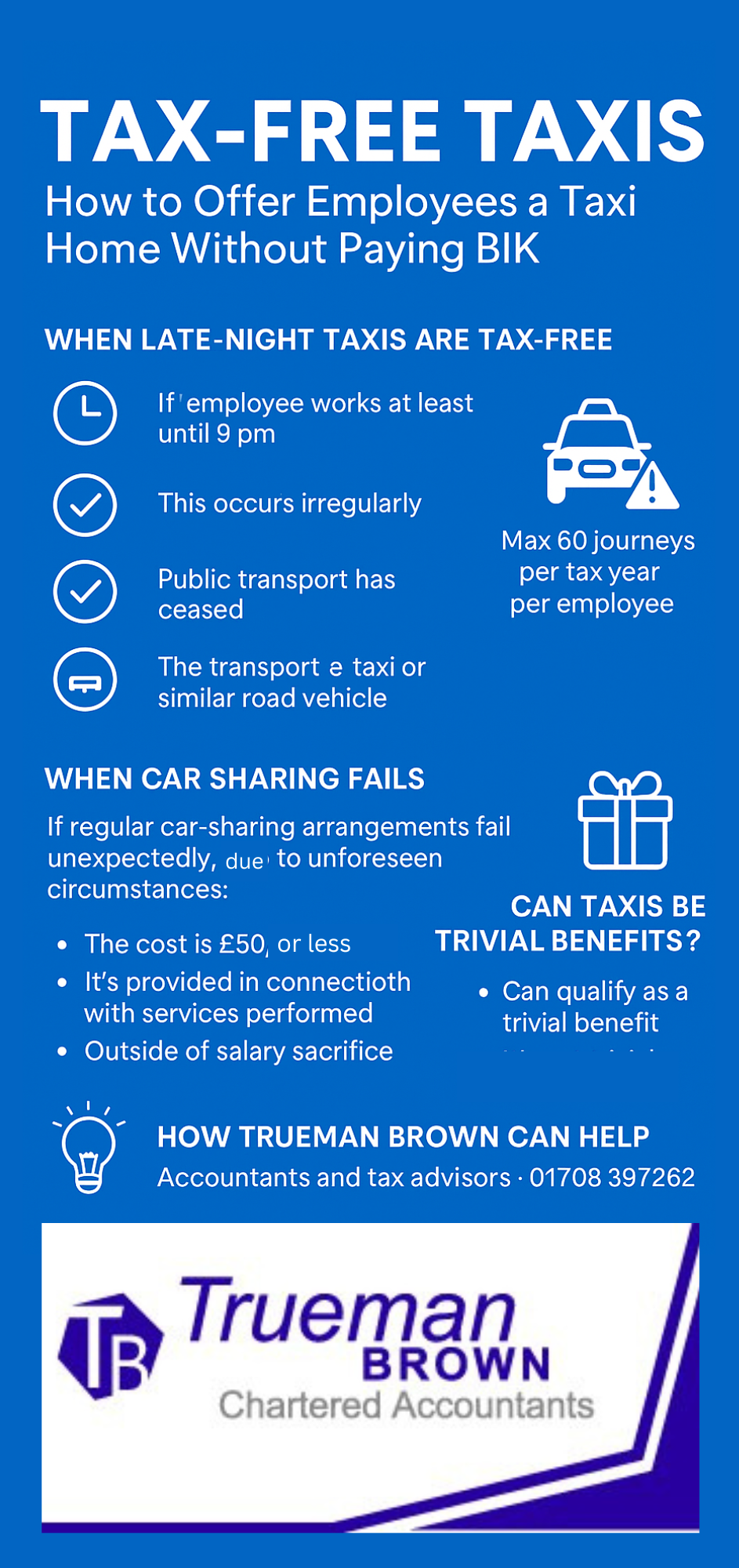

While taxi journeys between home and work are usually considered private and therefore taxable, there are specific exemptions that allow you to provide Tax-free Taxis in certain circumstances — particularly for late-night travel or when car-sharing arrangements fail.

Understanding these rules can help employers support staff safely while remaining compliant with tax law.

Late-night Tax-free Taxis

One of the most common ways to offer Tax-free Taxis is through the late-night travel exemption. HMRC recognises that public transport isn’t always available, so employers may pay for a taxi home in specific situations without triggering a taxable benefit — provided four key conditions are met:

- The employee is required to work later than usual and until at least 9 pm.

- This happens irregularly, not as part of the employee’s normal working pattern.

- By the time the employee finishes, public transport has stopped running or it would be unreasonable to expect them to use it.

- The transport provided is a taxi or similar road vehicle.

This exemption applies to up to 60 journeys per tax year (2025/26 onwards) per employee — whether due to late-night work or failed car-sharing.

Once the limit is reached, any further taxis will be taxable as a benefit-in-kind.

Example of Tax-free Taxis in Practice

Polly works at a patisserie and occasionally stays late to complete large orders.

One evening, she finishes at 10 pm — well past her usual 5 pm shift. Public transport has already stopped, so her employer pays for a taxi home.

Since Polly has only used this option a few times during the year, and all late-working conditions are met, this counts as one of her Tax-free Taxis, and she won’t pay any extra tax.

When Car Sharing Fails – Still a Tax-free Taxi

The exemption also applies when regular car-sharing arrangements fail unexpectedly.

If an employee normally travels to work with a colleague who becomes ill or leaves early, and the employer arranges a taxi home, the journey can qualify as one of the 60 Tax-free Taxis permitted per year.

The key is that the failure must be unforeseen — the employer cannot plan to use this rule regularly.

Can a Taxi Be a Trivial Benefit?

In some situations, a taxi might qualify as a trivial benefit, which also allows it to be tax-free — but the conditions are strict.

A benefit is considered trivial only if:

-

It costs £50 or less,

-

It’s not provided in recognition of services, and

-

It’s not part of salary sacrifice.

That means if the taxi is given because someone worked late, it’s a reward for service and not trivial.

The late-night taxi exemption wouldn’t apply either if the employee didn’t work until at least 9 pm.

However, if an employer pays for a taxi after a team meal or social event, where no services were performed, that journey might fall within the trivial benefit rules and remain tax-free.

2025/26 Update: HMRC Clarifications on Tax-free Taxis

For the 2025/26 tax year, there have been no major changes to the underlying legislation for Tax-free Taxis.

However, HMRC has reiterated the importance of accurate record-keeping and applying the 60-journey limit consistently.

Employers should:

-

Keep a log of each qualifying taxi journey, including the date and reason.

-

Distinguish between late-night exemptions and car-sharing failures.

-

Apply PAYE reporting where the conditions are not met.

These practices ensure compliance with HMRC’s Employment Income Manual (EIM21855 and EIM21860) and avoid unexpected benefit-in-kind liabilities.

How Trueman Brown Can Help with Tax-free Taxis

At Trueman Brown, we specialise in helping employers understand and implement the Tax-free Taxis exemption correctly.

We can assist with:

-

Reviewing your internal policies and travel records.

-

Assessing whether your late-night journeys qualify as Tax-free Taxis.

-

Managing reporting obligations through payroll and P11D submissions.

-

Advising on other employee benefits that can be provided tax-efficiently.

Get peace of mind knowing your business is compliant and your staff are looked after.

📧 Email: mark@truemanbrown.co.uk

📞 Phone: 01708 397262

FAQs About Tax-free Taxis

Q: How many Tax-free Taxis can I provide in a tax year?

A: Up to 60 journeys per employee per tax year — covering both late-night travel and failed car-sharing.

Q: Does it matter how much the taxi fare costs?

A: No, the cost doesn’t affect the exemption — but the journey must meet the qualifying conditions.

Q: What if an employee regularly finishes after 9 pm?

A: Regular late working means the exemption won’t apply, as it must occur irregularly. Those journeys become taxable.

Q: Can I use both the trivial benefit and the late-night exemption for the same taxi?

A: No — each trip can only fall under one exemption. If it doesn’t meet either set of conditions, it’s taxable.

Q: How do I prove compliance if HMRC asks?

A: Keep written or digital records of each instance — the date, reason for travel, and confirmation that all conditions were met.

If you’d like expert advice on Tax-free Taxis or any other employee benefit, contact Trueman Brown today at mark@truemanbrown.co.uk or call 01708 397262 — we’re here to help you stay compliant and tax-efficient.

Recent Comments