Employer Supplied Mobile Phone Tax Exemption – 2025/26 Guide for UK Employers

The employer supplied mobile phone tax exemption allows UK businesses to provide employees with mobile phones without triggering a taxable benefit—provided certain HMRC rules are met.

This article explains how the exemption works for 2025/26, what’s changed, and how employers can stay compliant.

Understanding the Employer Supplied Mobile Phone Tax Exemption

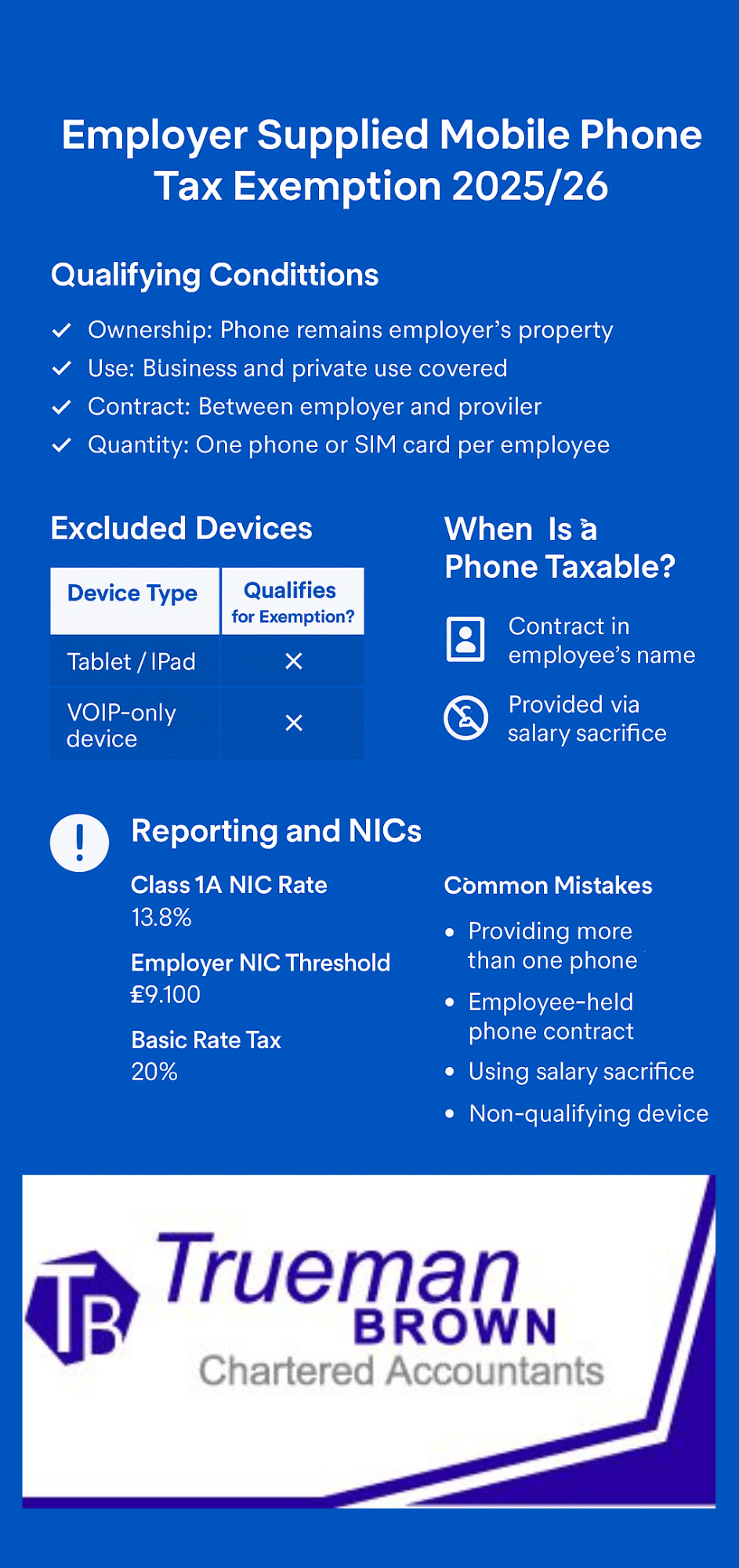

Under current HMRC legislation, one mobile phone (or SIM card) may be provided to an employee tax-free if:

| Condition | Requirement |

|---|---|

| Ownership | The phone must remain the property of the employer |

| Use | Covers both business and private use |

| Contract | Must be between the employer and the phone provider |

| Quantity | Only one phone or SIM card per employee qualifies |

If these conditions are met, there is no Benefit in Kind (BiK) for the employee.

Contract Rules – A Key Factor for the Tax Exemption

The employer supplied mobile phone tax exemption only applies when the contract is in the employer’s name.

If the employee holds the contract and the employer reimburses the cost, this counts as settling a personal bill — which is taxable.

Smartphones and the 2025/26 Clarifications

Smartphones continue to qualify under the exemption for 2025/26.

However, HMRC confirms that tablets, laptops, and VOIP-only devices (such as iPads or Zoom phones) do not qualify.

| Device Type | Qualifies for Exemption? |

|---|---|

| Smartphone (iPhone, Android) | ✅ Yes |

| SIM-only device | ✅ Yes |

| Tablet / iPad | ❌ No |

| VOIP-only device | ❌ No |

Salary Sacrifice and Optional Remuneration Arrangements (OpRA)

The employer supplied mobile phone tax exemption does not apply if the device is provided via a salary sacrifice or other optional remuneration scheme.

Under OpRA, the taxable benefit is the higher of:

-

The value of the benefit, or

-

The salary given up.

Employer Reporting and Class 1A NICs (2025/26)

For 2025/26, where the exemption does not apply, the following rates are relevant:

| Item | Rate 2025/26 |

|---|---|

| Class 1A NIC on BiK | 13.8% |

| Employer NIC Threshold | £9,100 per annum |

| Personal Allowance | £12,570 |

| Basic Rate Tax | 20% |

Employers should record non-qualifying phones on form P11D and pay Class 1A NIC by 19 July following the end of the tax year.

Common Mistakes to Avoid

-

Providing more than one phone per employee.

-

Placing the contract in the employee’s name.

-

Using salary sacrifice schemes for phones.

-

Providing devices that don’t meet the HMRC definition of a mobile phone.

How Trueman Brown Can Help You On Employer Supplied Mobile Phone Tax Exemption

At Trueman Brown, we specialise in ensuring local businesses stay compliant with evolving HMRC rules — including the employer supplied mobile phone tax exemption.

We can help you:

-

Structure staff benefits tax-efficiently.

-

Review current mobile contracts for compliance.

-

File accurate P11D and Class 1A NIC submissions.

-

Identify other available exemptions for 2025/26.

📞 Call: 01708 397262

📧 Email: mark@truemanbrown.co.uk

FAQs on Employer Supplied Mobile Phone Tax Exemption

Q1: Can employees have more than one tax-free mobile phone?

No — only one phone or SIM per employee qualifies under the exemption.

Q2: What if the phone is used mainly for private calls?

It’s still exempt, as long as the phone contract is between the employer and supplier.

Q3: Can an employer reimburse an employee’s personal mobile phone bill?

No. That would be treated as a taxable benefit.

Q4: Do company directors qualify for the exemption?

Yes, provided they are employees and meet the same conditions.

Q5: How do salary sacrifice arrangements affect the exemption?

They remove eligibility — the benefit becomes taxable under OpRA rules.

Recent Comments