Local Employers Should Look at Student Loan Deductions (2025/26 Update)

Student loan deductions are a key payroll responsibility for UK employers, and the rules have recently changed for the 2025/26 tax year.

Making sure you deduct the correct amount for your employees — and stay compliant with HMRC — can save your business time and cost in errors.

What is a Student Loan Deduction?

In the UK, a student loan deduction is a compulsory payroll deduction taken from an employee’s pay once their earnings exceed a defined threshold for their loan type.

Employers collect these through the PAYE system and pay them over to HMRC.

There are several different plans, including Plan 1, Plan 2, Plan 4 (Scotland), and Postgraduate Loans.

The repayment structure is income contingent, meaning the deduction only applies if the employee is earning above the thresholds for their specific loan plan.

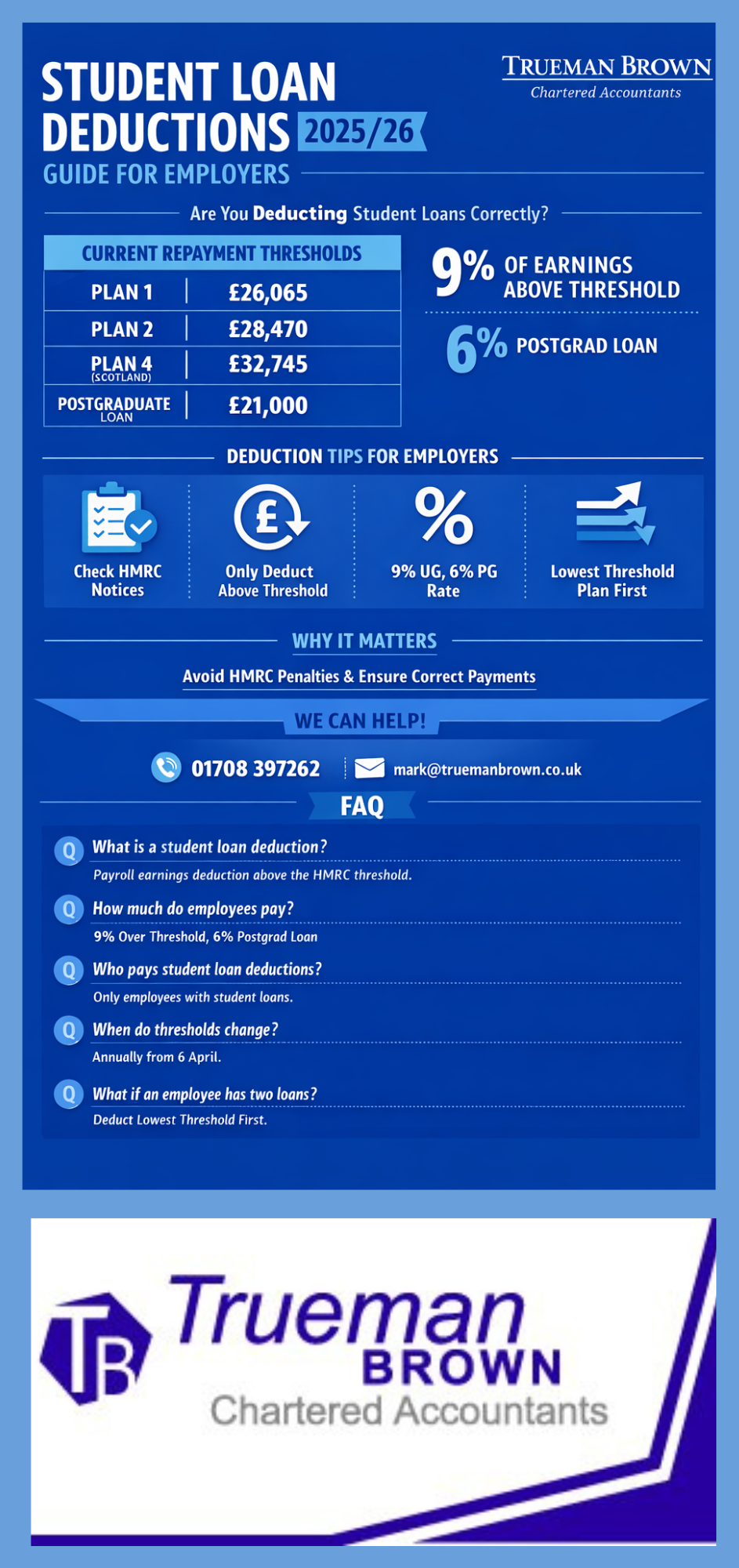

Student Loan Repayment Thresholds for 2025/26

| Loan Plan | 2025/26 Threshold | Deduction Rate |

|---|---|---|

| Plan 1 | £26,065 | 9% of earnings above threshold |

| Plan 2 | £28,470 | 9% of earnings above threshold |

| Plan 4 (Scotland) | £32,745 | 9% of earnings above threshold |

| Postgraduate Loan | £21,000 | 6% of earnings above threshold |

These new thresholds mean some employees may see lower deductions compared with previous years if their earnings remain close to the threshold, resulting in more take-home pay.

How Employers Should Apply Student Loan Deductions

To correctly apply student loan deductions:

-

Use HMRC SL1 / PGL1 notices or starter checklist info to identify the loan plan.

-

Only deduct if earnings for that pay period are above the plan threshold.

-

Deduct at the percentage rate for that plan type (6% postgraduate, 9% undergraduate plans).

-

Pay the deductions over to HMRC alongside tax and National Insurance by the usual PAYE deadlines.

For employees with multiple loan types, employers should deduct using the plan with the lowest threshold first, then apply the remainder where applicable.

Why Student Loan Rules Matter for Your Payroll

Getting your student loan deductions right protects your business from HMRC penalties and ensures employees are paying the correct amount. Incorrect deductions can lead to underpayments to the Student Loans Company or HMRC, as well as administrative headaches.

How Trueman Brown Can Help

If you’re unsure how to apply student loan deductions in your payroll or want to ensure your systems are compliant with the 2025/26 rules, Trueman Brown can support you.

Whether you need tailored payroll advice, help setting up HMRC notices correctly, or ongoing accounting support, our team is here to help:

📞 01708 397262

📧 mark@truemanbrown.co.uk

We work with local employers to simplify payroll complexities, including student loan compliance, so you can focus on running your business.

FAQ – Student Loan Deductions (2025/26)

Q: What is a student loan deduction?

A: It’s a PAYE payroll deduction taken from an employee’s earnings when they exceed the HMRC threshold for their specific loan plan.

Q: Do all employees pay student loan deductions?

A: Only those who have taken out a student loan and earn above the repayment threshold for their plan.

Q: How much do employees pay?

A: Typically 9% of income above the threshold for undergraduate plans and 6% for postgraduate loans.

Q: When do thresholds change?

A: They are updated annually by HMRC, usually taking effect from 6 April each tax year.

Q: What if an employee has more than one loan plan?

A: Deductions are made first on the plan with the lowest threshold. Any excess can apply to the next plan.

Recent Comments