Property Developers and CIS: What Every Developer Needs to Know

If you’re operating in real-estate development, then understanding property developers and CIS is absolutely crucial.

Whether you’re refurbishing one unit or building multiple properties for sale, the rules around the Construction Industry Scheme (CIS) may apply — and missing a step could leave you facing unexpected tax deductions, penalties or compliance headaches.

In this guide we cover how CIS applies to property development, what you need to do from registration to monthly returns, the recent changes affecting developers, and why staying on top of property developers and CIS matters for your business.

What is CIS – and how does it relate to property developers?

Under CIS, when a “contractor” pays a “sub-contractor” to carry out construction operations, the contractor normally has to deduct tax at source from the payment, pass it to HM Revenue & Customs, and fulfil monthly reporting obligations.

For property developers and CIS, the key issue is that a property developer may be treated as a contractor if the work being done on properties for sale or refurbishment counts as ‘construction operations’.

The CIS rules define “construction work” broadly to include building, altering, repairing, extending or dismantling.

In short: if you buy a property and carry out substantial works (rather than simply re-letting) you could be caught by CIS.

The blog below explains how to assess that and stay compliant.

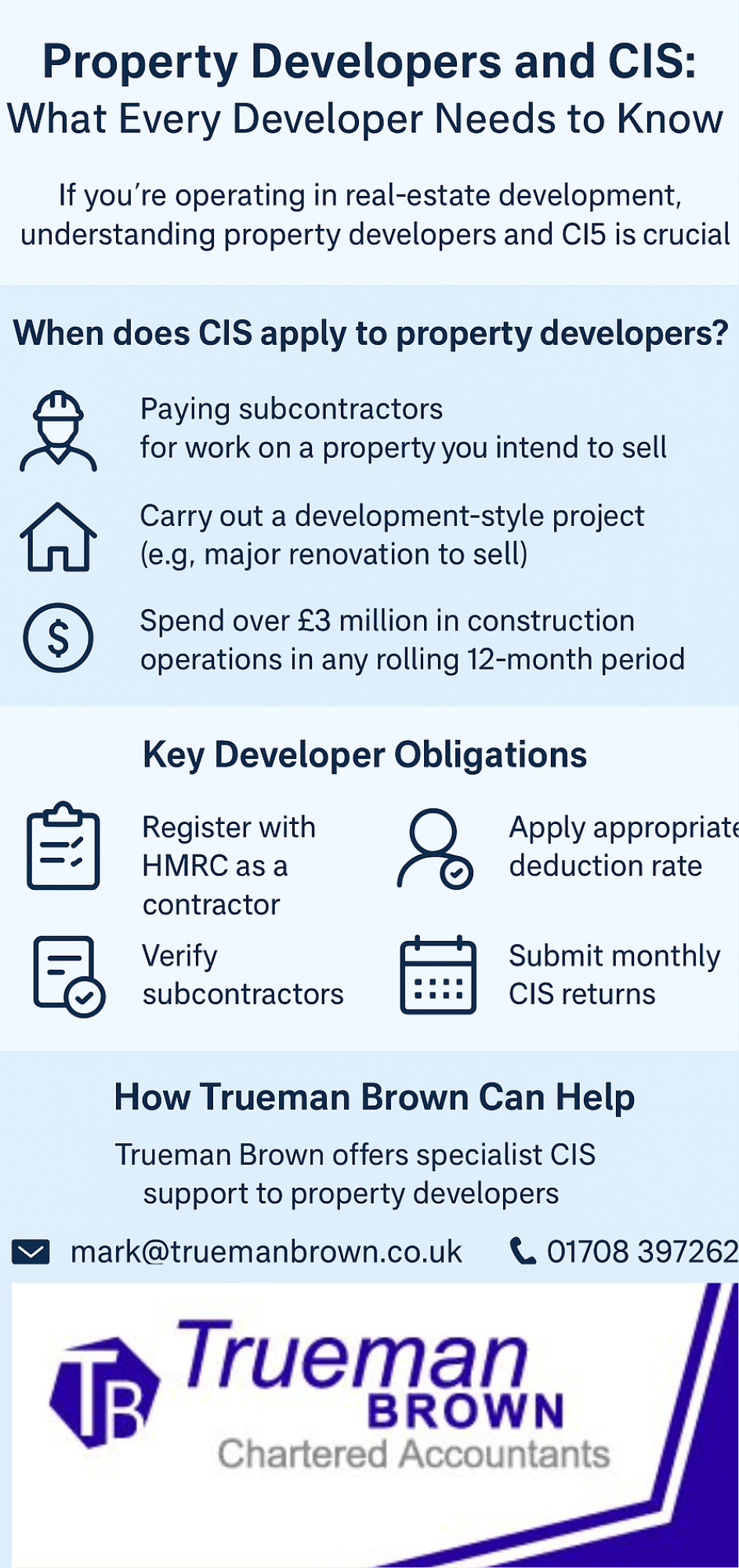

When does CIS apply to property developers?

Property developers and CIS obligations typically arise in these scenarios:

-

If you as a developer are paying subcontractors (for example: builders, decorators, installation services) for work on a property you intend to sell, then you may be a “contractor” under CIS.

-

If you’re primarily a property investor (buying and letting) but you carry out a development-style project (e.g., major renovation to sell), then you may also fall into contract-oriented work and become subject to CIS.

-

If your non-construction business spends above a certain threshold on construction operations, you can be a “deemed contractor” and have to register and apply CIS. Recent rules raise that threshold to £3 million in construction spend within any rolling 12-month period for the deemed contractor test.

Key implications for developers: you must assess whether the works you’re doing are caught by the definition of construction operations, whether you need to register as a contractor, and whether you must verify and deduct tax when paying subcontractors.

Key Developer Obligations: registration, verification & deductions

When property developers and CIS combine, here are the obligations you must meet:

-

Register with HMRC as a contractor before making payments to subcontractors (or as soon as you hit the threshold for deemed contractor status).

-

Verify subcontractors – before making payments you must check the subcontractor’s CIS status via HMRC’s online service (or via compliant software) so you apply the correct deduction rate (0 %, 20 % or 30 %).

-

Apply appropriate deduction rate when paying eligible subcontractors for construction operations. If you pay a subcontractor who is registered under CIS you normally deduct at 20 %. If they are not registered you may have to deduct at 30 %.

-

Submit monthly CIS returns to HMRC by the 19th of the following month, and pay any deductions to HMRC by the 22nd. Even if you made no payments you still need to file.

-

Keep detailed records of payments, subcontractor status, deductions, materials, invoices and so on—and retain them for at least 3 years (often more).

If you’re a property developer you’ll want to ensure your contracts, subcontractor vetting, payment chains and record-keeping are robust and adapted to CIS demands.

Special considerations for property developers and CIS

As developers there are some particular issues you should watch for when it comes to CIS:

-

Material costs: The deduction should normally be based on the labour (or labour plus minimal plant) element of the subcontractor payment. If the subcontractor purchases materials wholly for their contract you may deduct on the net labour cost.

-

Deemed contractor threshold: If your property development business is spending large sums (now over £3 m in 12 months) on construction work, you may become a deemed contractor and automatically caught by CIS—even if development is not your principal business.

-

Works by the developer itself: If you as the developer undertake the work yourself (i.e., employing labour directly) you may not fall under CIS in the same way as when you subcontract. But if you subcontract you’ll likely have the obligations.

-

Scope expansion: From 1 March 2025 onward, certain services previously thought outside CIS (such as traffic-management services integral to construction operations) are now within scope. While this is more relevant to some contractors than property developers, it highlights HMRC’s increasing breadth and vigilance.

-

Upcoming digital changes: From April 2026, the move to Making Tax Digital (MTD) for Income Tax means that many CIS subcontractors and contractors (including developers) will need to keep digital records and submit quarterly. It’s wise for property developers and CIS compliance interplay to anticipate this.

In essence: as a property developer you need to think not just about the building works but the tax mechanics behind your payments to others, and ensure you act as the contractor under CIS if you fall into that role.

Penalties for non-compliance

If you neglect your duties under property developers and CIS, you risk penalties and enforcement actions such as:

-

HMRC may simply disallow any deduction claims made by subcontractors if no evidence is held of the deductions.

-

Failure to submit monthly returns or pay over deductions on time can trigger fines and interest.

-

If you apply for gross payment status (GPS) and supply false information (or encourage someone to do so) from April 2025 onward, penalties apply to those influencing the application, including agents or directors.

-

If you should have registered as a deemed contractor (for example you exceeded £3 m spend) and fail to do so, you may be liable for retrospective deductions or other consequences.

Ensuring your compliance regime is tight is especially important where property developers delegate large works to subcontractors.

“A ‘property investment business’ is not the same thing as a ‘property developer’. A property investment business acquires and disposes of buildings for capital gain or uses the buildings for rental. “

However, a problem arises when an investor landlord buys a property, doing it up intending to keep it as a rental property – is that person now a developer and therefore caught under the CIS rules? HMRC confirm that this is the case as further on in the CIS manual it states that:

How can Trueman Brown help you with property developers and CIS?

At Trueman Brown our specialist accountants and tax advisers understand the intersection of property development and CIS in the UK market.

Whether you’re buying, refurbishing or selling properties, we’ll help you identify when you become a “contractor” for CIS, how to register, verify subcontractors, file monthly returns and avoid costly penalties.

If you’d like support in relation to property developers and CIS, you can get in touch with us:

-

Email: mark@truemanbrown.co.uk

-

Phone: 01708 397262

We’ll review your contracts, subcontractor arrangements, expenditure thresholds and assist with the full compliance cycle—so you can focus on your project and leave the tax work to us.

FAQ – Frequently Asked Questions about Property Developers and CIS

Q: I’m a developer buying a property to refurbish and then rent out. Does CIS apply to me?

A: Possibly. If you’re simply buying and letting with minimal refurbishment, your activity may be “property investment” rather than “development” so CIS might not apply. However, if the refurbishment involves substantial building/extension/alteration intended to sell or prepare for sale, you could fall under the CIS rules as a contractor. The classification depends on the nature of the work. truemanbrown.co.uk+1

Q: If I hire tradesmen to work on a property I own for sale – do I need to deduct CIS?

A: Yes — if you qualify as a contractor under CIS, you must register, verify the subcontractors, deduct the appropriate rate (20 % or 30 %) and file monthly returns. If you don’t register, HMRC may require you to deduct at the higher rate and you risk penalties.

Q: What is the “deemed contractor” threshold and how does it affect developers?

A: From April 2025, if your business (even if not primarily construction) spends over £3 million in construction operations in any rolling 12-month period, you become a deemed contractor and must comply with CIS. Developers with large portfolios or major refurbishment programmes should monitor this closely. Stonebridge+1

Q: How do material costs affect CIS deductions for developers?

A: When you pay a subcontractor for construction operations, the deduction should generally be based on the labour (and any directly incurred materials by the subcontractor). If the subcontractor purchases materials themselves for the contract, you may deduct on the net labour only. HMRC tightened the rules on materials to prevent inappropriate claims. GOV.UK

Q: I heard about MTD for CIS. What should developers expect?

A: From April 2026, many businesses fall under the Making Tax Digital regime, meaning digital records and quarterly submissions will become mandatory. For property developers engaging with CIS payments, this means your accounting software and processes will need to handle digital capture of payments, deductions, subcontractor statements, and reporting. It’s wise to prepare early. tax2u.co.uk+1

Q: What happens if I hire a subcontractor and forget to verify their CIS status?

A: If you fail to verify the subcontractor before payment, you may apply the wrong deduction rate (e.g., 30 % instead of 20 %), risk penalties, and expose your business to compliance risk. Correct verification is a key obligation for contractors.

Q: Where can I get help with property developers and CIS?

A: Specialist accountants like Trueman Brown are experienced in this area. We can guide you through registrations, monthly filings, managing thresholds, subcontractor verification and emerging digital requirements. Contact us at mark@truemanbrown.co.uk or 01708 397262.

Recent Comments