Trading losses in early years – what you need to know

Starting a new business can be challenging and, in many cases, you may incur trading losses in early years.

These losses can arise when initial costs, set-up expenses or unexpected circumstances (such as the pandemic) push your outgoings ahead of income.

Fortunately, tax legislation provides reliefs that allow early-year trading losses to be used for tax benefits, but the rules are specific and have changed for the 2025/26 tax year.

In this article we’ll guide you through how trading losses in early years work, what the updated 2025/26 rules say, what your options are, and how we at Trueman Brown Chartered Accountants can help.

What are “trading losses in early years”?

If you start a new trade (sole trader or partner in a partnership), and in one of your first four tax years you make a loss (i.e., allowable deductions exceed your income from the trade), that is a candidate for relief under the rules for trading losses in early years.

Essentially, one of the reliefs allows you to carry that loss back, in certain circumstances, to your earlier years’ income and generate a tax refund.

The key point: you must be within the first four years of trading.

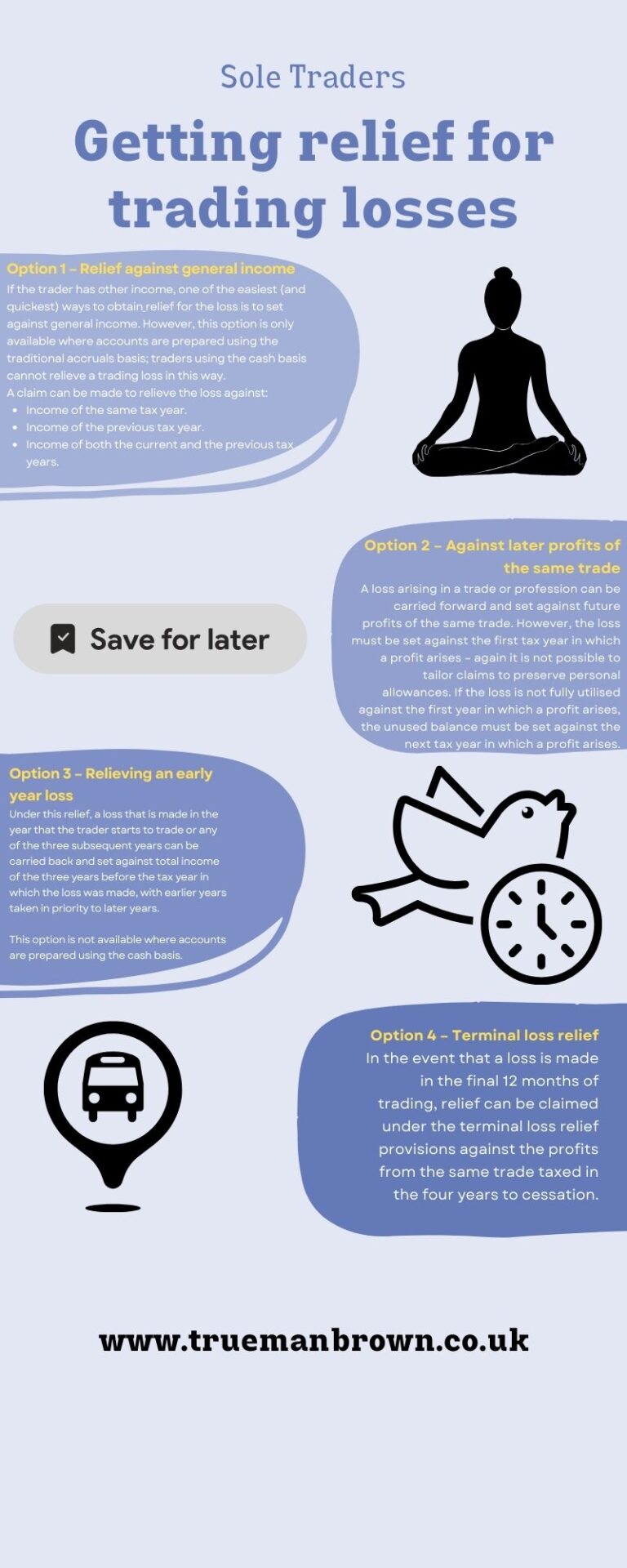

How the relief works for trading losses in early years

When you incur trading losses in early years, you may claim relief by carrying the loss back and offsetting it against your total taxable income of the three tax years immediately preceding the loss year.

The set-off must start with the earliest of those years first, then the next, then the last. This reduces your taxable income in those years and may give you a repayment of tax paid.

For example: if you started trading in 2023/24 and made a big loss in 2024/25 (your second year of trade), you may carry that loss back to your 2021/22, 2022/23 and 2023/24 years (if you had other income in those years) — subject to the rules.

It is vital to note that for losses arising in earlier years certain basis of accounting rules applied — for example losses arising in 2023/24 or earlier might need to be calculated on the accruals basis.

But as of the 2025/26 context, newer rules allow either cash or accrual basis in some cases.

Updated rules for 2025/26 you need to check

Here are key rule changes and important considerations as of the 2025/26 tax year when dealing with trading losses in early years:

-

The relief for early-years trading losses remains: a new trader may use losses from any of the first four years of the trade to set off against total income of the previous three tax years.

-

For losses arising in tax years 2024/25 or earlier, the requirement may still apply that the loss must be calculated on the accruals basis. But for losses arising in 2024/25 onwards a cash basis may be used.

-

The relief cannot be used if you (or your spouse/partner) first carried on the trade before 6 April 2020.

-

The time limit for making a claim for losses made in 2024/25 is 31 January 2027.

-

You cannot cherry-pick years to preserve your personal allowance: the loss carried back will reduce the taxable income in those earlier years and may affect your allowances or tax bands. This can trigger loss of personal allowances (for example, personal allowance reduction) or unexpected tax consequences.

-

Due to the reform of the basis period rules (for self-employed trades moving to accounting period to tax year alignment), you should check how your first years are treated and whether you can still rely on the “first four years” definition as before.

Therefore, while the principle remains the same, you must ensure you meet all eligibility criteria and correctly apply the loss and basis rules when claiming relief for your trading losses in early years.

Key eligibility and traps to watch for

When planning relief for trading losses in early years, you should check:

-

Your trade must be a commercial trade carried on “for the purpose of profit” (i.e., not just as a hobby).

-

The trade must have commenced within the last four tax years (for the loss year). If you started before 6 April 2020, you cannot use the early-years carry-back relief.

-

The loss must relate to your first four years of the trade. After that, this particular relief is unavailable (though losses can still be carried forward).

-

You must apply the loss start from the earliest of the preceding three years first, then the next, then the last. You cannot choose a later year ahead of an earlier year.

-

If you prepare accounts on cash basis and your loss year is 2024/25 or later, you may be eligible; if earlier years then accrual basis may be required.

-

Be aware of how the loss carry-back might affect personal allowances and tax bands in the earlier years — for example losing your personal allowance or entering higher tax bands.

-

Ensure you claim within the time limits (always double-check). For 2024/25 losses: by 31 January 2027.

-

Keep clear records and show your claim in the “Any other information” box on your Self-Assessment tax return for the loss year, including details of each year to which the loss is carried back.

When carrying forward may be more beneficial than carrying back your trading losses in early years

Although the relief to carry back trading losses in early years is valuable, in some cases it may be better to carry the loss forward against future profits rather than carry it back. A few scenarios where that might apply:

-

If the income in your earlier years (the three preceding years) is low or you have little tax paid, then carrying back may give only a small repayment or none at all.

-

If carrying back would cause you to lose personal allowances or push you into a higher rate tax band in the earlier years, the net benefit may be reduced.

-

If you expect future profits (in year 5 or later) to be substantial and you anticipate the higher rate of tax then, you might achieve greater benefit by carrying forward the loss.

-

If you have alternative reliefs (for example loss relief against capital gains) that you expect to use in future years, carrying forward may give more flexibility.

-

You must consider the time value of the tax refund (you’ll get the benefit now) versus saving tax in future years (which could be at a higher rate).

-

Also, note that if you do nothing, your loss will automatically be carried forward and set against profits of the same trade in later years.

Therefore, when faced with trading losses in early years, you should model both carry-back and carry-forward routes to determine which gives you the best tax outcome.

How Trueman Brown can help you

Here at Trueman Brown, we understand the impact of trading losses in early years and how important it is to manage them properly for your tax position. We can help you by:

-

Advising on the accounting basis (accruals or cash) and when losses arise to maximise your ability to claim.

-

Running the modelling — comparing carry-back vs carry-forward — to determine the optimum route for your circumstances.

-

Preparing the calculations and ensuring your Self-Assessment tax return includes the correct claim in the “Any other information” box, with proper narrative.

-

Liaising with the HM Revenue & Customs where necessary and responding to any queries.

-

Helping you avoid pitfalls such as personal allowance losses, unintended tax band consequences, or missed deadlines.

If you would like to review your position and get tailored advice on trading losses in early years, please contact us today:

Email: mark@truemanbrown.co.uk

Phone: 01708 397262

We’re here to guide you and ensure you make the most of available tax reliefs while staying compliant.

Frequently Asked Questions (FAQ)

Q1: What exactly counts as a “new trade” for the purposes of the early-years loss relief?

A: A new trade is one you commence carrying on in self-employment (or partnership) and in which you will incur profits or losses. You must be within the first four tax years of that trade for the relief to apply. If you first carried on the trade before 6 April 2020, you cannot claim the early-years carry-back relief.

Q2: If I made a loss in tax year 2025/26 (i.e., the tax year ending 5 April 2026), can I carry it back?

A: Yes — if it is within your first four years of trade, you may consider carrying it back under the early-years relief. However, you must ensure you meet all other conditions (such as basis of accounting if relevant). Also you must make the claim by the relevant deadline (typically 31 January of the tax year two years following the loss year, but always check).

Q3: Does using the cash basis for accounting prevent the relief?

A: For losses arising in years up to 2023/24, the accruals basis might have been required for some types of relief. From 2024/25 onwards, losses computed under either the cash basis or accruals basis may qualify for many reliefs, including reliefs for trading losses. Nevertheless, you must check specifically for the early-years carry-back relief whether your accounting basis meets the eligibility criteria.

Q4: If I carry back the loss, will I lose my personal allowance for those earlier years?

A: Potentially yes. When you carry back a loss and reduce your taxable income in an earlier year, it may reduce or eliminate your personal allowance, or result in loss of tax credits or other allowances you previously benefited from. It’s important to check the wider tax consequences.

Q5: What if my loss is bigger than my income in the earliest of the three preceding years?

A: Then you carry the remainder of the loss to the second preceding year, and if still unused then to the third preceding year — in that order. Any remaining loss afterwards can typically be carried forward to future years to offset profits of the same trade.

Q6: Is there a time limit to submit the claim for early-years trading losses?

A: Yes — for losses arising in the 2024/25 tax year, for example, you must claim by 31 January 2027. Always check the deadline applicable for your loss year.

Q7: If I don’t use this carry-back relief, can I still carry the loss forward?

A: Yes. If you choose not to carry back, or if you are not eligible, your loss will normally be carried forward and set against profits of the same trade in subsequent tax years (subject to the rules).

Q8: Can I amend my earlier year tax returns to accommodate this loss relief?

A: Usually you enter the claim in your current loss year tax return’s “Any other information” box and show the details of the loss and the years it is carried back to. In some cases you may need to amend the earlier years’ returns, or use a standalone claim. It’s best to consult your adviser.

If you’d like a discussion around your individual situation and how trading losses in early years could work for you, please get in touch — we’d be happy to help.

Recent Comments