Annual investment allowance or writing down allowance — what your business should know

If you’re investing in plant or machinery, understanding how the annual investment allowance works could save your business a significant amount in tax.

In this post we explain how the annual investment allowance compares with writing-down allowance, how the rules stand for 2025/26, and when each may be the better choice.

What is the annual investment allowance — and why it matters

The annual investment allowance (AIA) is a key capital-allowances relief that lets you deduct the full cost of qualifying plant and machinery from your taxable profits — up to a specified limit — in the year you buy it.

For many businesses, using the annual investment allowance can accelerate tax relief considerably, turning capital expenditure into immediate savings.

That improved cashflow can help free up funds for further investment, wage bills or other busine

The current annual investment allowance limit (2025/26)

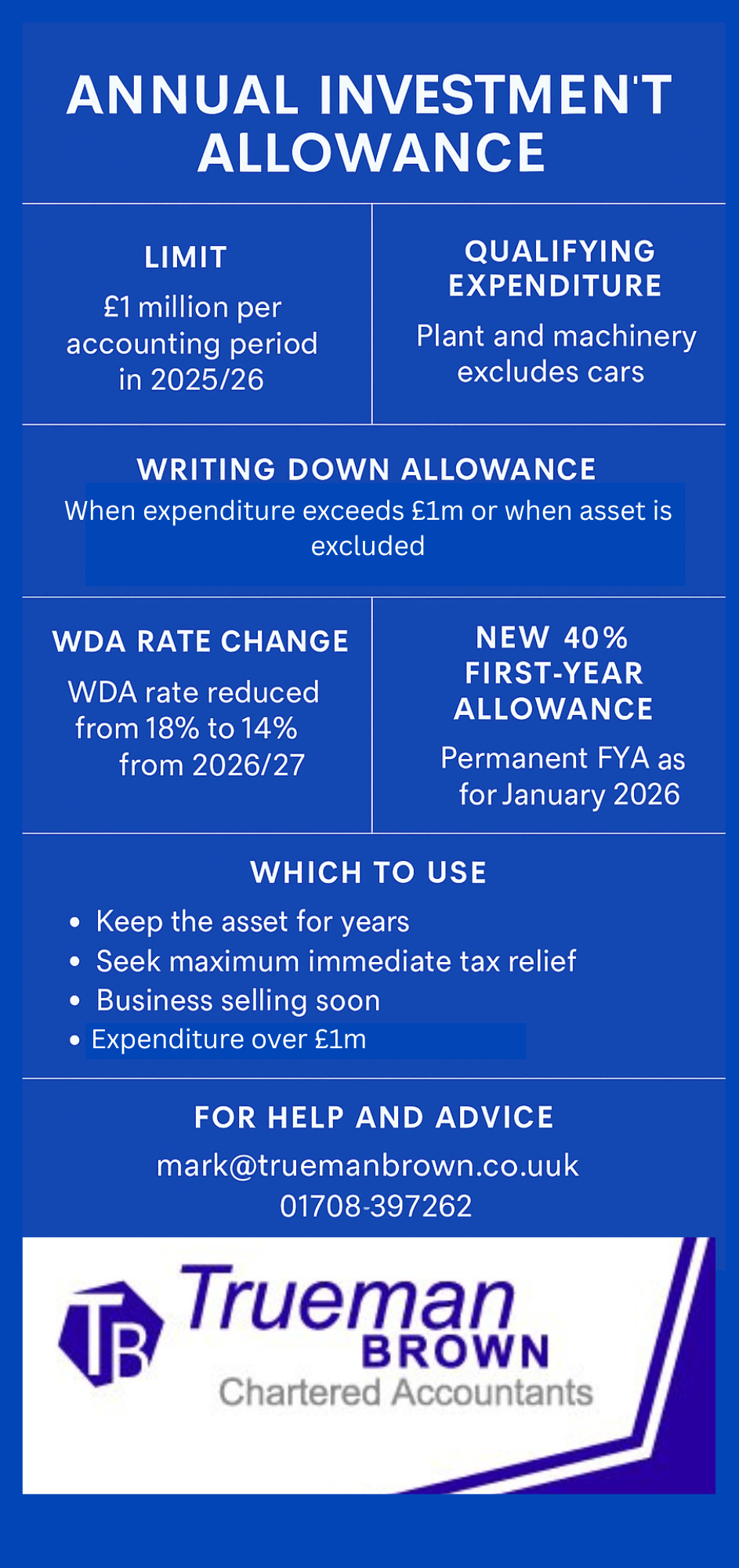

As of 2025/26, the annual investment allowance remains set at £1 million per accounting period.

This means businesses — whether unincorporated or companies — can claim 100% tax relief on up to £1 million of qualifying expenditure each year.

If your accounting period is shorter (or longer) than 12 months, the amount you can claim may need to be prorated. For example, a 6-month period would give an AIA of £500,000.

What qualifies — and what doesn’t — under the annual investment allowance

The annual investment allowance typically covers items such as machinery, equipment, certain fixtures, tools, office equipment, and other plant and machinery.

However, there are important exclusions. You cannot claim AIA on business cars, or on items that were owned or used by you before they were used in the business, or items received as gifts. For such assets, you must use writing-down allowances instead.

Also, if your total capital expenditure in a year exceeds £1 million, only the first £1 million qualifies under the annual investment allowance. The remainder must go into the broader capital-allowance pool.

When the annual investment allowance isn’t the best option — using writing-down allowance

When AIA is not available — either because you’ve exceeded the limit, or because the asset is excluded (e.g. a car) — you may claim a writing-down allowance (WDA) instead. WDA spreads the deduction over a number of years.

Under current rules, the main pool WDA rate remains 18% per year on a reducing-balance basis. However, under proposals introduced in the 2025 Budget, the main pool rate is scheduled to be reduced from 18% to 14%.

That reduction becomes operative for periods starting on or after 1 April 2026 for corporation tax, or 6 April 2026 for income tax — meaning some businesses may need to apply a hybrid rate if their accounting period spans that date.

There is also a new permanent “first-year allowance” (FYA) at 40% being introduced for certain assets from January 2026 — offering another potential accelerated relief route for qualifying expenditure beyond AIA or full-expensing.

Which to use: annual investment allowance or writing down allowance?

Which is better — using the annual investment allowance or opting for writing-down allowance — depends on your business’s circumstances. Here are some guiding considerations:

-

If you want maximum immediate tax relief, and you have room under the AIA limit, annual investment allowance offers the biggest short-term benefit.

-

If you expect to dispose of the asset soon, claiming AIA might trigger a larger “balancing charge” on disposal. In such cases WDA may spread the impact.

-

If your expenditure exceeds £1 million in a year, using the annual investment allowance for part and WDA for the rest can optimise relief.

Because every business’s tax, cashflow and investment plans are different, there is no “one-size-fits-all” answer.

What changed for 2025/26 — what’s new

Recent changes introduced in the 2025 Budget affect the capital allowances landscape:

-

The main-pool writing-down allowance rate will be reduced from 18% to 14%, effective from 1 April 2026 (Corporation Tax) / 6 April 2026 (Income Tax) for relevant accounting periods.

-

A new permanent 40% first-year allowance (FYA) will be introduced for certain qualifying assets from January 2026, offering enhanced flexibility for capital expenditure beyond the scope of the annual investment allowance or full expensing.

-

The annual investment allowance remains at the generous £1 million per year cap.

These changes make tax-planning around capital expenditure more nuanced — but also more flexible.

How Trueman Brown can help

If you’re unsure which allowance to claim — annual investment allowance, first-year allowance, or writing-down allowance — our team at Trueman Brown can guide you through the options and tailor the claim to the needs of your business.

For expert advice and support, contact us at mark@truemanbrown.co.uk or call 01708 397262.

We’ll help ensure your capital expenditure delivers the maximum possible tax benefit.

FAQ

Q: What is the annual investment allowance limit for 2025/26?

A: The annual investment allowance remains at £1 million per accounting period for 2025/26.

Q: Can I claim annual investment allowance on any asset?

A: No. The annual investment allowance applies to qualifying plant and machinery, but excludes items such as business cars and any assets you owned before using them in the business, or assets received as gifts.

Q: What happens if I spend more than £1 million in a year?

A: You can claim the first £1 million under annual investment allowance; any qualifying expenditure beyond that must be claimed via writing-down allowances (or other reliefs if eligible).

Q: What is the writing-down allowance rate under the new rules?

A: Currently the main-pool writing-down allowance remains 18%. However, under proposed legislation, the rate will drop to 14% from 1 April 2026 (Corporation Tax) and 6 April 2026 (Income Tax) for applicable periods.

Q: Can I mix allowances — e.g. claim annual investment allowance for some items and writing-down allowance for others?

A: Yes. It is common to use AIA for part of your expenditure (up to the £1 million limit) and WDA (or first-year allowance where eligible) for the remainder, depending on your capital spend and tax-planning strategy.

Q: Do I have to claim the full annual investment allowance limit?

A: No — claiming AIA is optional. In some cases, you may prefer to use writing-down allowances (or first-year allowances) depending on how long you intend to hold the asset and your wider tax position.

Recent Comments