Postponed VAT Accounting from 1 January 2021 and What You Need to Know

From 1 January 2021, the UK introduced postponed VAT accounting for imports, meaning that importers can declare and recover import VAT on the same VAT return.

This postponed VAT accounting scheme helps cash flow by removing the need to pay VAT upfront at import and then reclaim it later.

The rules have evolved since 2021, so below we summarise the principles of postponed VAT accounting, how it works, what’s changed since its introduction, how Trueman Brown can help you, and a helpful FAQ.

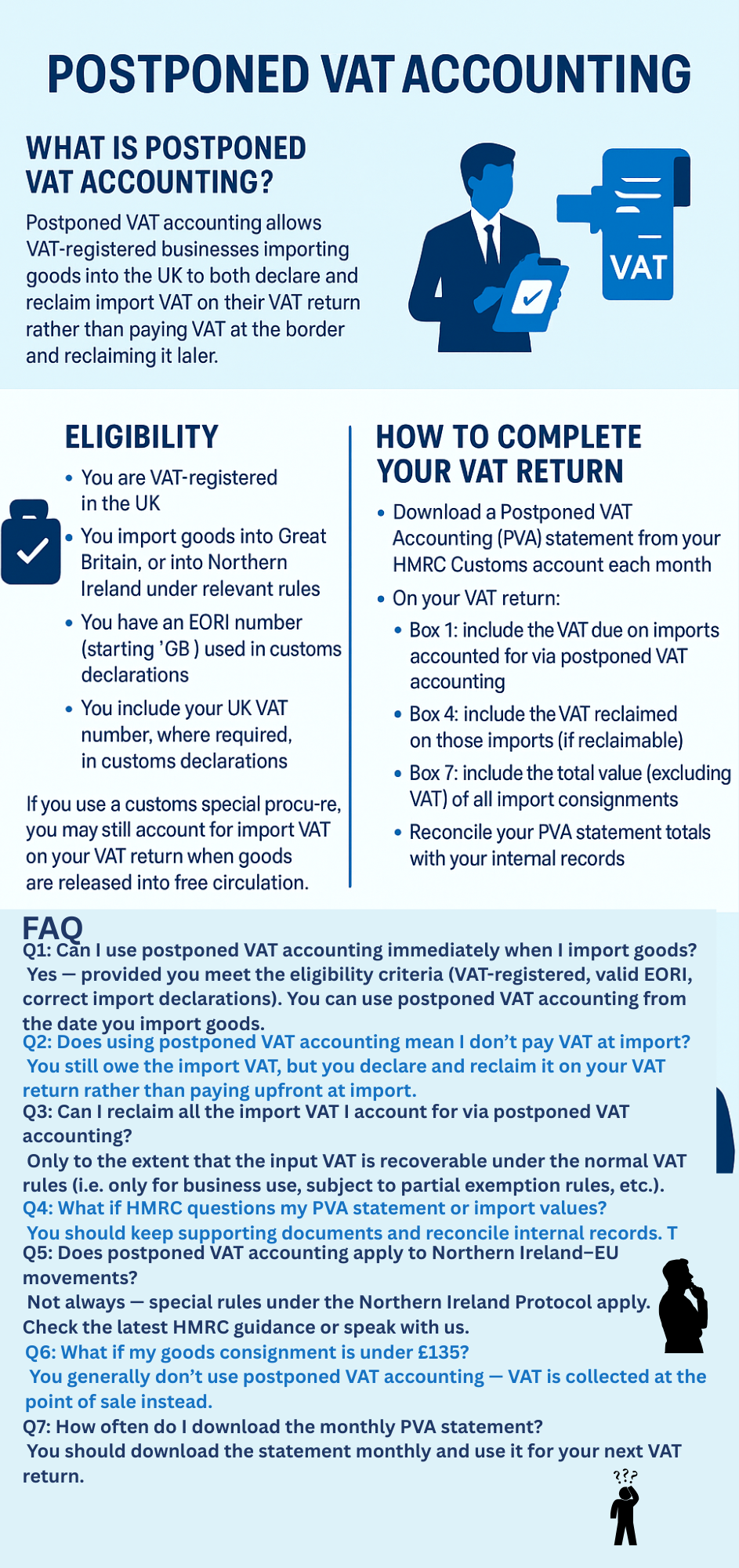

What Is Postponed VAT Accounting? (Postponed VAT Accounting Explained)

The concept of postponed VAT accounting allows VAT-registered businesses importing goods into the UK (or into Northern Ireland under certain conditions) to both declare and reclaim import VAT on their VAT return — rather than paying VAT at the border and reclaiming it later.

Under this scheme:

-

Import VAT is accounted for via your VAT return instead of at the point of importation.

-

This reduces cash-flow strain for businesses.

-

The usual VAT rules about what input VAT can be reclaimed still apply.

Since Brexit, this was one of the major changes to import VAT treatment in the UK.

Eligibility for Postponed VAT Accounting

To use postponed VAT accounting, you must satisfy certain conditions:

-

You are VAT-registered in the UK.

-

You import goods into Great Britain (or into Northern Ireland under the relevant rules).

-

You have an EORI number (starting “GB”) used in your customs declarations.

-

You include your UK VAT number, where required, in the customs declarations.

If you use a customs special procedure (for example, customs warehousing or a free zone), you may still account for import VAT on your VAT return when goods are released into free circulation.

Since 2021, these eligibility criteria remain largely the same, though HMRC occasionally issues clarifications regarding Northern Ireland and import VAT under the Northern Ireland Protocol.

How to Complete Your VAT Return with Postponed VAT Accounting

With postponed VAT accounting, there are some specific steps and changes to how you fill in your VAT return:

-

Each month, you should download a Postponed VAT Accounting (PVA) statement from your HMRC Customs account, which states the total import VAT postponed in that month.

-

On your VAT return:

-

Box 1 should include the VAT due on imports accounted for via postponed VAT accounting.

-

Box 4 should include the VAT reclaimed on those imports (if reclaimable).

-

Box 7 should include the total value (excluding VAT) of all import consignments (from the PVA statement).

-

-

Ensure you reconcile your PVA statement totals with your internal records.

These procedures remain in place, and there have been no radical changes to these basic steps since 2021.

Small Consignments and Exceptions (Postponed VAT Accounting and £135 Consignments)

There is a special rule for consignments not exceeding £135:

-

If the consignment value is £135 or less (goods-only value), import VAT will normally be collected at the point of sale (i.e. by the seller or marketplace) rather than through postponed VAT accounting.

-

Therefore, for low-value consignments, you will not use postponed VAT accounting — the importer does not need to do that.

This rule continues to apply and was part of the original import VAT changes introduced in January 2021.

Changes and Updates Since January 2021

While the framework for postponed VAT accounting remains largely the same as when introduced, there have been a few clarifications and updates worth noting:

-

HMRC has refined guidance on how postponed VAT accounting interacts with the Northern Ireland Protocol. Where goods move between Northern Ireland and the EU, the rules differ; you should check HMRC guidance specific to Northern Ireland.

-

HMRC has improved its online PVA statement interface and processing, making monthly statements more accessible.

-

Where customs processes evolve or special regimes (e.g. new freeports) are introduced, businesses should watch for rules that may affect how and when import VAT can be postponed.

-

Businesses should remain alert to HMRC updates or consult specialist advisers, as HMRC may issue further clarifications or changes over time.

How Trueman Brown Can Help with Postponed VAT Accounting

If you’re unsure how postponed VAT accounting applies to your business, or you’d like help implementing it correctly, Trueman Brown can assist. We can:

-

Review whether your business qualifies for postponed VAT accounting.

-

Help you set up your systems to record and reconcile the PVA statements.

-

Guide you through filling VAT returns accurately (Boxes 1, 4, and 7).

-

Liaise with HMRC on your behalf if there are issues.

-

Provide ongoing support and monitor changes in VAT law.

If you’d like assistance, please contact mark@truemanbrown.co.uk or call 01708 397262 — we’ll be happy to advise.

FAQ on Postponed VAT Accounting

Q1: Can I use postponed VAT accounting immediately when I import goods?

Yes — provided you meet the eligibility criteria (VAT-registered, valid EORI, correct import declarations). You can use postponed VAT accounting from the date you import goods.

Q2: Does using postponed VAT accounting mean I don’t pay VAT at import?

You still owe the import VAT, but you declare and reclaim it on your VAT return rather than paying upfront at import.

Q3: Can I reclaim all the import VAT I account for via postponed VAT accounting?

Only to the extent that the input VAT is recoverable under the normal VAT rules (i.e. only for business use, subject to partial exemption rules, etc.).

Q4: What if HMRC questions my PVA statement or import values?

You should keep supporting documents and reconcile internal records. Trueman Brown can help you respond to HMRC queries.

Q5: Does postponed VAT accounting apply to Northern Ireland–EU movements?

Not always — special rules under the Northern Ireland Protocol apply. Check the latest HMRC guidance or speak with us.

Q6: What if my goods consignment is under £135?

You generally don’t use postponed VAT accounting — VAT is collected at the point of sale instead.

Q7: How often do I download the monthly PVA statement?

You should download the statement monthly and use it for your next VAT return.

If you have more questions or want help, just reach out via mark@truemanbrown.co.uk or dial 01708 397262.

Recent Comments