Charities and VAT: A Practical Guide – Building Projects for the 2025/26 Charity Sector

Introduction

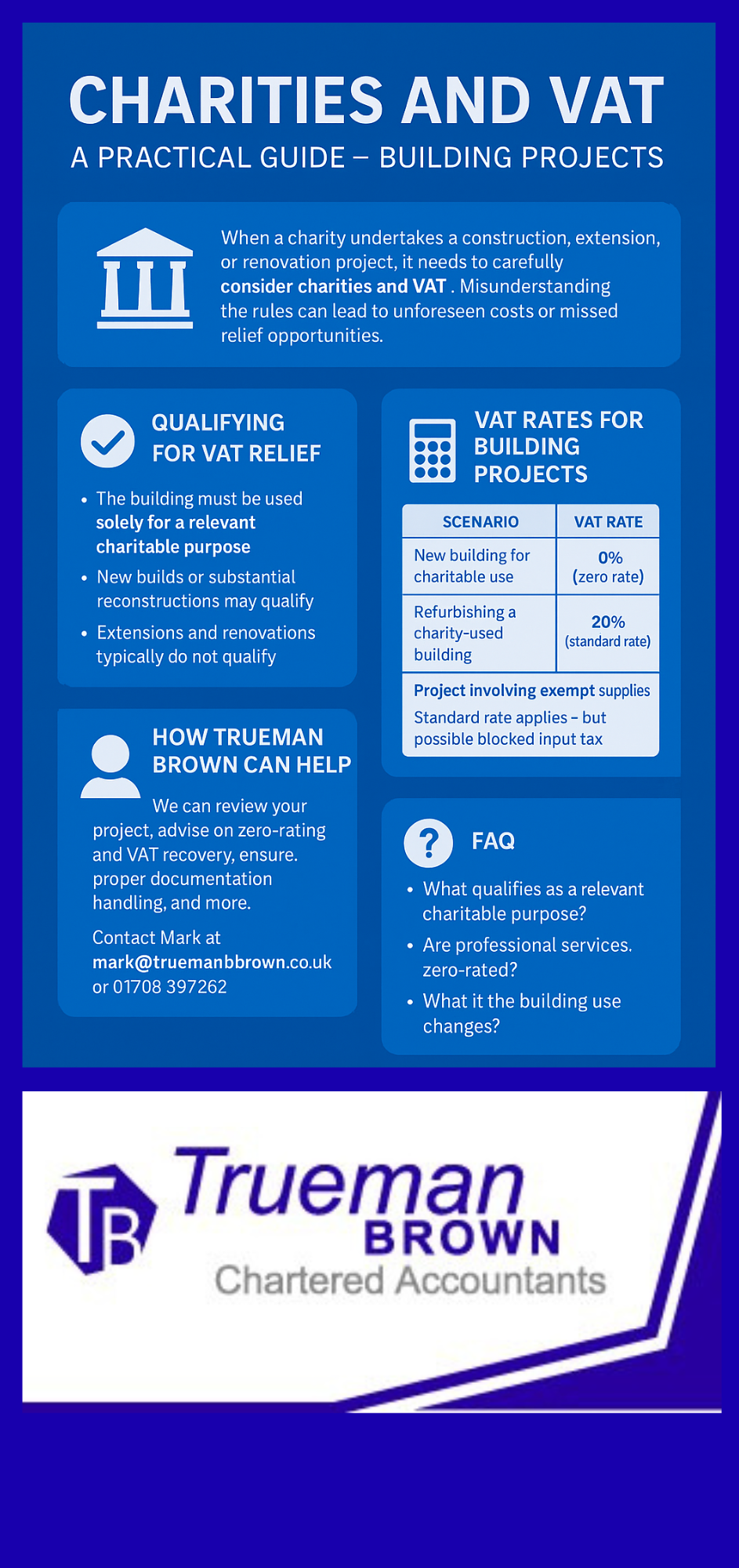

When a charity embarks on a construction, extension or refurbishment project, the issue of charities and VAT is one that needs careful thought at an early stage.

Many charitable organisations assume that because they are non-profit and charitable, VAT does not apply, but that is not the case.

In fact, the reliefs and rules for charities and VAT are detailed and complex, and getting them wrong can lead to unexpected costs or lost opportunities for relief.

This guide is based on the principles set out by the CAF Bank and the updated HMRC guidance, refreshed for the 2025/26 period, and tailored specifically for charities, social enterprises and not-for-profits engaging in building projects.

Understanding Reliefs: Charities and VAT in Construction Projects

Charitable bodies may benefit from VAT reliefs in certain building projects.

The starting point is the HMRC guidance for building work under VAT Notice 708 (Buildings and construction) which was last updated in June 2025.

Key points for charities and VAT:

-

A building used solely for a relevant charitable purpose may qualify for zero rating (0 %) on construction work, provided strict conditions are met.

-

If the building does not qualify for zero-rating, standard rating (20 %) usually applies.

-

The rate of VAT impacts not just what you charge, but also whether you can reclaim input tax. The concept of “blocked input tax” is important when the building is being used for exempt supplies.

-

The VAT domestic reverse charge for construction services may apply where both supplier and recipient are VAT-registered and the services fall under the Construction Industry Scheme (CIS).

Qualifying Buildings for Charities and VAT Relief

Not every building project qualifies for VAT relief – if a charity wants to benefit from the zero-rate, the project must meet the criteria set out in the HMRC rules, and the charity must understand how charities and VAT relate in this context.

What counts as a ‘qualifying building’?

For a charity seeking relief under charities and VAT:

-

The building must be intended for use solely for a relevant charitable purpose (ie a non-business use) or a “village hall” type use.

-

It must be constructed from scratch (i.e. new build) or substantially reconstructed (demolition to ground level, etc).

-

For an extension or annex, the annex must have independent access and not act as the main access to the existing building.

What about conversion or refurbishment?

Refurbishing an existing building for charitable use may not always enjoy the zero-rate of VAT for charities and VAT relief. Usually, standard or reduced rates apply instead, and much will depend on the previous use and the nature of the work

.Applying the Right Rate: Charities and VAT in Practice

Understanding which VAT rate applies is critical. This section explains how charities and VAT apply in practice for building projects.

| Scenario | Rate of VAT | Key consideration |

|---|---|---|

| New building used solely for charitable purpose | 0% (zero rated) | Charity must be able to certify intended use and meet the definition of relevant charitable building. |

| Standard refurbishment of an existing charity-used building | 20% (standard rate) | Unless other relief applies, standard rate is default for charity building work. |

| Project where charity will make exempt supplies (eg hall hire) | Standard rate applies; input tax may be blocked | The fact the charity makes exempt supplies means full input tax recovery may be restricted. |

Important update for 2025/26 for charities and VAT:

-

The HMRC guidance (VAT Notice 708) shows that the domestic reverse charge continues to apply for relevant construction services in the UK.

-

There have been clarifications (June 2025) regarding how electrical blinds or certain devices are treated for building material status.

-

Charities must ensure that any certificate they provide (to contractors) for zero-rating is current and properly completed; HMRC’s rules around certificates remain strict.

Input Tax and Partial Exemption: Charities and VAT Considerations

As part of considering charities and VAT, charities must look at input tax recovery and the implications of partial exemption.

-

If a charity makes taxable supplies, then it can reclaim input VAT on costs that relate solely to those taxable activities.

-

If a charity makes exempt supplies (for example, some hall hire, or social welfare services), then any input tax related to those exempt supplies may be blocked or only recoverable on a partial basis.

-

For building projects, if the building qualifies for zero-rating because it’s used for charitable purposes, some goods incorporated in the building may still be blocked from input tax recovery (especially non-building materials).

-

Charities must maintain appropriate documentation: certificates, invoices, evidence of use, details of mixed usage, etc.

Thus, it is essential for any charity involved in a building project to assess not just the VAT rate on the building work, but also how the project affects its overall VAT recovery position – part of the broader theme of charities and VAT.

Practical Steps & Procurement Checklist for Charities and VAT

Checklist for Charities and VAT

-

Define the project scope: new build, extension, conversion or refurbishment?

-

Establish the intended use of the building solely for a relevant charitable purpose? If yes, consider zero-rating.

-

Check whether you can issue a valid UK VAT certificate to the contractor specifying charitable use.

-

Confirm the contractor and sub-contractor status and whether the domestic reverse charge for construction services will apply.

-

Identify each element of the contract: building work, installation, non-building materials (e.g., carpets, furniture) – determine if they are “building materials” for VAT purposes.

-

Review whether the charity makes exempt supplies and assess how the building project affects input tax recovery (partial exemption rules).

-

Ensure contract/invoice documentation separates VAT-chargeable works, zero-rated works, and identifies non-building materials.

-

Put in place a log of intended use, access, certification of independent entrance (annexes) if relevant.

-

During project procurement, check whether VAT is correctly applied by suppliers and ensure tax invoices are received for input VAT claims.

-

After completion, monitor actual use of the building – if the use changes (e.g., becomes partly a business use) then the charity may face a “self-supply” charge and input tax adjustments.

-

Keep documentation for at least 6 years (or longer if required) in case HMRC asks for evidence.

-

During the project budget planning, include potential VAT costs, and where relief is claimed, include review of how much input tax may be blocked.

How Trueman Brown Can Help

If your charity is planning a building project and needs to navigate the complexities of charities and VAT, we at Trueman Brown can help you every step of the way.

-

We can review your project documentation and assist in determining whether your scheme qualifies for zero-rating.

-

We will help you map out your input tax recovery position, identify any exemption/licensing issues, and advise on the procurement process (including the domestic reverse charge).

-

We will liaise with your contractors to ensure VAT certificates and documentation are correctly handled in respect of charities and VAT.

-

For tailored advice and support, please contact Mark at mark@truemanbrown.co.uk or call 01708 397 262.

FAQ

Q: Does every charity building project qualify for zero-rating under charities and VAT rules?

A: No. Only building work on a new building (or substantially reconstructed building) intended to be used solely for a relevant charitable purpose (and meeting the detailed HMRC conditions) qualifies for zero-rating. If the work is an extension, refurbishment or mixed use, standard rate usually applies.

Q: What is the significance of the domestic reverse charge for charities and VAT in building work?

A: If the supplier and recipient are VAT-registered and the work falls under the Construction Industry Scheme (CIS), then the recipient (the charity) may have to account for the VAT under the domestic reverse charge instead of the supplier charging VAT. This affects how VAT is recorded and reclaimed.

Q: What do charities need to watch out for in terms of input tax recovery?

A: If the charity makes exempt supplies (for example hall hire, social welfare services) then any input tax relating to those exempt supplies may not be recoverable or only partially recoverable. Also, if the building changes use so that it no longer meets the conditions for zero-rating, the charity may face a “self-supply” charge.

Q: Are professional services (architects, surveyors) zero-rated for charities and VAT?

A: Typically not. Professional services are usually standard-rated (20%) even if connected with a zero-rated building project because they are not “building work in the course of construction” of a qualifying building for zero-rating. Always check with your advisor.

Q: If a charity builds a new hall for hire, does that mean zero rating automatically applies under charities and VAT?

A: Not necessarily. The use must be “solely for a relevant charitable purpose” – if the hall will be hired commercially (to non-charitable users) and the charity intends to make taxable supplies (or business use) then the zero rating may not apply in full. Input tax recovery will also be impacted.

Q: What happens if a building that was zero-rated changes use?

A: If the building ceases to be used wholly for charitable purposes (e.g., business use begins), the charity may need to account for a self-supply and adjust input tax accordingly under the capital goods scheme rules.

We trust this guide will help you steer your charity’s building project through the maze of charities and VAT.

If you’d like an initial assessment or a tailored support package, do get in touch with Trueman Brown via mark@truemanbrown.co.uk or call 01708 397 262.

Recent Comments