Introduction

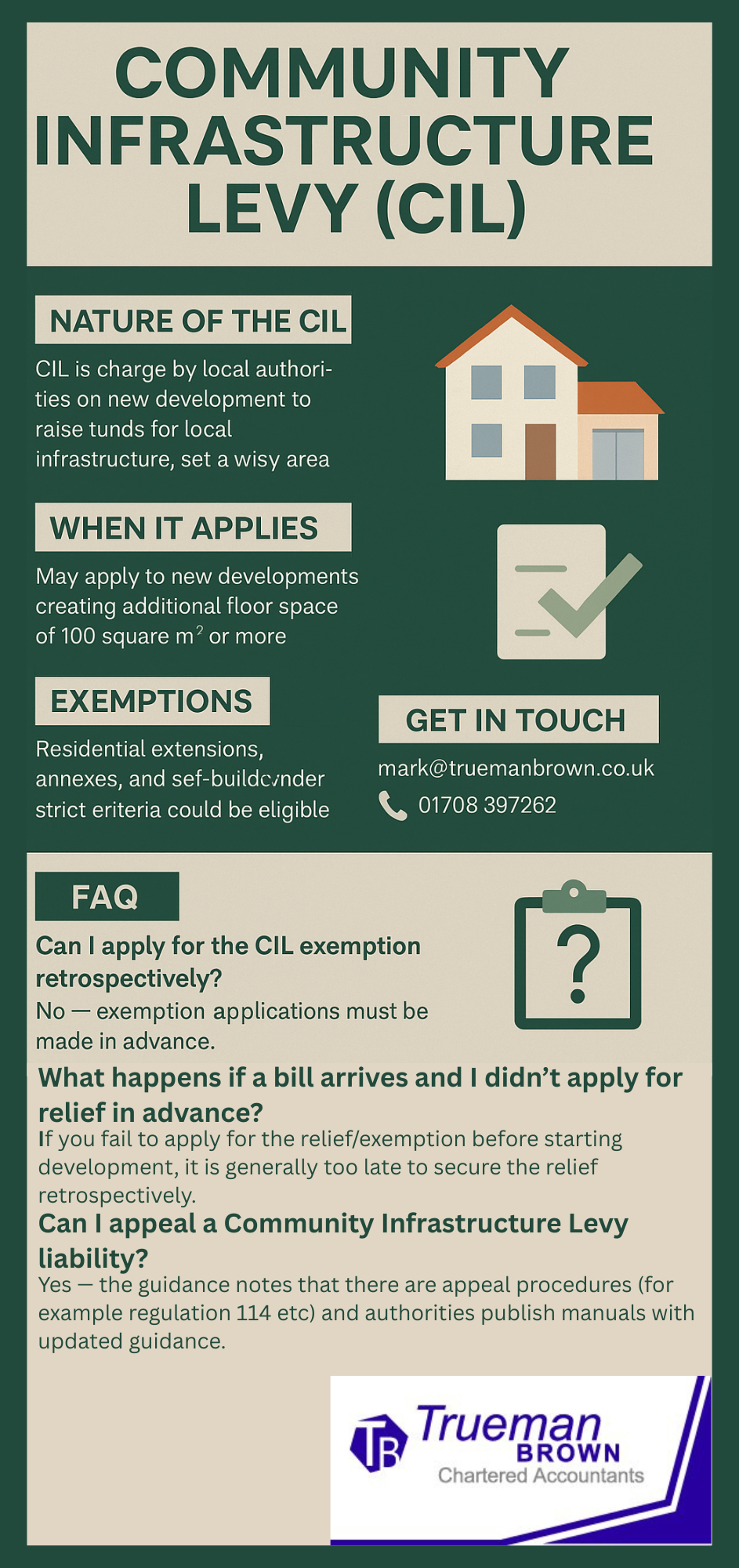

The Community Infrastructure Levy is increasingly affecting homeowners as well as developers.

While originally designed to fund infrastructure through new large-scale development, extensions and self-builds are now frequently caught by the Community Infrastructure Levy (“CIL”) — essentially a charge placed on new or additional floor space.

It remains vital to understand exactly when the Community Infrastructure Levy applies, how it works, and how to secure exemptions where relevant.

What the Community Infrastructure Levy is

The term Community Infrastructure Levy describes a charge local authorities may levy on certain new developments.

It is intended to raise funds for infrastructure such as roads, schools, flood defences, parks and other community facilities.

Only local authorities that have consulted on and approved a charging schedule may impose the Community Infrastructure Levy, and the rate will vary depending on area and type of development.

When the Community Infrastructure Levy applies

In general, the Community Infrastructure Levy may apply if your development creates additional floor space equivalent to 100 square metres or more, or adds an extra dwelling.

However, the key is whether the relevant local authority has adopted a charging schedule for that area. If so, they will charge a rate per square metre of new floorspace (or other specified criteria).

The Community Infrastructure Levy is calculated on the net increase in floorspace in many cases.

Also, for planning applications submitted from 1 May 2025 onwards, the amended regulations require the application to include certain information relating to the levy (for example: whether the development is liable for CIL, an estimate of gross internal area, and details of any relief or exemption claimed).

Exemptions and relief under the Community Infrastructure Levy

Fortunately, not all developments are liable for the Community Infrastructure Levy. Common exemptions or reliefs include:

-

Residential extensions and annexes (subject to strict criteria)

-

Self-build houses and flats built by individuals meeting the necessary definition

-

Some charitable or publicly-funded developments (depending on local policy)

The rules are strict and applications for relief must typically be submitted before development commences.

Failure to do so may result in an unexpected bill for the Community Infrastructure Levy.

Key procedural changes for 2025/26

A number of important updates to the Community Infrastructure Levy framework became effective in 2025:

-

The Community Infrastructure Levy (Amendment etc.) (England) Regulations 2025 came into force on 1 May 2025, amending the original 2010 Regulations.

-

Under these amendments, planning applications must include a statement about whether the development will be liable for CIL; and developers must submit estimates of gross internal areas etc.

-

Indexation: Many charging authorities are applying an annual BCIS All-In Tender Price Index update for CIL liability notices issued from 2025-26.

-

Data and transparency obligations: Authorities must publish infrastructure funding statements showing CIL receipts, expenditure and allocations.

It is therefore especially important, in 2025/26, to check whether your local charging authority has updated its schedule, and whether your development qualifies for relief before you begin work.

Practical tips: how to avoid a surprise Community Infrastructure Levy bill

-

Check before you start building whether your local authority has adopted a CIL charging schedule.

-

If your project may trigger the levy (e.g., extension +100 m², new dwelling, annex), investigate whether relief or exemption is available, and submit the required forms in advance of commencement.

-

Make sure your planning application or reserved matters application includes all required CIL information under the 2025 regulations (such as gross internal area created, any existing buildings to be demolished/retained, claimed reliefs etc).

-

Keep proof of your exemption / relief decision from the authority — if you commence without it, the relief cannot typically be applied retrospectively.

-

Don’t assume: even modest extensions have attracted large CIL bills when paperwork was incomplete or deadlines missed.

-

Consider instalment payment options if your CIL liability is large — many authorities publish an instalments policy.

How Trueman Brown can help

If you’re planning an extension, annex, self-build development or any project which may trigger the Community Infrastructure Levy, our team at Trueman Brown can guide you through the process. We will:

-

check whether the relevant local authority has a charging schedule for CIL in your area

-

review your project to determine whether you need to apply for relief or exemption

-

prepare and submit all required pre-commencement notifications and paperwork to minimise risk of unexpected liability

-

liaise with the council on your behalf and advise on payment/investment strategies

For full support, please contact us at:

Email: mark@truemanbrown.co.uk

Phone: 01708 397262

Let us help you avoid the “extension tax” trap and stay compliant with the latest Community Infrastructure Levy rules.

Frequently Asked Questions (FAQ)

Q1: What exactly is the Community Infrastructure Levy?

A1: The Community Infrastructure Levy is a charge that certain local authorities may impose on new development (or additional floorspace) in their area, with the aim of funding infrastructure needed to support growth.

Q2: Does the Community Infrastructure Levy apply to all extensions?

A2: No — it applies only where the local authority has adopted a charging schedule and where the development meets the criteria (often additional floorspace of 100 m² or more, or a new dwelling). However, local policy may vary and some extensions may fall outside the charge.

Q3: How do I know if relief or exemption is available for the Community Infrastructure Levy?

A3: Relief/exemption is available in some cases (e.g., self-build homes, annexes) but you must apply in advance of the work starting and satisfy the strict conditions laid down by the authority. If you start without securing relief, you may still receive a bill.

Q4: What changed in 2025/26 for the Community Infrastructure Levy?

A4: Key changes include: the amendment regulations coming into force from 1 May 2025, meaning additional requirements in planning applications to include CIL information; updated indexation rules; increased transparency obligations for councils.

Q5: What happens if a bill arrives and I didn’t apply for relief in advance?

A5: Unfortunately, if you fail to apply for the relief/exemption before starting development, it is generally too late to secure the relief retrospectively. You will likely be liable for the Community Infrastructure Levy charge and may face interest/surcharges for late payment — professional advice should be sought promptly.

Q6: Can I appeal a Community Infrastructure Levy liability?

A6: Yes — the guidance notes that there are appeal procedures (for example regulation 114 etc) and authorities publish manuals with updated guidance. However, appeals can be complex and time-limits apply.

Q7: Who should I contact for help with Community Infrastructure Levy issues?

A7: For expert assistance on whether your project triggers the levy, how to apply for relief/exemption, and how to respond to a bill, contact us at Trueman Brown: mark@truemanbrown.co.uk or 01708 397262.

Recent Comments