An Introduction to the Construction Industry Scheme

If you work in the building and contracting sector, you’ll almost certainly come across the construction industry scheme (CIS).

This set of rules governs how tax must be deducted from payments made by contractors to subcontractors in construction work.

Getting your obligations right under the construction industry scheme is vital to avoid unexpected penalties or disputes with HMRC.

There have been a few updates and reminders from HMRC in recent years, but the core principles of the construction industry scheme remain: contractors must verify subcontractors, make deductions when required, submit monthly returns, and keep accurate records.

Below, we explain what you need to know and how to stay compliant.

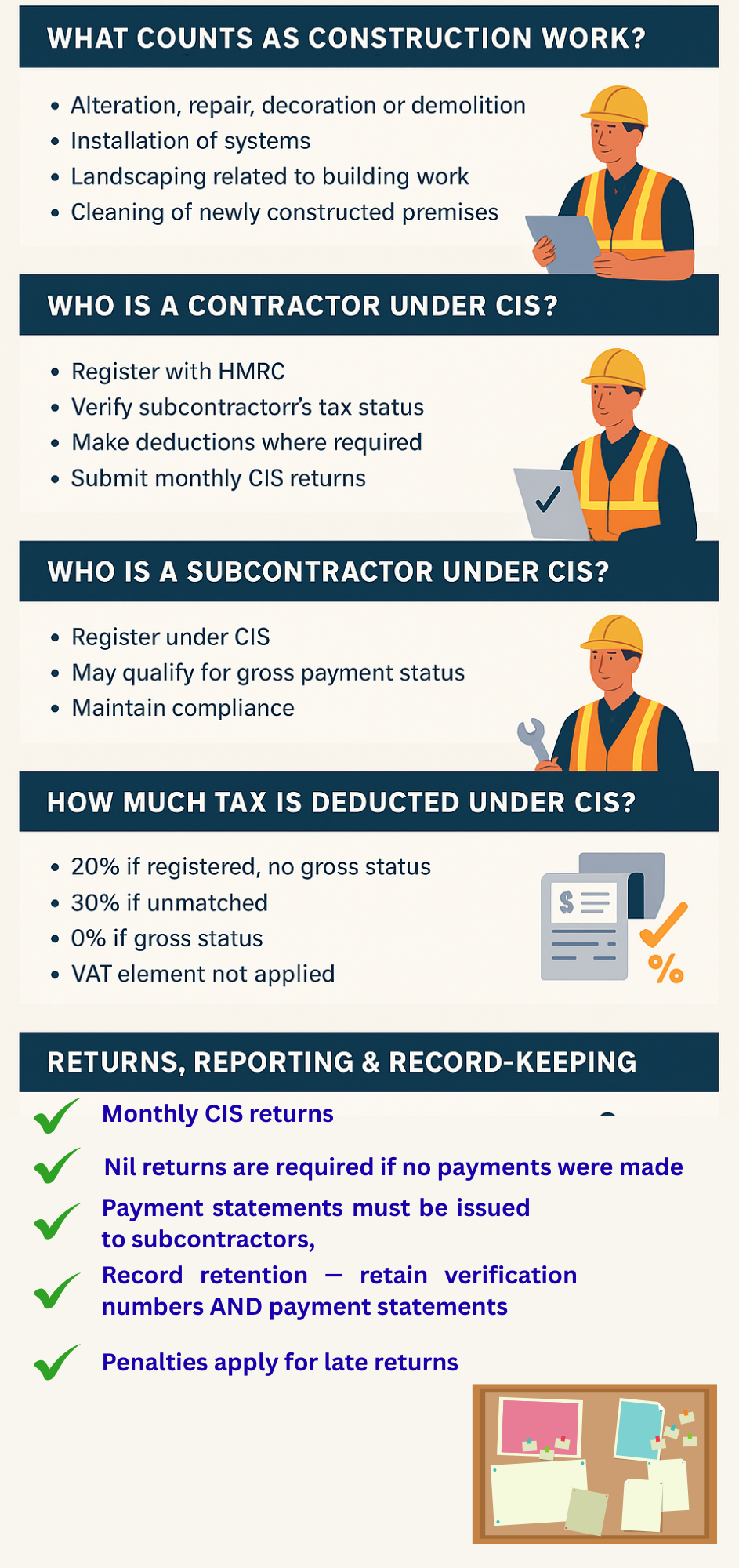

What Counts as “Construction Work”?

Under the construction industry scheme, “construction operations” is defined very broadly.

It includes not just building and renovation, but tasks such as:

-

Alteration, repair, decoration, or demolition

-

Installation of systems (heating, lighting, ventilation)

-

Landscaping closely related to building works

-

Cleaning of newly constructed premises before occupation

Even work such as site clearance or external paving may fall into scope.

If in doubt, check HMRC’s CIS guidance (for example in CIS 340) to confirm whether your job is caught by the rules.

Who Is a Contractor (and Their Duties) under the Construction Industry Scheme?

In the context of the scheme, a contractor is any person or business that pays others to carry out construction work. Under the construction industry scheme, those duties include:

-

Registering as a contractor with HMRC before making any payments subject to CIS

-

Verifying subcontractors’ tax status before making payments

-

Making deductions where required (20 %, or in certain cases 30 %)

-

Issuing payment statements to subcontractors

-

Submitting monthly CIS returns to HMRC

-

Maintaining compliance (e.g. meeting deadlines, avoiding late returns)

A business can act as both a contractor and a subcontractor, depending on the contracts it enters, so being aware of dual roles is important under the construction industry scheme.

Who Is a Subcontractor?

A subcontractor is someone engaged to undertake construction work for a contractor (i.e. providing labour or services, not purely supplying materials). Under the construction industry scheme:

-

Subcontractors must register under CIS unless they only work for private individuals who are not contractors

-

They may qualify for gross payment status, meaning payments can be made without deductions

-

To maintain gross status, they must satisfy turnover, business, and compliance tests

-

If they lose compliance or miss returns, HMRC may withdraw gross status and require deductions

Being properly registered and maintaining compliance helps subcontractors avoid heavier deductions and operational disruption.

How Much Tax Is Deducted?

When deductions must be made under the construction industry scheme, the rules are:

-

20 % deduction applies to payments where the subcontractor is registered but not eligible for gross status, or has lost that status

-

30 % deduction applies when a subcontractor is “unmatched” (i.e. HMRC cannot verify their details)

-

No deduction if the subcontractor is approved for gross payment status (and all conditions are met)

-

VAT element of invoices should never have CIS deductions applied

-

Subcontractors can offset CIS deductions against other tax liabilities or reclaim (for example via PAYE or Corporation Tax)

It’s important to get the deduction rate correct — mistakes here are a common source of HMRC disputes.

Returns, Reporting & Record-Keeping Requirements Under CIS

Under the construction industry scheme, contractors and subcontractors must abide by various reporting rules:

-

Monthly CIS returns must be filed within 14 days of the end of each tax month (i.e., by the 19th)

-

Nil returns are required if no payments were made

-

Payment statements must be issued to subcontractors, either per payment or monthly

-

Record retention — retain verification numbers, payment statements, and all related documents

-

Penalties apply for late returns (starting at £100 per month) or missing payment statements

-

Contractors who do not expect to make any CIS payments for six months can register as inactive, but must notify HMRC if activity resumes

Ensuring you comply with these obligations under CIS is critical to avoid fines or sanctions.

Recent Updates in the Construction Industry Scheme

Although the core rules of the construction industry scheme remain steady, there have been some updates and reminders from HMRC that contractors and subcontractors should note:

-

Stricter digital reporting expectations — HMRC increasingly expects that returns and communications be handled via digital channels (e.g. Making Tax Digital compatibility).

-

Penalties for inconsistency — HMRC has shown greater vigilance around late submissions, mismatched records, or failing to verify subcontractors properly.

-

Review of gross payment status — HMRC may periodically reassess and withdraw gross status if compliance slips.

-

Increased scrutiny on verification mismatches — where subcontractor data is incorrect or unmatched, 30 % deductions may be applied until corrected.

-

Awareness of dual roles — contractors operating also as subcontractors need to carefully manage interactions in both capacities to avoid compliance conflicts.

You should monitor HMRC’s published updates on CIS to stay ahead of any forthcoming changes.

How Trueman Brown Can Help You With the Construction Industry Scheme

Understanding and correctly applying the construction industry scheme can be complex — missteps can lead to costly penalties or cashflow issues.

At Trueman Brown, we specialise in helping contractors and subcontractors navigate their CIS obligations.

Whether you’re:

-

registering as a contractor

-

verifying subcontractors and setting deduction rates

-

applying for or maintaining gross payment status

-

preparing and filing monthly CIS returns

-

managing audits or disputes with HMRC

we can guide you every step of the way.

If you’d like advice or hands-on support, please get in touch with us:

Email: mark@truemanbrown.co.uk

Phone: 01708 397262

We’ll be happy to discuss how we can help make sure your CIS compliance is as smooth and low-risk as possible.

FAQ – Construction Industry Scheme

Q: Do I need to register under the construction industry scheme?

A: Yes — if you make or receive payments for construction work under contract (other than purely materials) you must register. Contractors must register before making payments; subcontractors register to receive payments.

Q: What if I only do small jobs for private individuals?

A: If you work only for private customers (non-contractors), you are generally outside CIS and no deductions should be made. But once you work for a contractor, CIS rules apply.

Q: How do I apply for gross payment status?

A: You must apply to HMRC, satisfy turnover tests, show you run a legitimate business, and maintain good compliance (file returns, pay tax on time). You’ll be reviewed periodically, and HMRC may withdraw status if compliance slips.

Q: What happens if HMRC cannot verify my details?

A: If subcontractor details are “unmatched,” HMRC requires deductions at the higher 30 % rate under the construction industry scheme until the mismatch is resolved. It’s in your interest to correct it quickly.

Q: Can I reclaim deductions made under CIS?

A: Yes — subcontractors can offset CIS deductions against their tax liabilities (e.g. via PAYE, Corporation Tax or self-assessment) or reclaim after filing returns.

Q: What penalties apply for non-compliance?

A: Penalties include fines for late returns (starting at £100 per month), failure to issue payment statements, late registrations, and the possibility of HMRC withdrawing gross status or applying higher deductions.

Q: How often must I file CIS returns?

A: Monthly. Returns must be filed within 14 days after the end of each tax month (i.e. by the 19th of each month). Nil returns are required where no payments have been made.

Q: Can a business act as both contractor and subcontractor under CIS?

A: Yes — many businesses fall into both roles, depending on the contracts. It’s essential to treat each role properly under CIS rules to avoid conflicts or compliance issues.

Recent Comments