Understanding CGT Payments on Account for Property in the UK

If you’re selling a residential property, it’s essential to understand how CGT payments on account for property work.

Since HMRC introduced stricter reporting deadlines, property owners must calculate, report, and pay any Capital Gains Tax (CGT) within 60 days of completion. Missing these deadlines can lead to penalties and interest charges.

What Are CGT Payments on Account for Property?

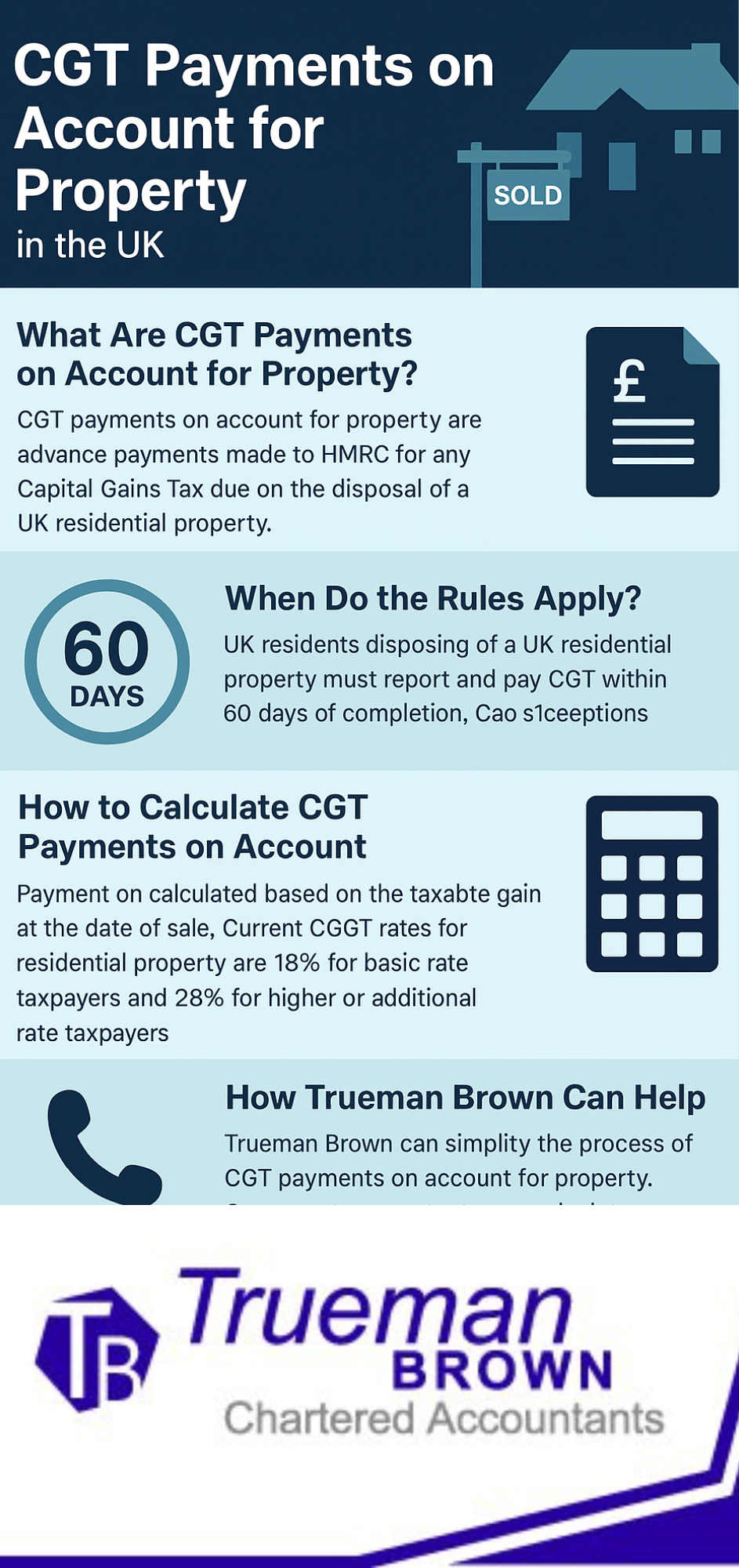

CGT payments on account for property are advance payments made to HMRC to cover any CGT due on the sale of a residential property.

This system ensures tax is collected closer to the transaction date rather than months later through Self Assessment.

When Do the Rules Apply?

As of 27 October 2021, UK residents disposing of a UK residential property must report and pay CGT within 60 days of completion.

Non-UK residents have been subject to similar rules since 2019.

These rules apply to second homes, buy-to-let properties, and properties that have not always been your main residence.

Transactions where there’s no CGT liability—for example, transfers between spouses or sales fully covered by Private Residence Relief—are exempt.

When Do the Rules Apply?

As of 27 October 2021, UK residents disposing of a UK residential property must report and pay CGT within 60 days of completion.

Non-UK residents have been subject to similar rules since 2019.

These rules apply to second homes, buy-to-let properties, and properties that have not always been your main residence.

Transactions where there’s no CGT liability—for example, transfers between spouses or sales fully covered by Private Residence Relief—are exempt.

How to Calculate CGT Payments on Account for Property

Your payment on account is calculated based on the taxable gain at the date of sale.

This includes allowable deductions such as your annual exempt amount (£3,000 for 2025/26) and eligible expenses like solicitor or estate agent fees.

Current CGT rates for residential property are 18% for basic rate taxpayers and 28% for higher or additional rate taxpayers.

Example Calculation

Emma sells a buy-to-let property on 1 May 2025, making a gain of £45,000 after all allowable costs.

As a higher-rate taxpayer, her CGT payment on account will be 28% of £45,000, or £12,600, which she must pay within 60 days of completion.

Filing Your Return and Adjusting Your CGT Payment

You must file a separate Capital Gains Tax on UK Property Return through your Government Gateway account.

After submitting your annual Self Assessment, any overpaid or underpaid tax is reconciled.

If your total annual income or gains change, HMRC will adjust your final liability.

How Trueman Brown Can Help

At Trueman Brown, we simplify the process of CGT payments on account for property.

Our expert accountants can calculate your liability, prepare your CGT return, and ensure it’s filed on time — preventing fines and delays.

Whether you’re a landlord, investor, or homeowner, we’ll guide you through every step and help you optimise your tax position.

📧 Email: mark@truemanbrown.co.uk

📞 Call: 01708 397262

FAQs on CGT Payments on Account for Property

1. What happens if I miss the 60-day deadline?

HMRC charges late filing penalties and daily interest on unpaid CGT after 60 days.

2. Do I need to report if there’s no gain?

No, if the sale results in no CGT liability, reporting is not required.

3. Can I amend a return after filing?

Yes, you can amend your CGT return within 12 months of submission.

4. Are overseas properties included?

No, these rules apply only to disposals of UK residential property.

5. How can an accountant help?

An accountant ensures accurate calculations, timely filing, and advice on reliefs and deductions — saving you both time and money.

Recent Comments