Should higher rate taxpayers file a self assessment return?

If you are among the higher-rate taxpayers, you may assume that all your tax affairs are handled automatically under PAYE.

However, many higher-rate taxpayers are required to file a self assessment return — and may miss out on valuable reliefs if they don’t.

In this article, we’ll explain the rules (as of 2025/26), highlight common pitfalls for higher-rate taxpayers, and show how Trueman Brown can assist you.

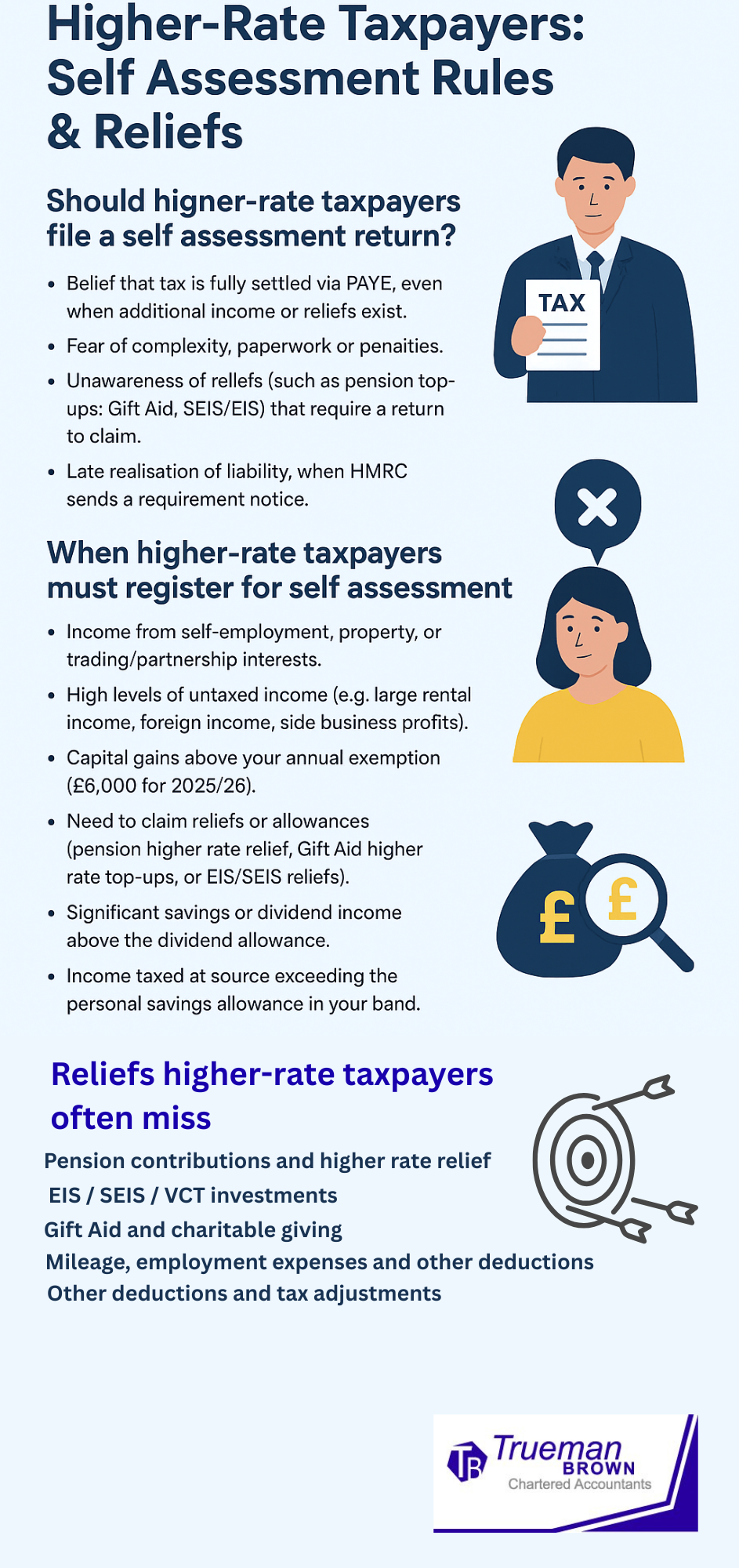

Why some higher rate taxpayers avoid self assessment

Even though higher-rate taxpayers pay tax at 40 % (or 45 %, for those above the additional rate threshold), a significant number do not submit a self assessment.

Many believe that everything is sorted through PAYE, but that is not always the case. Recent research (from HMRC and tax commentators) continues to show that a surprising number of higher-rate taxpayers are not fulfilling their obligations.

Here are some of the common misconceptions and barriers:

-

Belief that tax is fully settled via PAYE, even when additional income or reliefs exist.

-

Fear of complexity, paperwork or penalties.

-

Unawareness of reliefs (such as pension top-ups, Gift Aid, SEIS/EIS) that require a return to claim.

-

Late realisation of liability, when HMRC sends a requirement notice.

When higher rate taxpayers must register for self assessment

It’s not always straightforward, but here are the key triggers (for 2025/26) that mean a higher rate taxpayer must register for self assessment:

-

You have income from self-employment, property, or certain trading/partnership interests.

-

You receive high levels of untaxed income (e.g. large rental income, foreign income, side business profits).

-

You have capital gains above your annual exemption (currently £6,000 for 2025/26, down from previous years).

-

You need to claim reliefs or allowances (such as pension higher rate relief, Gift Aid higher rate top-ups, or EIS/SEIS reliefs).

-

You have significant savings or dividend income above the dividend allowance.

-

You have income taxed at source (such as interest) that exceeds the personal savings allowance in your band.

-

HMRC issues you a notice to file.

If any of these apply, higher rate taxpayers must notify HMRC (typically by 5 October following the tax year) to register for self assessment.

Failing to file when required can lead to penalties, interest and lost reliefs.

Reliefs higher rate taxpayers often miss

One of the biggest reasons self assessment is critical for higher rate taxpayers is the opportunity to claim tax reliefs or deductions that are not fully captured through PAYE. Here are key areas to check:

Pension contributions and higher rate relief

If you make personal pension contributions, you automatically receive basic rate relief (20 %) via the provider. But as a higher rate taxpayer, you can claim the additional 20 % (or 25 % for additional-rate payers) via self assessment. The effect is to extend your basic rate band and reduce your overall liability.

Gift Aid and charitable giving

Donations made under Gift Aid gain basic rate relief at source, but higher-rate taxpayers can claim an extra 20 % relief (or more) on the difference — typically via self assessment. This means for every £100 donated, you may reduce your taxable liability by an extra £25 (on top of what the charity already claims).

EIS / SEIS / VCT investments

If you invest in Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS), or Venture Capital Trusts (VCTs), there are generous income tax reliefs and capital gains deferrals available — but many higher rate taxpayers don’t claim them because they never file.

Mileage, employment expenses and other deductions

If your employer reimburses you at less than HMRC’s Approved Mileage Allowance Rates (AMAP) or with insufficient expense allowances, you may claim the difference via self assessment. Also, professional subscriptions, business clothing, and other allowable employment costs may be claimed.

Other deductions and tax adjustments

Don’t forget about annual investment allowances, losses carried forward, foreign tax credits, marriage allowance transfers, and other niche reliefs — many higher rate taxpayers overlook these.

Recent changes you should watch as higher rate taxpayers

Tax rules evolve, and higher rate taxpayers must stay alert to changes. Here are some recent or upcoming changes to watch:

-

Capital gains allowance changes: For tax year 2025/26, the annual capital gains exemption was reduced to £6,000 (from £12,300 previously). This means more taxpayers must report gains via self assessment.

-

Dividend allowance and rates: The dividend allowance has been reduced (now £1,000 for 2025/26). Higher rate taxpayers receiving dividends beyond that will face higher effective rates.

-

Pension annual allowance and tapering: The standard annual allowance remains £60,000, but high earners may have a tapered allowance or reduced values depending on their income. Those who exceed it may owe tax charges which require reporting via self assessment.

-

Higher Inheritance Tax (IHT) rates and allowances: While not directly self assessment, higher rate taxpayers should monitor changes to nil-rate bands and residential nil-rate bands that might trigger additional planning needs and tax returns.

-

Digital reporting and HMRC requirements: HMRC continues to push digitisation (e.g. MTD for Income Tax is being phased in). Higher rate taxpayers with unincorporated income may be required to file via digital software.

-

Penalty regime updates: HMRC’s penalty regime has become more stringent. Late filings, late payments, or inaccurate returns by higher rate taxpayers may attract steeper penalties and interest.

Risks of not filing for higher rate taxpayers

Failing to submit a self assessment when required can carry several risks, especially for higher-rate taxpayers:

-

Penalties and interest — default penalties and interest on unpaid tax can accumulate quickly.

-

Lost reliefs — you may permanently lose valuable tax reliefs, meaning your effective tax rate is higher than necessary.

-

HMRC demands or investigations — late filing or non-compliance may trigger notices or investigations.

-

Reputational or professional risk — for contractors, directors or professionals, tax irregularities may affect credibility.

-

Tax under-estimation — when self assessment is required, failing to declare income (e.g. property or side business) can result in underpayment and enforcement.

For higher-rate taxpayers, the cost of inaction often outweighs the administrative burden of filing.

How Trueman Brown can help higher-rate taxpayers

If you are a higher-rate taxpayer uncertain whether to file or how to maximise your reliefs, we at Trueman Brown can help you navigate the process smoothly.

Our experienced tax advisers assist with:

-

Determining whether you must register for self assessment

-

Completing and filing your return accurately and on time

-

Identifying all available reliefs and deductions (pensions, Gift Aid, EIS/SEIS, expenses)

-

Advising on tax planning to minimise your liability legally

-

Dealing with HMRC correspondence, notifications and appeals

To speak to a specialist, contact us via email at mark@truemanbrown.co.uk or call 01708 397262.

Let us take the stress out of managing self assessment so that you, as a higher-rate taxpayer, can be confident your tax affairs are optimised and compliant.

FAQ for higher-rate taxpayers and self assessment

Q1: What counts as a “higher-rate taxpayer”?

A: In the UK for 2025/26, a higher-rate taxpayer is someone whose income falls into the 40 % tax band (above the basic rate threshold and below the additional rate threshold). Above that threshold, the additional rate (45 %) may apply.

Q2: If all my income is taxed via PAYE, do I still need to file?

A: Not necessarily — but if you have additional untaxed income, reliefs to claim, capital gains, or HMRC asks you to, then yes. Even higher-rate taxpayers with multiple sources should check carefully.

Q3: When is the deadline for registering and filing?

A: You must register for self assessment by 5 October following the end of the tax year. The filing deadline is typically 31 October for paper returns, or 31 January for online returns (following the tax year). Penalties begin accruing for late registration and late filing.

Q4: Can I amend a return after submission?

A: Yes — you typically have up to 12 months from the 31 January filing deadline to amend a return for that tax year (for example, until 31 January the following year). After that, special rules apply.

Q5: What if I miss the deadline?

A: You may incur automatic penalties (£100 or more), daily penalties, interest, and potential additional HMRC enforcement. For higher-rate taxpayers, the sums involved can be significant, so prompt filing or contacting HMRC is advisable.

Q6: How do I claim pension or charitable reliefs as a higher-rate taxpayer?

A: You include details of your personal pension contributions and Gift Aid donations in the self assessment return. The system will apply the additional relief (beyond basic rate) to adjust your tax liability.

Q7: How much does Trueman Brown charge for handling self assessments for higher-rate taxpayers?

A: The cost depends on complexity — number of income sources, investment reliefs, property, etc. We’ll provide a transparent quote before engagement.

If you’d like to explore whether you should file, or want help preparing your return as a higher-rate taxpayer, email mark@truemanbrown.co.uk or call 01708 397262 today.

Recent Comments