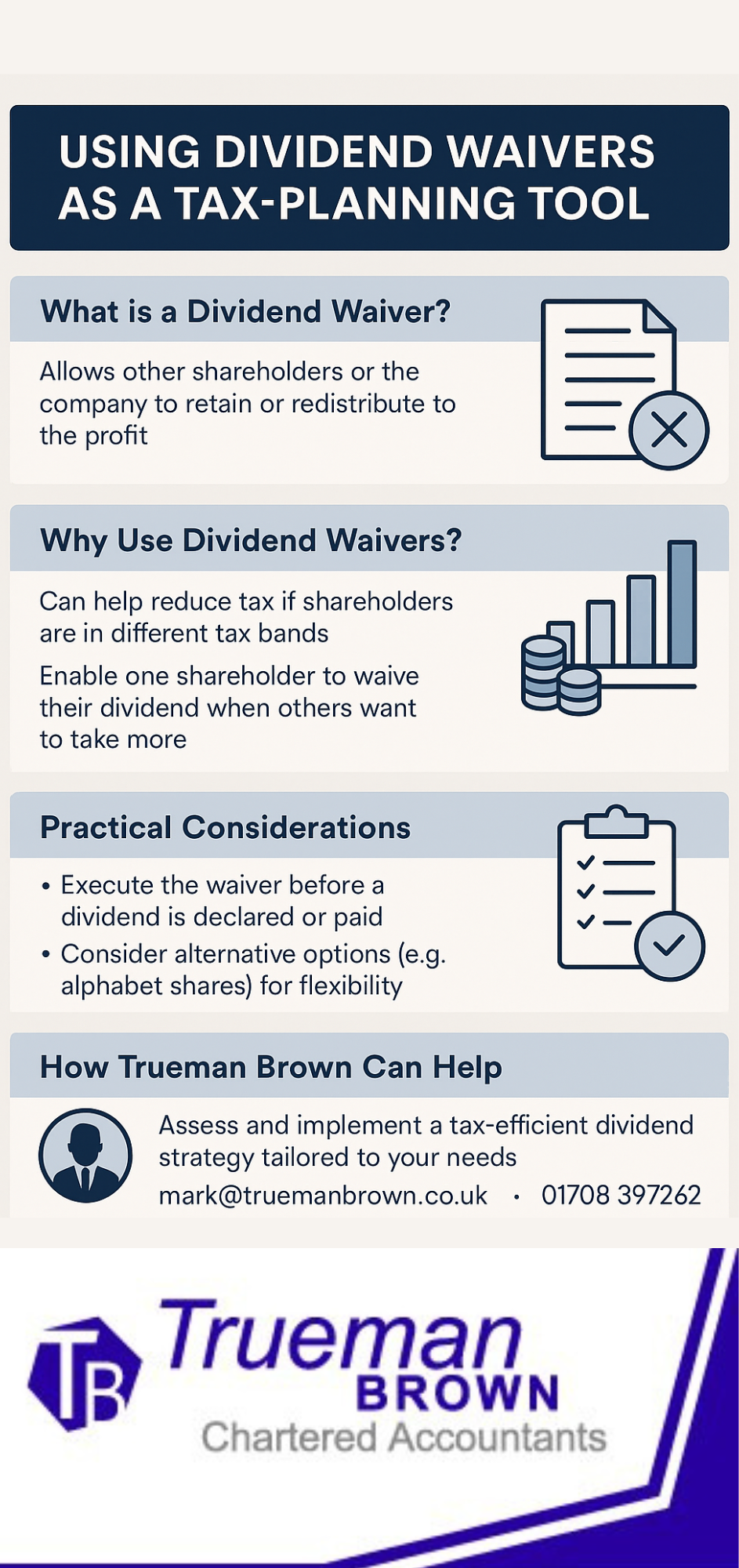

Using dividend waivers as a tax-planning tool

When it comes to effective tax planning for company shareholders, dividend waivers can play a significant role.

By deliberately arranging for a shareholder to waive their entitlement to a dividend, you can redirect profit distributions in a way that may minimise tax liabilities across the shareholder base.

In this post we look at how dividend waivers work, the risks to watch, the relevant tax and national insurance (NI) rules for 2025/26, and how we at Trueman Brown can help you implement them.

What are dividend waivers?

The effect is that the remaining shareholders receive a greater share of the distributable profits, while the waiver-shareholder receives nothing.

This can be particularly useful when one shareholder is subject to higher or additional rate tax and another is at a lower rate.

However, to be effective, the waiver must be formalised (typically by deed) and must be in place before the right to the dividend arises. Once the dividend is declared or paid, you cannot retrospectively waive it.

Why use dividend waivers in a closely-held company?

If you and other shareholders own a private limited company, the allocation of ordinary shares may initially mirror the proportions of share capital. Over time, however, one shareholder may become a higher or additional rate taxpayer and may prefer not to receive a dividend (or may want to leave distributable profits in the company).

In such cases, dividend waivers allow that shareholder to forgo their dividend, enabling others (often lower-rate taxpayers) to take more without changing shareholdings.

The concept is that the distributable profits are split among the shareholders not waiving their dividend entitlement, and the waiver-shareholder’s share remains within the company.

But like all tax-planning tools, there are traps: the waiver must not be seen as a device to distribute income to someone else (which could trigger the “settlements” legislation).

Key tax / allowance rules for 2025/26 in relation to dividend planning

When considering dividend waivers, you must also consider the tax environment for the 2025/26 tax year:

-

The personal allowance remains at £12,570.

-

The annual dividend allowance remains at £500.

-

Dividend tax rates for 2025/26:

-

Basic-rate taxpayer: 8.75% on dividend income above the allowance.

-

Higher-rate taxpayer: 33.75%.

-

Additional-rate taxpayer: 39.35%.

-

-

For national insurance: for employed earnings the main Class 1 employee rate is 8% between the primary threshold (£242/week) and the upper earnings limit (£967/week) for 2025/26; above £967/week the rate is 2%.

-

For employer NI: the rate is 15% on earnings above the secondary threshold (which is reduced to £96/week effective 2025/26) for the tax year.

Given this environment, dividend planning is especially pertinent: the small £500 allowance means dividend taxation bites quickly and the differential between basic and higher/additional rates is significant.

Use of dividend waivers therefore must be carefully aligned to the shareholder’s tax status and the timing of dividends.

Practical things to check before implementing dividend waivers

Here are key practical points for anyone considering dividend waivers:

-

Ensure the waiver is executed before the final dividend is declared or interim dividend paid. Past entitlement cannot be waived.

-

The waiver should ideally be in deed form, as there is no consideration (payment) given for the waiver.

-

Consider whether the waiver may trigger the “settlements” legislation: if the arrangement essentially diverts income from one person to another (for example a spouse), HMRC may challenge it.

-

Assess whether the company has sufficient distributable profits: if profits would not cover the dividend had the waiver not taken place, this may raise questions.

-

Recognise that a waiver may reduce the value of the shareholding being waived over time; the shareholder waiving their entitlement must be happy with the trade-off.

-

Consider alternatives: For example, using different share classes (alphabet shares) may avoid the need for waivers but have their own complexities.

Practical things to check before implementing dividend waivers

Here are key practical points for anyone considering dividend waivers:

-

Ensure the waiver is executed before the final dividend is declared or interim dividend paid. Past entitlement cannot be waived.

-

The waiver should ideally be in deed form, as there is no consideration (payment) given for the waiver.

-

Consider whether the waiver may trigger the “settlements” legislation: if the arrangement essentially diverts income from one person to another (for example a spouse), HMRC may challenge it.

-

Assess whether the company has sufficient distributable profits: if profits would not cover the dividend had the waiver not taken place, this may raise questions.

-

Recognise that a waiver may reduce the value of the shareholding being waived over time; the shareholder waiving their entitlement must be happy with the trade-off.

-

Consider alternatives: For example, using different share classes (alphabet shares) may avoid the need for waivers but have their own complexities.

How Trueman Brown can help

When you’re thinking about implementing dividend waivers, our team at Trueman Brown is ready to guide you through.

We can help you:

-

Assess whether a dividend waiver is appropriate for your company and shareholder structure.

-

Ensure the waiver is structured correctly and executed in advance of the dividend declaration.

-

Provide advice on associated tax implications (income tax, dividends tax, NICs) for the 2025/26 tax year and beyond.

-

Coordinate with solicitors (where required) to draft the waiver deed (a reserved legal service) and liaise with your company’s accountants.

-

Monitor changes in legislation and recommend alternatives if the waiver route ceases to be suitable.

If you’d like to discuss your situation or plan implementation of a dividend waiver, please contact us at mark@truemanbrown.co.uk or call 01708 397262.

We’d be pleased to help you assess and implement a tax-efficient dividend strategy.

FAQs

Q: What exactly is a dividend waiver?

A: It is an arrangement where a shareholder gives up their entitlement to receive a dividend, so that the other shareholders (or the company) can retain or redistribute the profit.

Q: When must the dividend waiver be executed?

A: Before the shareholder becomes entitled to the dividend. For interim dividends, the waiver must be in place before the payment. For final dividends, before formal declaration and shareholder approval.

Q: Are dividend waivers always tax-efficient?

A: Not always. They depend on the company having sufficient distributable profits, the shareholder structure, and the tax status of each shareholder. The presence of “bounty” (income diverted) issues under the settlements legislation must also be considered.

Q: What are the current dividend tax rates for 2025/26?

A: After the £500 allowance, the rates are 8.75% for basic-rate taxpayers, 33.75% for higher-rate taxpayers, and 39.35% for additional-rate taxpayers.

Q: Will implementing a dividend waiver affect my National Insurance contributions?

A: Dividend payments are subject to dividend tax, not NI (for shareholders). However, if you take salary instead of dividends, NI may apply. The main NI employee rate for 2025/26 is 8% between £242 and £967/week, 2% above that.

Q: Do dividend waivers change the shareholdings?

A: No – a waiver does not change shareholdings or rights attached to shares. It simply means a shareholder gives up their right to a proposed dividend. That means the waiver must be clearly documented so that rights and ownership remain unchanged.

Q: Does executing a dividend waiver affect the value of the shareholding of the waiver-shareholder?

A: Potentially yes. If a shareholder consistently waives dividends, over time their effective return on the shareholding may be reduced, which could affect value or future exit considerations.

Q: Can we use share class restructuring instead of dividend waivers?

A: Yes — different share classes (“alphabet shares”) where dividends can be paid unequally may be an alternative. But they bring their own legal, tax and commercial implications. A dividend waiver may still be appropriate depending on circumstances.

If you’d like to explore how dividend waivers could work in your company, get in touch: mark@truemanbrown.co.uk | 01708 397262.

Recent Comments