Taxation of dividends for the 2025/26 tax year – key changes and what you need to know about the dividend allowance 2025/26

If you’re a shareholder or director drawing dividends from your company, it’s important to understand how the dividend allowance 2025/26 affects your take-home pay.

For the tax year starting 6 April 2025 and ending 5 April 2026, the allowance remains at £500 — meaning the first £500 of your dividend income is tax-free, with tax charged on amounts above that.

This blog explains the major rules and rates for 2025/26, how dividend extraction from a company works, and what planning you should consider — updated from previous years to reflect the latest position.

Please note this is general guidance only and you should consult your accountant for your bespoke circumstances.

Impact of corporation tax changes

While the spotlight is often on dividends, remember that dividends are paid from retained profits after corporation tax.

From 1 April 2023, the HM Revenue & Customs (HMRC) introduced a main corporation tax rate of 25% for companies with profits above £250,000 and a small profits rate of

19% for profits up to £50,000, with marginal relief in-between.

As the available profit for dividend extraction is reduced, less can realistically be paid out as dividends.

The dividend extraction strategy must therefore consider both the corporation tax bite and the personal tax on dividends.

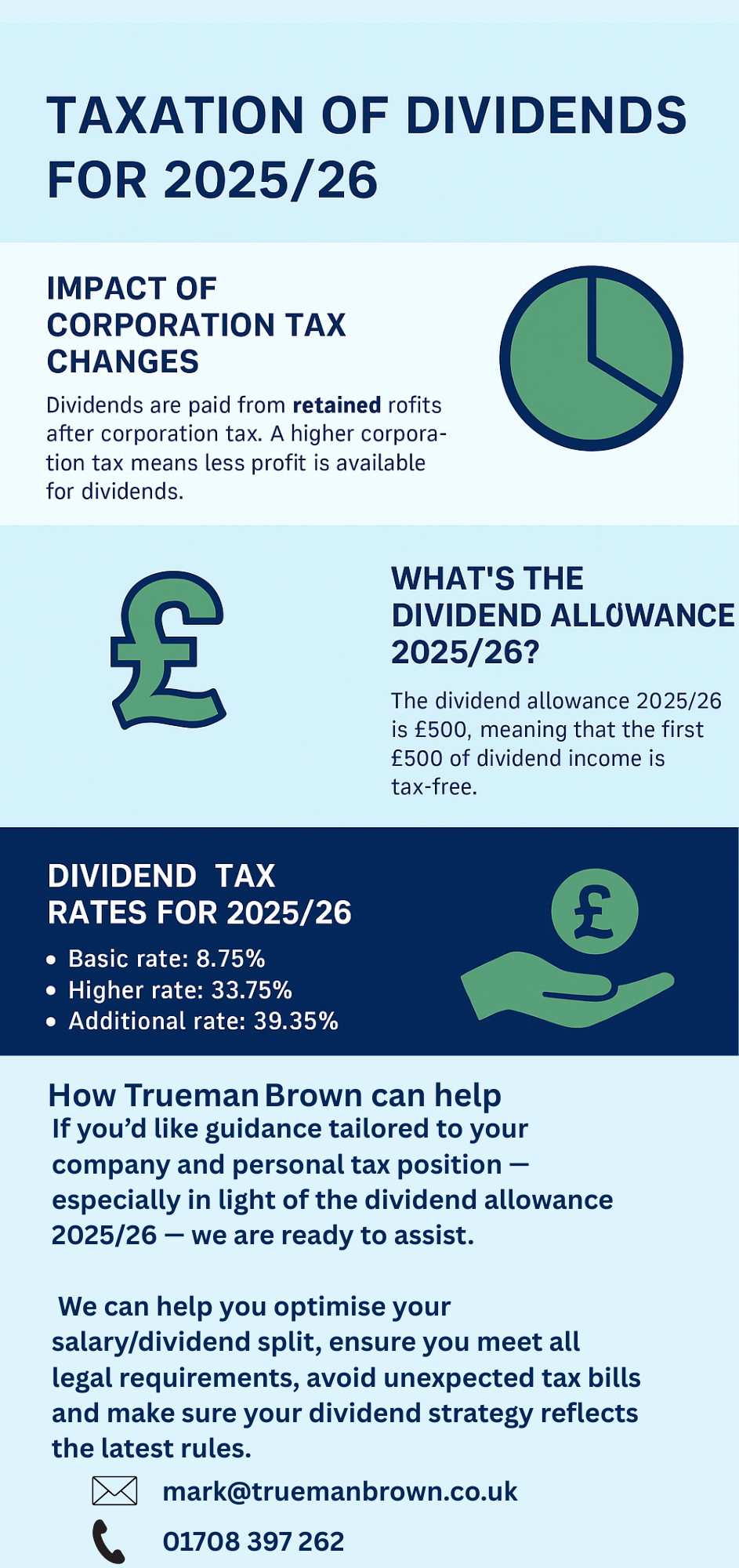

What’s the dividend allowance 2025/26?

The dividend allowance 2025/26 is £500.

That means for the 2025/26 tax year the first £500 of dividend income you receive is tax-free (subject to your other income circumstances).

This allowance is separate from your Personal Allowance (currently £12,570). So if you receive only dividends and no other income, you could receive up to £13,070 tax-free (combining Personal Allowance + dividend allowance).

It’s worth noting that the allowance was previously higher (e.g., £1,000 in the previous year), so this reflects a significant tightening of the tax-free threshold for dividend income.

Dividend tax rates for 2025/26

Once your dividends exceed the dividend allowance 2025/26 (and once your Personal Allowance is used up), the rate of tax you pay depends on your total income (salary + dividends + other taxable income).

For tax year 2025/26 the key figures are:

-

Personal Allowance: £12,570

-

Basic rate band: £12,571 to £50,270

-

Higher rate band: £50,271 to £125,140

-

Additional rate: over £125,140

Dividend tax rates (on income over the dividend allowance) for England, Wales & Northern Ireland are:

-

Basic rate: 8.75%

-

Higher rate: 33.75%

-

Additional rate: 39.35%

If you are in Scotland you use the same dividend tax-rates, although your income tax bands for non-dividend income differ.

Example of dividend extraction in 2025/26

Suppose you are a company director and you pay yourself a salary up to your Personal Allowance (£12,570) and take dividends thereafter. If you take dividends of, say, £50,000 in 2025/26:

-

£12,570 salary is tax-free via Personal Allowance

-

£500 of dividends is tax-free via the dividend allowance (i.e., dividend allowance 2025/26)

-

The remaining £49,500 (dividends) sits in the basic rate band up to £50,270 (i.e., £50,270 less salary and allowance = remaining basic rate room of ~£37,200) → taxed at 8.75%

-

Any dividends beyond your basic-rate band get taxed at 33.75% or 39.35% depending on total income.

The upshot: because the allowance is only £500, most of your dividend income is now taxable.

It makes careful planning all the more important.

Who this impacts and what has changed

-

If you own shares (in your own company or elsewhere) and rely on dividends for income, the drop in the allowance means you will pay tax on more of your dividend income than in previous years.

-

If you pay yourself dividends from a family or personal company, it’s more important to check that your strategy remains efficient given the low dividend allowance 2025/26.

-

The freezing of tax bands means that as profits/income increase with inflation, you may get pushed into higher tax bands or hit higher dividend tax even without a rate change.

-

The allowance was cut from £1,000 (for 2023/24) to £500 in 2024/25 and remains at £500 for 2025/26.

Planning considerations

-

Since the dividend allowance 2025/26 is only £500, you should review how much you draw as dividends and when.

-

Consider the salary + dividends mix carefully: paying a modest salary (to utilise the Personal Allowance) and then dividends may still be efficient — but monitor how much dividend falls into higher-rate tax.

-

Where possible, dividends paid into tax-efficient wrappers (for example, using shares held in an ISA) may help avoid dividend tax. Note: dividends paid inside an ISA are exempt from dividend tax.

-

If your spouse or partner is a shareholder and is taxed at a lower rate, you may consider distributing dividends accordingly (subject to shareholder/share class and anti-avoidance rules).

-

Retained profits must be sufficient before dividends can be paid — check your company’s profit and reserves before declaring dividends.

How we at Trueman Brown can help you with the dividend allowance 2025/26

If you’d like guidance tailored to your company and personal tax position — especially in light of the dividend allowance 2025/26 — we are ready to assist.

We can help you optimise your salary/dividend split, ensure you meet all legal requirements, avoid unexpected tax bills and make sure your dividend strategy reflects the latest rules.

Contact us:

Email: mark@truemanbrown.co.uk

Phone: 01708 397 262

We’ll review your current position, model different scenarios (given the £500 allowance, relevant tax bands and your overall income), and help you plan your dividend payments in the most tax-efficient manner for 2025/26 and beyond.

FAQ – Dividend allowance 2025/26

Q: What exactly does the dividend allowance 2025/26 mean?

A: It means that for the 2025/26 tax year you can receive up to £500 in dividend income tax-free. Any dividends above that threshold will be taxed at the dividend rates applicable to your income tax band.

Q: If I receive only dividends (no salary), can I receive more than £500 tax-free?

A: Yes — if you have no other income, your Personal Allowance (£12,570) can cover some dividends. So you could receive up to £12,570 (covered by Personal Allowance) + £500 (dividend allowance) = £13,070 in dividends tax-free. But once your total income exceeds the basic rate threshold, further dividends will incur tax.

Q: Have the dividend tax rates changed for 2025/26?

A: No — the dividend tax rates remain 8.75% for the basic rate band, 33.75% for the higher rate band and 39.35% for the additional rate band.

Q: Does the dividend allowance 2025/26 apply if I hold shares in an ISA or pension?

A: No — dividends paid on shares held within an ISA or certain pension wrappers are tax-free and do not use up your dividend allowance.

Q: What if my company doesn’t have enough retained profits — can I still pay dividends?

A: No — dividends must be paid out of accumulated, realised profits (after tax) and cannot exceed the company’s distributable reserves. If you pay dividends without sufficient reserves you risk triggering unlawful dividend rules and potential tax consequences.

Q: With the dividend allowance 2025/26 so low, should I stop paying dividends?

A: Not necessarily. Dividends remain a tax-efficient way to extract profits from a company provided they’re structured properly alongside salary, pension contributions and profit planning. The key is to review your overall plan in light of the current allowance and your personal tax band.

Recent Comments