Relevant motoring rules: motor expenses and NIC – what you need to know

If you or your employees use personal vehicles for business, motor expenses and NIC are closely linked.

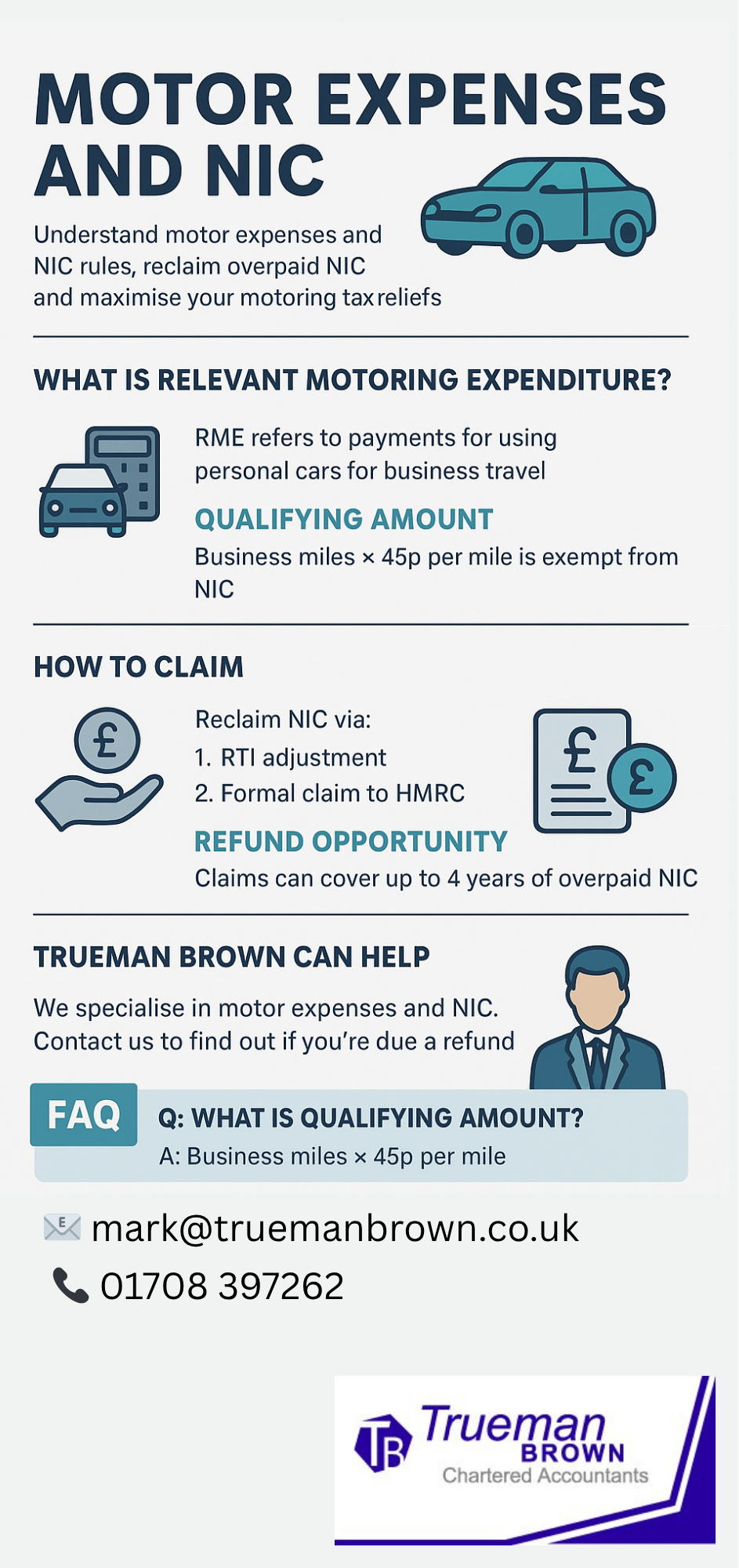

That’s because certain motoring payments can be excluded from National Insurance (NIC) contributions as part of “relevant motoring expenditure” (RME).

Getting this right can lead to significant savings — and sometimes refunds — for both employers and employees.

In this guide, we explain how motor expenses and NIC interact under current HMRC rules, recent developments, and what to watch out for.

Then we’ll show how truemanbrown.co.uk can help you claim correctly and avoid mistakes.

What is “relevant motoring expenditure” in the context of motor expenses and NIC?

When an employee uses their own car for business travel, the employer might pay them a mileage allowance.

Under the concept of relevant motoring expenditure, some of these payments can be disregarded when calculating Class 1 NIC — in effect reducing the NIC liability.

In other words, a portion of motor expenses and NIC can be offset if they qualify.

The key is whether the payment falls within the “qualifying amount” of RME: the business miles in the NIC earnings period multiplied by an approved rate (for cars and vans, HMRC treats 45p per mile as that rate for NIC purposes).

Even if the employer pays more than 45p per mile (for example, 50p), only the portion up to 45p × miles may be disregarded from NIC liability. The excess becomes subject to NIC as normal.

How HMRC’s mileage rates and NIC rules have changed (or been reinforced)

Latest HMRC and advisory fuel rates

From September 2025, HMRC revised its advisory fuel rates for company cars. These rates help define what reimbursements are tax-free and influence how motor expenses and NIC are calculated in practice.

Tribunal rulings opening up NIC refunds

Recent Upper Tribunal decisions (e.g. in Laing O’Rourke and Willmott Dixon cases) have expanded the scope of RME, enabling employers to reclaim NIC paid on car allowances in certain circumstances, especially where reimbursements were below 45p per mile.

NIC applied over full mileage at 45p

For NIC purposes, the “approved” 45p/mile rate applies to all approved business miles — not just the first 10,000 — even if for tax purposes a lower rate (e.g. 25p over 10,000 miles) is used.

So if an employer pays less than 45p, the shortfall may trigger additional NIC adjustments.

Employer obligations and RTI corrections

If an employer has been overpaying NIC (i.e. not fully utilising RME), they may correct the amounts via Real Time Information (RTI) on a pay-period basis, provided the records allow it.

Where RTI correction is not possible, a formal claim to HMRC (under “Relevant Motoring Expenditure”) must be submitted, with supporting evidence of business mileage, employee NI numbers, car allowances etc.

Application: motor expenses and NIC in different scenarios

Employee paid a car allowance

Suppose an employer gives a monthly car allowance (say £300), but the employee only uses the car for a fraction of business mileage.

The employer can treat part of that allowance as RME, up to the qualifying amount (business miles × 45p), and exclude it from NIC.

The remainder may become subject to NIC.

Reimbursement less than 45p

If an employer reimburses 25p per mile (which is common for tax purposes beyond 10,000 miles), for NIC treatment the full 45p × miles is used.

The shortfall becomes NIC-exposed. This is where claiming refunds under expanded RME rules may benefit employers.

Mixed usage (business + private)

Where a vehicle is used both privately and for business, only the business proportion qualifies.

Proper records must support the apportionment if you are to claim the benefit under motor expenses and NIC rules.

Directors / beneficial use of cars

If a company car is made available for private use, benefits in kind and Class 1A NIC may apply.

That side of motoring taxation is distinct and not covered in the RME regime.

When and how refunds or adjustments can be made for motor expenses and NIC

If NIC has been overpaid because the employer did not correctly exclude RME, adjustments can be made:

-

RTI correction: where pay records permit, the employer may adjust NIC on a pay-period basis to reflect correct RME exclusions.

-

Formal claim to HMRC: if RTI adjustment isn’t feasible, prepare a “Relevant Motoring Expenditure” claim in writing, with evidence of business mileage, employee NI numbers, car allowances, etc.

Employers should review historic car allowances to see if sizeable NIC refunds are possible under the newer, broader interpretation.

How Trueman Brown can assist you with motor expenses and NIC claims

At Trueman Brown, we specialise in ensuring that motor expenses and NIC are handled correctly — maximising reliefs and minimising unnecessary liabilities.

Whether you are an employer wanting to reclaim overpaid NIC, or an employee wishing to understand your entitlements, we can help.

-

We review your historical car allowance payments and mileage records to spot overpaid NIC.

-

We assist in preparing RTI corrections or formal claims to HMRC.

-

We advise your payroll/HR team on correct current treatment of motor expenses and NIC under the latest rules.

-

We audit your internal policies to avoid future mis-treatment.

To discuss your situation, contact us at mark@truemanbrown.co.uk or call 01708 397262. Let us help you recover NIC that should never have been paid — or avoid future errors.

Frequently Asked Questions about motor expenses and NIC (FAQ)

Q1: What exactly counts as relevant motoring expenditure (RME) for NIC?

A1: RME includes payments relating to the use of an employee’s vehicle for business journeys — typically mileage allowances or part of a car allowance — up to the qualifying amount (business miles × 45p). Anything above that is treated as earnings for NIC.

Q2: Why is 45p per mile used for NIC even if tax rules allow lower rates?

A2: HMRC requires the NIC “approved” rate to be 45p per mile for cars and vans, applied to all business mileage, regardless of thresholds for tax. This ensures consistency in NIC treatment.

Q3: Can I get a refund of NIC already paid on past car allowances?

A3: Yes, in many cases. Thanks to recent tribunal decisions widening RME, employers may reclaim NIC overpayments either via RTI corrections or formal claims to HMRC — assuming adequate records exist.

Q4: What supporting records are needed for a refund claim?

A4: You’ll need business mileage logs, employee NI numbers, details of car allowances and reimbursements, and payroll records showing NIC payments.

Q5: Does this relief apply to fully employer-provided cars?

A5: No. The RME/NIC treatment is for payments relating to employee-owned vehicles. For fully employer-provided cars, you deal with benefit-in-kind rules and Class 1A NIC rather than RME.

Q6: Do these rules change soon?

A6: The principles of RME and NIC are settled by tribunal and HMRC guidance. However, future government changes to mileage or NIC policy could alter details, so periodic review is prudent.

Recent Comments