Preparing for making tax digital in the 2025/26 tax year

The era of making tax digital is fast approaching.

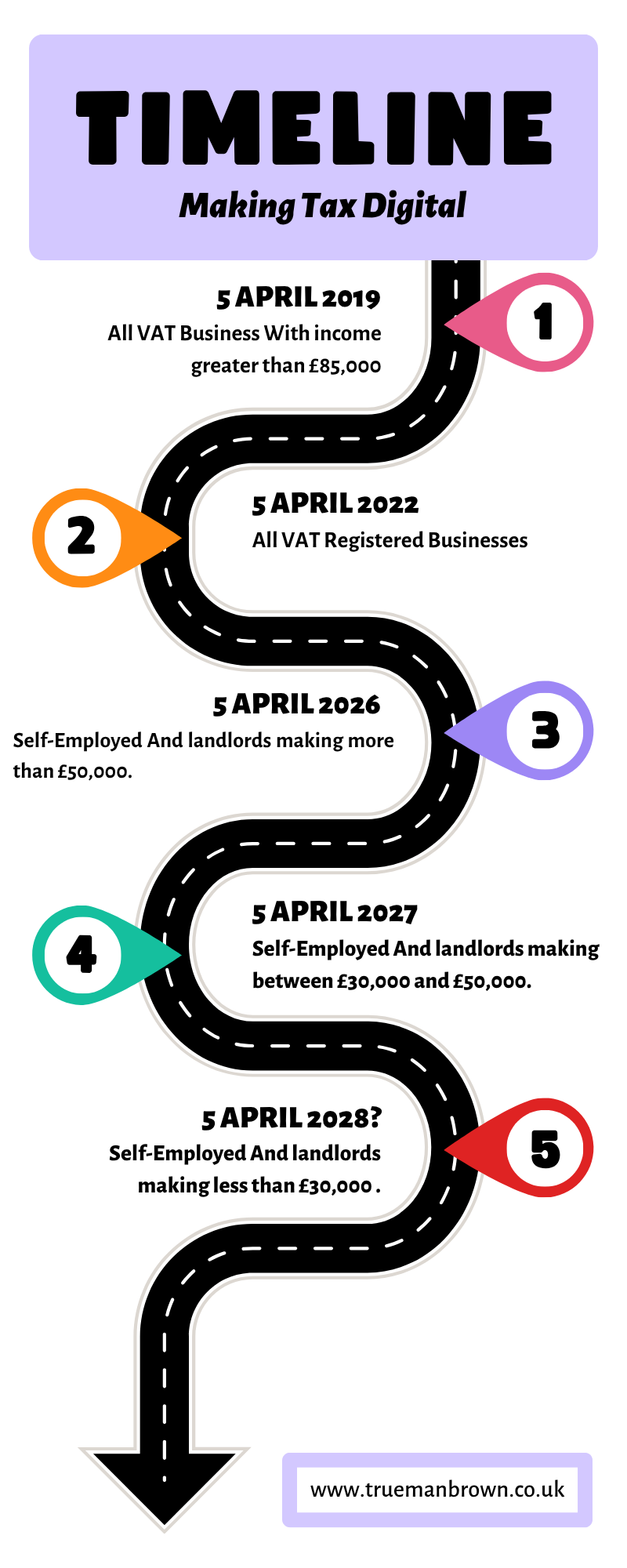

From April 2026, many sole traders, self-employed individuals and unincorporated landlords will need to adopt digital accounting and comply with the new reporting obligations.

With the 2025/26 tax year now underway, this is the time to get ahead of the changes so you’re ready when the rules bite.

What does making tax digital mean for you?

In essence, making tax digital (MTD) is the initiative from HM Revenue & Customs (HMRC) to modernise tax-reporting by requiring digital records and periodic submissions rather than just one annual return. For the 2025/26 tax year and beyond:

-

For many sole traders and landlords the first compulsory compliance date is 6 April 2026 (for those with combined business and/or property income of £50,000 or more).

-

From 6 April 2027, the threshold falls to £30,000.

-

There are further planned reductions to the threshold (e.g., down to £20,000 in future years) though those later dates are subject to legislation.

-

Although your tax payment process remains unchanged, making tax digital changes when and how you report to HMRC—not how much tax you pay.

Because the 2025/26 year is active, this is a perfect moment to review your systems, ensure they are compatible with MTD and start thinking ahead.

Who will be in scope of making tax digital (for income tax)

If you’re a sole trader, self-employed, or an unincorporated landlord, this section is especially important.

The in-scope rules for making tax digital in the income tax (Self Assessment) regime are:

-

From 6 April 2026: you’ll be in scope if your combined business and property income is £50,000 or more in the prior tax year.

-

From 6 April 2027: income threshold lowers to £30,000.

-

Once you fall into scope you remain in until your income stays below the threshold for three consecutive years (in most cases).

-

Even if you are not yet required to comply with making tax digital, adopting digital records now is strongly recommended as good practice and it will ease the transition when you do become obligated.

-

Exemptions are limited; for example, you might qualify if you’re “digitally excluded” (for disability, religious beliefs or lack of internet access) but this applies only in very narrow circumstances.

Thus, for the 2025/26 tax year you should be assessing your 2024/25 results and your plans for 2026 and beyond.

What are the obligations under making tax digital

Once you fall into scope of making tax digital, your compliance obligations will be significantly different than under the traditional annual Self Assessment model. Key requirements include:

-

Digital record-keeping: You must keep business and/or property income and allowable expenses in digital form, using software that is compatible with HMRC’s requirements. Spreadsheets may be acceptable if they meet the criteria and can link to the HMRC platform.

-

Quarterly updates: Instead of only submitting an annual return after the year end, you’ll submit interim (quarterly) summaries of your income and expenses during the year.

-

Final declaration: At the end of the tax year you’ll still file a final submission (replacing or supplementing the traditional Self Assessment) which reconciles allowances, reliefs and other sources of income.

-

Compatible software: Because this is central to making tax digital, you must use software that meets HMRC’s MTD standards.

-

No change to payment process: It’s important to stress that while reporting changes, the way you pay tax remains the same. Making tax digital does not change your tax payment deadlines or liabilities.

For the 2025/26 tax year this means you should ensure your accounting systems and reporting routines are aligned well ahead of the first key dates in April 2026.

How to prepare now for making tax digital

Getting ready early is wise. Here are steps to take during 2025/26 to ensure you are ready when making tax digital obligations begin:

-

Review your accounting systems – Are you using software or spreadsheets that are MTD-compatible? If not, plan migration now.

-

Digitise your records – From invoices and receipts to banking and property income, ensure your records are maintained digitally and stored securely.

-

Start quarterly mental-habit changes – Even if you’re not yet required to submit quarterly updates, getting used to reviewing your income & expenses every three months will help.

-

Map out your reliefs and allowances – Capital allowances, interest deductions (for landlords), loss carry-forwards and other adjustments will all need to be captured accurately in the digital record-keeping system.

-

Monitor your income thresholds – Keep a close eye on your combined business and property income so you can determine when you will come into scope of making tax digital.

-

Engage professional support early – With the change looming, getting guidance from experienced accountants will reduce the risk of missing compliance deadlines later.

By acting now (during the 2025/26 tax year) you give yourself breathing space to make the change smoothly when 6 April 2026 arrives.

How we at Trueman Brown can support you

At Trueman Brown, we understand how daunting the shift to making tax digital can feel — but you don’t have to face it alone.

Our team is ready to support you every step of the way:

-

We’ll help you select and implement MTD-compatible software, and ensure your accounting system is set up correctly.

-

We’ll assist you with ongoing bookkeeping and digital record maintenance, so your income and expenses are always ready for quarterly submissions.

-

We’ll manage quarterly updates and the final declaration for you, so you meet the obligations of making tax digital without stress.

-

We’ll advise on tax reliefs, allowances and planning strategies so you not only comply, but optimise your tax position.

-

We’re ready to get started now to ensure you’re fully prepared ahead of the first key deadline.

If you’d like to talk through how we can help you make the transition to making tax digital, please get in touch:

Email: mark@truemanbrown.co.uk

Phone: 01708 397262

Let’s make sure your business is ready for the new world of digital tax reporting.

Frequently Asked Questions (FAQ)

Q: When does making tax digital for income tax actually start?

A: For many sole traders and unincorporated landlords the requirement begins 6 April 2026 if you meet the income threshold (£50,000+). The threshold falls to £30,000 from 6 April 2027.

Q: Will making tax digital change the way I pay my tax?

A: No — the payment deadlines and liability remain the same. What changes is when and how you report your income and expenses.

Q: Do I need to use special software for making tax digital?

A: Yes — you must use MTD-compatible software or a structured spreadsheet that links to HMRC’s platform for reporting quarterly summaries.

Q: What if my income falls below the threshold after I enter the regime?

A: You’ll normally remain in the regime unless your income stays below the threshold for three consecutive years.

Q: Can I start early with making tax digital even if I’m not yet required?

A: Absolutely. Starting your digital record-keeping early is good practice and means you’ll be ahead of the curve.

Q: What should I do now, during the 2025/26 tax year?

A: Review your current systems, digitise your records, plan for quarterly updates, and engage a professional such as Trueman Brown to support you.

We hope this guide gives you a clear overview of what making tax digital means and how to prepare.

If you’d like help navigating the changes ahead, get in touch with us at Trueman Brown — we’re here to help you make the transition smoothly.

Recent Comments