Understanding PAYE settlements: what they are and why they matter

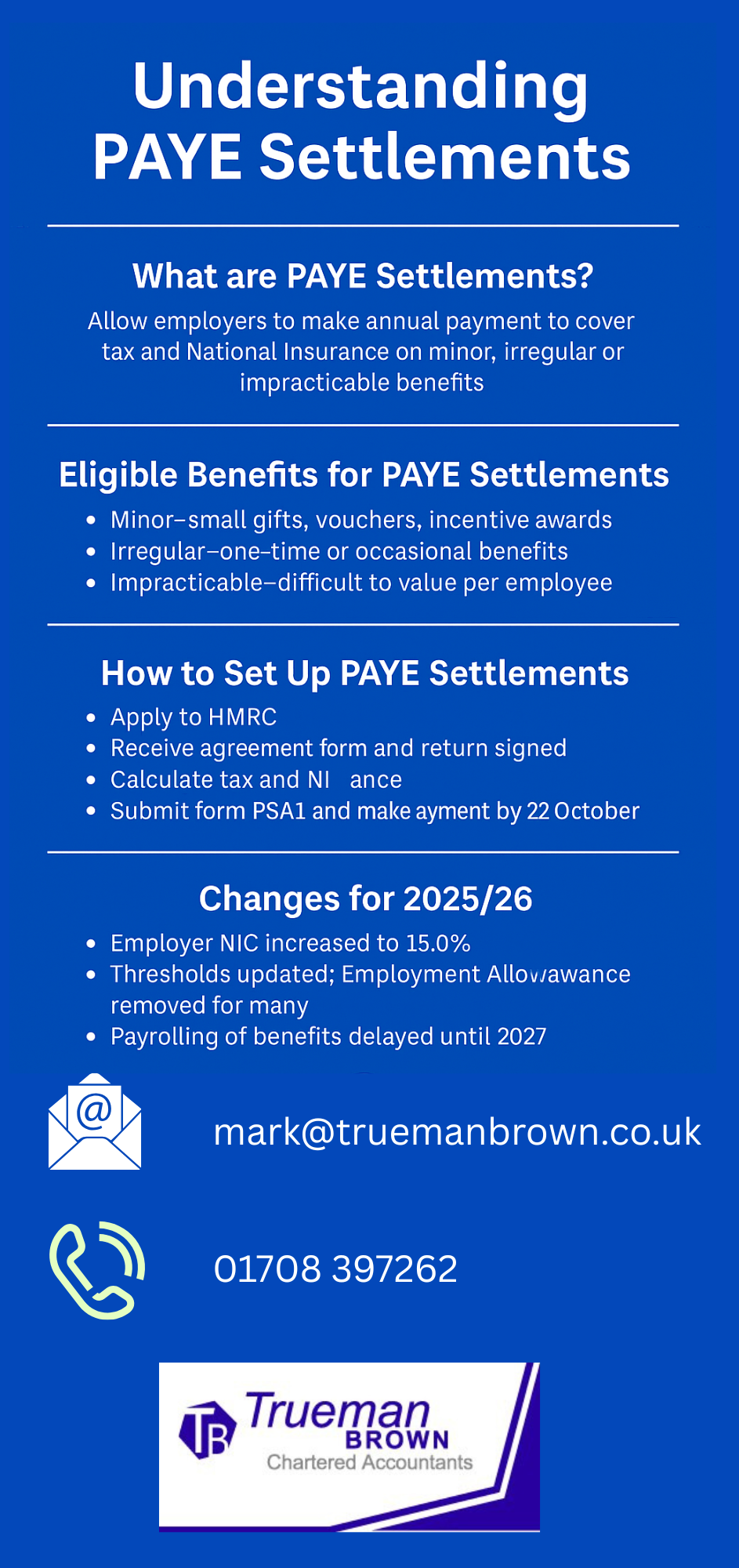

A PAYE settlements arrangement allows an employer to make a single annual payment to cover all the tax and National Insurance due on certain employee benefits or expenses, rather than pushing that liability onto the employee.

This can make life easier for both employer and employee when dealing with small, irregular or hard-to-value benefits.

Many businesses find that PAYE settlements bring welcome simplicity — reducing administrative burden, avoiding employee surprise tax bills, and helping ensure compliance with current HMRC rules.

What kinds of employee benefits suit PAYE settlements?

Minor, irregular or impracticable benefits

PAYE settlements are suitable only for certain kinds of benefits or expenses. Typically, those that qualify fall into one of three categories:

-

Minor benefits — small gifts or vouchers, incentive awards, and similar items that don’t qualify under trivial-benefit exemptions.

-

Irregular benefits — one-off or occasional benefits such as relocation costs (when above exempt thresholds) or occasional use of a company flat.

-

Impracticable benefits/expenses — items where it is difficult, impractical or disproportionate to allocate a value to each individual employee. These might include staff entertainment, shared cars, group events, or other benefits where dividing costs individually would be complex and burdensome.

Benefits not included under PAYE settlements: cash payments (bonuses, cash allowances), high-value benefits such as company cars or medical insurance (unless otherwise payrolled), beneficial loans or other large, regular benefits.

If a benefit qualifies, including it under a PAYE settlements arrangement can relieve the employee of the tax burden — the employer picks it up instead.

How to set up PAYE settlements — the process

-

Apply to HMRC. To use PAYE settlements for a tax year, you must apply to HMRC describing the benefits or expenses to be covered. Once agreed, the arrangement is typically enduring — it remains in place until revoked by you or HMRC.

-

Agree the terms. Once approved, HMRC send draft copies of a PSA form (previously P626) which you return signed. That formalises the PAYE settlements agreement.

-

Calculate the liability. After the end of the tax year, you must compute the tax and National Insurance due on the agreed benefits. Income tax is “grossed up” at the employee’s marginal rate (and Scottish tax rates if applicable).

-

Submit and pay. Use form PSA1 to submit calculations, and pay the total due. For the 2025/26 tax year (i.e. benefits provided to 5 April 2026), payment must be made by 22 October (if paying electronically) or 19 October (if paying by cheque).

What’s changed for 2025/26 — what employers must know

-

From 6 April 2025, Employer National Insurance (Class 1, Class 1A, Class 1B) increased from 13.8% to 15.0%. This change applies to NIC on salaries and also to NIC due under PAYE settlements.

-

The threshold at which Employer NIC becomes payable (secondary threshold) has been lowered — affecting overall pay costs.

-

The removal of the historic Employment Allowance threshold (previously £100,000) means small employers can no longer rely on that allowance to reduce employer NIC liability — increasing the cost of benefits when covered under PAYE settlements.

-

The scheduled move to mandatory payrolling of most benefits in kind has been delayed until 6 April 2027.

-

As a result, a properly constructed PAYE settlements agreement remains fully relevant through the 2025/26 and 2026/27 tax years — though employers should keep an eye on the 2027 transition if they wish to continue simplifying benefits tax.

Why using PAYE settlements can make sense (cost, compliance, goodwill)

Adopting PAYE settlements can deliver several practical advantages:

-

Reduced admin burden — no need to handle multiple P11Ds or add each benefit separately to payroll. This is especially useful for numerous small or irregular benefits.

-

Compliance and clarity — by agreeing the treatment in advance with HMRC, employers avoid mistakes and penalties for under-reporting or misreporting.

-

Improved employee experience — employees don’t get unexpected tax bills for gifts, social events or occasional perks. Instead, the employer handles the liabilities, which can reinforce goodwill and retention.

-

Flexibility — as long as benefits fit the “minor / irregular / impracticable” test, PAYE settlements allow a broad range of perks to be bundled, avoiding the need for individual assessment or complex payroll adjustments.

Even though employer NIC costs have risen for 2025/26, many companies still find PAYE settlements cost-effective when balancing administrative relief, compliance risk and benefits for staff.

How Trueman Brown Chartered Accountants can help you implement PAYE settlements

At Trueman Brown, we appreciate how complex HMRC rules around benefits, tax and NIC can become — especially as they evolve.

That’s why we support businesses in setting up and managing their PAYE settlements properly.

Whether you’re looking to:

-

assess whether certain employee benefits qualify for inclusion under a PAYE settlements agreement;

-

prepare and submit the initial agreement to HMRC;

-

calculate grossed-up tax and Class 1B NIC liabilities correctly;

-

meet payment and filing deadlines (e.g. 22 October for electronic payments);

-

review existing benefit policies in light of 2025/26 changes (higher NIC rates, loss of Employment Allowance, 2027 payrolling changes) —

we can guide you step by step.

If you’d like help with PAYE settlements — or general payroll/tax compliance — please contact us at mark@truemanbrown.co.uk or call 01708 397262.

FAQ — Frequently Asked Questions about PAYE settlements

Q: What kinds of benefits can I include in a PAYE settlements agreement?

A: You can include benefits or expenses that are “minor” (small gifts, vouchers, non-exempt staff awards), “irregular” (one-off or occasional benefits such as relocation costs), or “impracticable” to allocate individually (e.g. staff entertainment, shared costs). You cannot include cash payments such as bonuses, high-value benefits like company cars, or ongoing regular benefits.

Q: When do I need to apply for a PAYE settlements agreement?

A: For a new agreement, you should apply to HMRC as soon as possible and no later than 5 July following the end of the tax year in which the benefits were provided.

Q: When must payment be made for PAYE settlements?

A: For electronic payments, the deadline is 22 October after the end of the relevant tax year. If paying by cheque, the deadline is 19 October.

Q: Has anything changed for 2025/26 that affects PAYE settlements?

A: Yes — Employer National Insurance (NIC) rates increased to 15.0% from 6 April 2025, raising the cost of providing taxable benefits. The threshold at which employer NIC applies has also decreased, and the Employment Allowance eligibility threshold has been removed.

Q: Will PAYE settlements still be relevant when mandatory payrolling of benefits in kind begins?

A: For now — yes. The move to mandatory payrolling of most benefits in kind has been delayed until 6 April 2027. Until then, PAYE settlements remain a valid and useful route. After 2027, some benefits may need to be processed differently, but PAYE settlements may still have a role depending on the benefit type and employer circumstances.

Recent Comments