Profit Extraction: Smart Strategies for 2025/26

Understanding profit extraction is essential if you run a limited company.

With ongoing changes to UK tax rates, National Insurance, allowance freezes and dividend tax adjustments set from the Autumn Budget 2025, planning how you draw funds from your business has never been more important.

This guide explains the practical approaches to getting money out of your company in the most tax-efficient way, while considering current rules and thresholds.

What Is Profit Extraction and Why It Matters

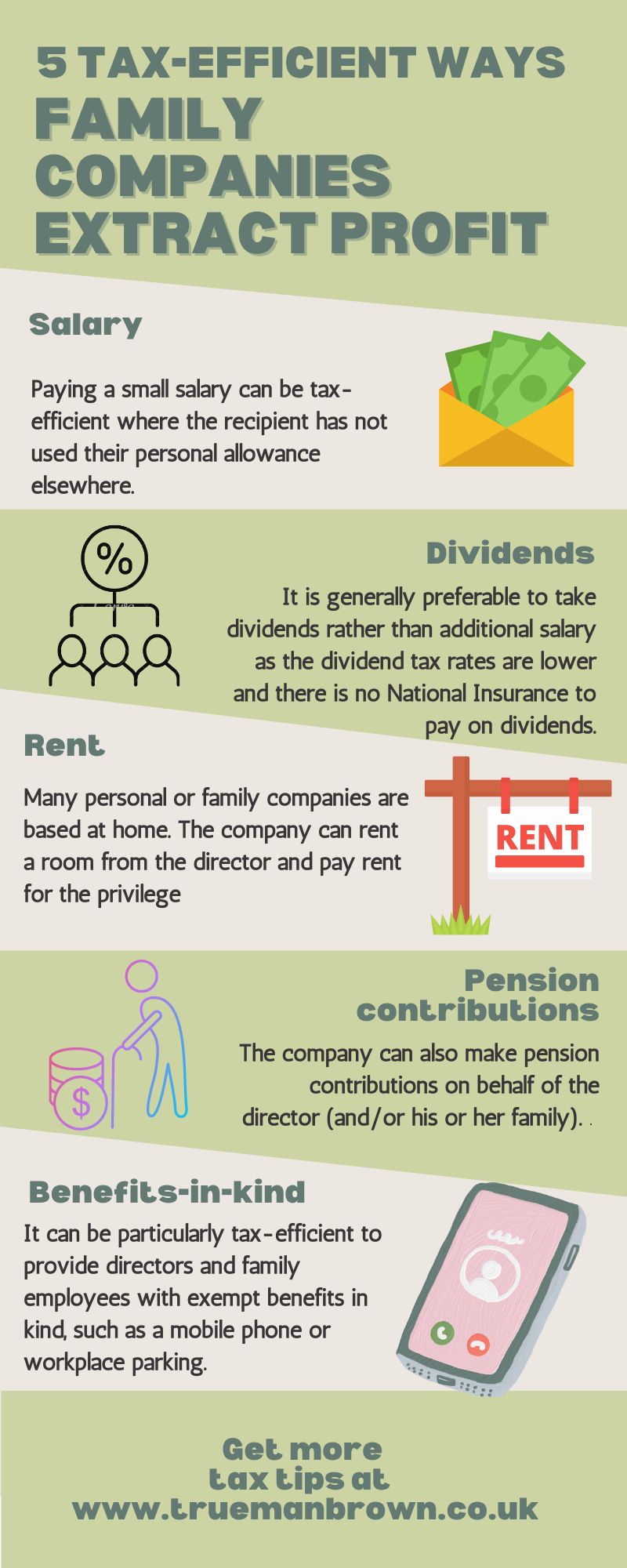

Profit extraction refers to the methods a business owner uses to take money out of their company for personal use, including salaries, dividends, pensions and benefits.

Because the tax landscape has shifted in recent years—with Personal Allowances frozen until 2031, Dividend Allowances at £500 and national insurance thresholds altered—how you extract profit affects both your take-home income and your company’s tax bill.

Salary vs Dividends: Balancing for 2025/26

One of the core considerations in profit extraction is deciding between paying yourself a salary or taking dividends:

-

Salary offers corporation tax relief as a deductible expense and can build qualifying years for the UK state pension.

-

Dividends are paid from post-tax profits, attract no National Insurance Contributions (NICs) but are subject to dividend tax. In 2025/26 the dividend allowance is £500, with dividend tax rates rising in April 2026, affecting future extraction strategies.

A common strategy is to pay a modest salary that utilises your personal allowance (e.g. around £12,570), then take further funds as dividends up to your tax-efficient limit.

Pension Contributions: A Tax-Efficient Extraction Route

Contributions:

-

Are deductible for corporation tax purposes;

-

Avoid personal income tax and NICs for you; and

-

Build long-term retirement wealth.

They must meet the “wholly and exclusively” test for the business, and current annual allowances and carry-forward rules should be considered in your plan.

Benefits & Other Profit Extraction Techniques

Aside from salary, dividends and pensions, you can use other extraction tools such as:

-

Tax-free benefits (e.g. a company mobile phone under benefit rules);

-

Director’s loans (with careful attention to repayment and tax implications);

-

Commercial rent or interest on loans to the company where applicable.

Each has its own tax and NIC profile and may be a useful part of a bespoke extraction strategy.

Changes in 2025/26 Affecting Profit Extraction

Recent tax changes mean that a one-size-fits-all approach to profit extraction no longer works.

Key updates include:

-

Dividends: Dividend income tax rates are due to rise from April 2026 (e.g. basic rate increasing by 2%), changing future extraction calculations.

-

National Insurance & Employment Allowance: Employer NIC rules changed from April 2025, including an expanded Employment Allowance (though not available for single-director companies).

-

Threshold Freezes: Personal allowance and income tax bands are frozen until at least 2031, creating “fiscal drag” that affects take-home income on profit extraction.

These updates make annual review and tailored planning essential.

How Trueman Brown Can Help

At Trueman Brown, we specialise in helping business owners optimise their profit extraction strategy in light of current tax law. Whether you are unsure how to balance salary and dividends, maximise pension contributions, or understand the impact of the Autumn Budget 2025, our advisors can help you plan a tax-efficient approach tailored to your situation.

📩 Email: mark@truemanbrown.co.uk

📞 Phone: 01708 397262

We can review your existing profit extraction plan, run projections under different scenarios and support your decisions with up-to-date tax expertise.

Frequently Asked Questions (FAQ)

Q: What is the most tax-efficient way to extract profits in 2025/26?

There’s no single answer—tax-efficient profit extraction often combines a modest salary, dividends, employer pension contributions and other tax-qualified benefits, depending on your circumstances.

Q: Has the dividend allowance changed for 2025/26?

Yes, it is set at £500 for the 2025/26 tax year. Dividend tax rates will rise in April 2026, which may affect strategies that focus on dividends.

Q: Should I always take a salary up to the personal allowance?

Many directors do this as it uses the personal allowance and can count toward state pension years, but the optimal salary level depends on NICs, corporation tax relief and personal tax rates.

Q: Can Trueman Brown help with profit extraction planning?

Yes. We provide tailored advice on extracting profits tax-efficiently, incorporating the latest tax rules and your business goals. Contact mark@truemanbrown.co.uk or call 01708 397262 for a consultation.

Recent Comments