Understanding a reasonable excuse for late tax return

Missing your filing deadline can lead to a penalty from HM Revenue & Customs (HMRC).

However, you may avoid the penalty if you can show you had a reasonable excuse for late tax return.

Whether HMRC accept your reason depends on the specific facts of your case — what counted as a reasonable excuse for someone else may not pass muster for you.

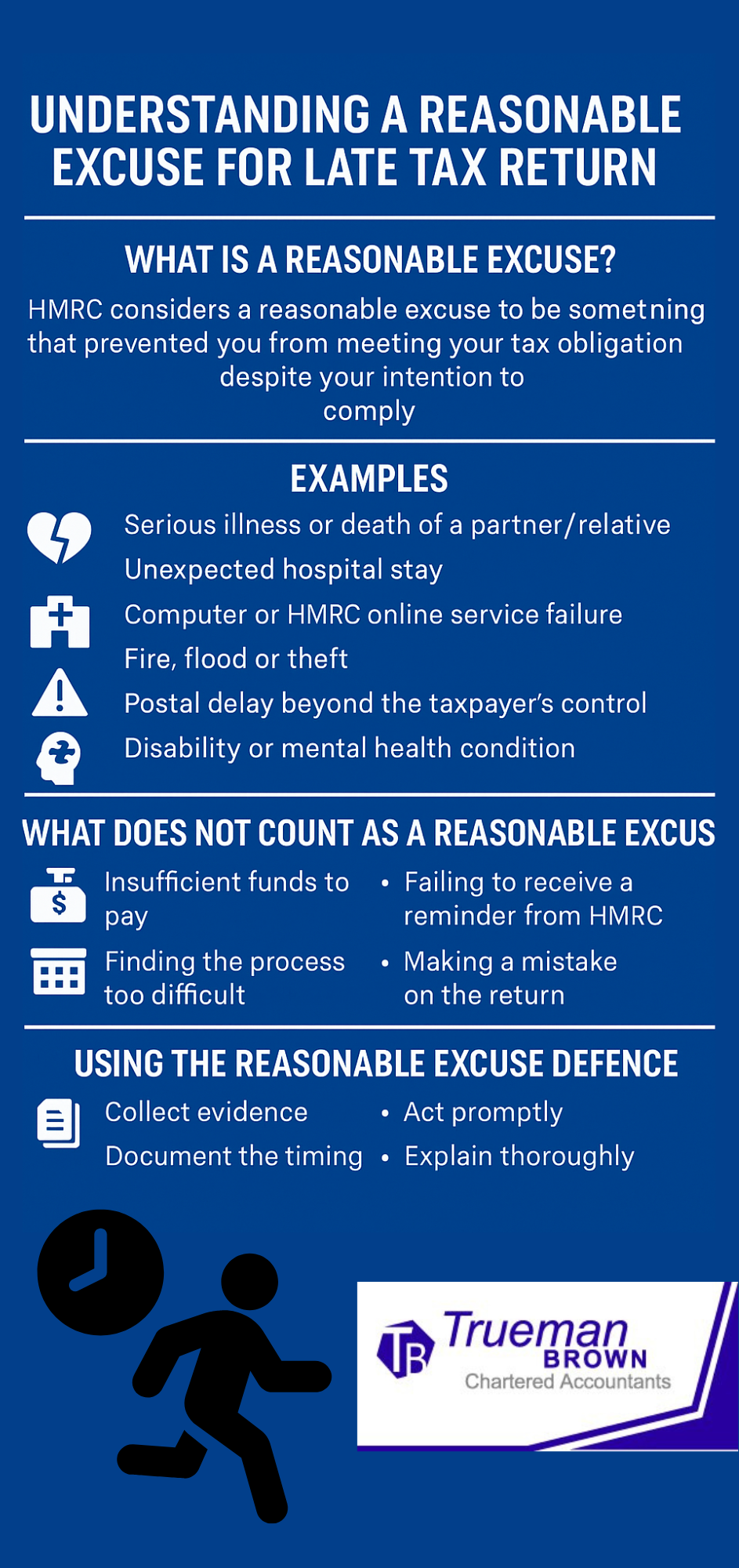

What does “reasonable excuse for late tax return” mean?

There’s no statutory definition of a reasonable excuse for late tax return. HMRC considers whether something prevented you from meeting your tax obligation despite your intention to comply.

In effect, the test is: Would a reasonable person in your position, with your abilities and attributes, who wanted to comply, have acted differently?

Key changes for 2025/26 and what they mean for a reasonable excuse for late tax return

For 2025/26, several relevant updates affect how late-filing and payment penalties are handled and thus how the “reasonable excuse for late tax return” argument fits in:

-

A new penalty regime for late submission and late payment is being introduced, aligned with the wider digital-filing and Making Tax Digital (MTD) programmes.

-

HMRC emphasises that if you have a reasonable excuse for late tax return, the penalty should not be applied.

-

HMRC’s guidance updated in August 2023 clarified that once the obstacle causing your reasonable excuse ends, you must act without unreasonable delay (they suggest roughly 14 days as a benchmark) to submit your return or make payment.

In short: even under the new system, you still can use the “reasonable excuse for late tax return” defence — but you must show the cause existed at the deadline, you acted promptly when it ended, and you took reasonable steps to comply.

Examples of a valid reasonable excuse for late tax return

Commonly accepted grounds for a reasonable excuse for late tax return include:

-

The taxpayer, their partner or a close relative died or suffered a serious illness just before the deadline.

-

Unexpected hospitalisation prevented handling the tax affairs.

-

A computer or software failure while filing online, or HMRC’s online service failed.

-

A fire, flood or theft prevented the taxpayer from filing on time.

-

A postal delay outside the taxpayer’s control meant the return could not reach HMRC in time.

-

A disability or mental-health condition which significantly impeded the taxpayer’s ability to meet the deadline.

In each case, you must show the event existed at the deadline, that you could not reasonably avoid it, and that you submitted the return as soon as the excuse ended.

Situations where a “reasonable excuse for late tax return” will likely fail

It’s equally important to understand what HMRC will not accept as a reasonable excuse:

-

Insufficient funds in your bank account or a payment cheque bouncing — unless the cause was completely outside your control.

-

The filing process being too difficult, or you simply found HMRC’s online system hard to use.

-

You didn’t receive a reminder from HMRC.

-

You made a mistake or error on the return. Mistakes alone generally don’t qualify.

-

Relying entirely on someone else (agent, accountant) without reasonable supervision or oversight.

If your excuse falls into one of those categories, the “reasonable excuse for late tax return” defence is unlikely to succeed.

How to use the “reasonable excuse for late tax return” defence — practical steps

-

-

Collect evidence: Get medical reports, system-failure logs, correspondence with HMRC, proof of postal delay, etc.

-

Document timing: Show when the excuse started, when it ended, and when you filed your return or made payment.

-

Act as soon as you can: Once the cause ended you should submit the return without unreasonable delay (HMRC suggests ~14 days as a typical benchmark).

-

Use the correct process: Appeal the penalty via HMRC’s online tool or by completing form SA370/SA371 as appropriate.

-

Explain thoroughly: In your appeal state clearly that you had a reasonable excuse for late tax return, what the circumstances were, how they prevented you from filing on time, and when you remedied the situation.

-

How Trueman Brown can help you

If you believe you may have a reasonable excuse for late tax return — or you are facing a penalty and want to assess whether the defence applies — we at Trueman Brown are here to help. We’ll review your specific facts, gather and assess supporting evidence, draft the appeal to HMRC, and liaise with you throughout.

For expert assistance contact:

-

Email: mark@truemanbrown.co.uk

-

Phone: 01708 397262

Don’t leave it too late — the sooner you act, the stronger your position.

FAQ

Q: How long does HMRC give me to appeal a penalty if I had a reasonable excuse for late tax return?

A: You normally have 30 days from the issue of the penalty notice to make your appeal.

If you miss that, you may still write, but you should act promptly.

Q: Can I rely on being unaware that I needed to file a return as a reasonable excuse for late tax return?

A: Possibly — but only in very limited circumstances. If you genuinely and reasonably didn’t know about your obligation, and you acted as soon as you found out, then it may be accepted. However, mere ignorance is not automatically accepted.

Q: If I had a software crash that stopped me filing, is that a reasonable excuse for late tax return?

A: Yes — if you can show the software or system failure was genuine, you made immediate attempts to resolve it or file another way, and you submitted the return promptly once it was fixed.

Q: Does having a “reasonable excuse for late tax return” mean I don’t have to pay any tax due?

A: No — the defence only applies to the penalty, not the tax itself or any interest on late payment. You still owe the tax and interest as applicable.

Q: If HMRC reject my appeal claiming a reasonable excuse for late tax return, what can I do next?

A: You can ask for an internal review of HMRC’s decision. If that fails, you can appeal to the First-tier Tribunal.

Recent Comments