Do Resident Cruisers Pay Income Tax in the UK?

An increasing number of people are choosing an unconventional lifestyle at sea.

These resident cruisers sell or rent out their homes and live full-time on cruise ships, enjoying all-inclusive accommodation, entertainment, travel and even housekeeping.

Some even invest in a so-called “villa at sea”, granting long-term residence aboard a ship for 15 years or more.

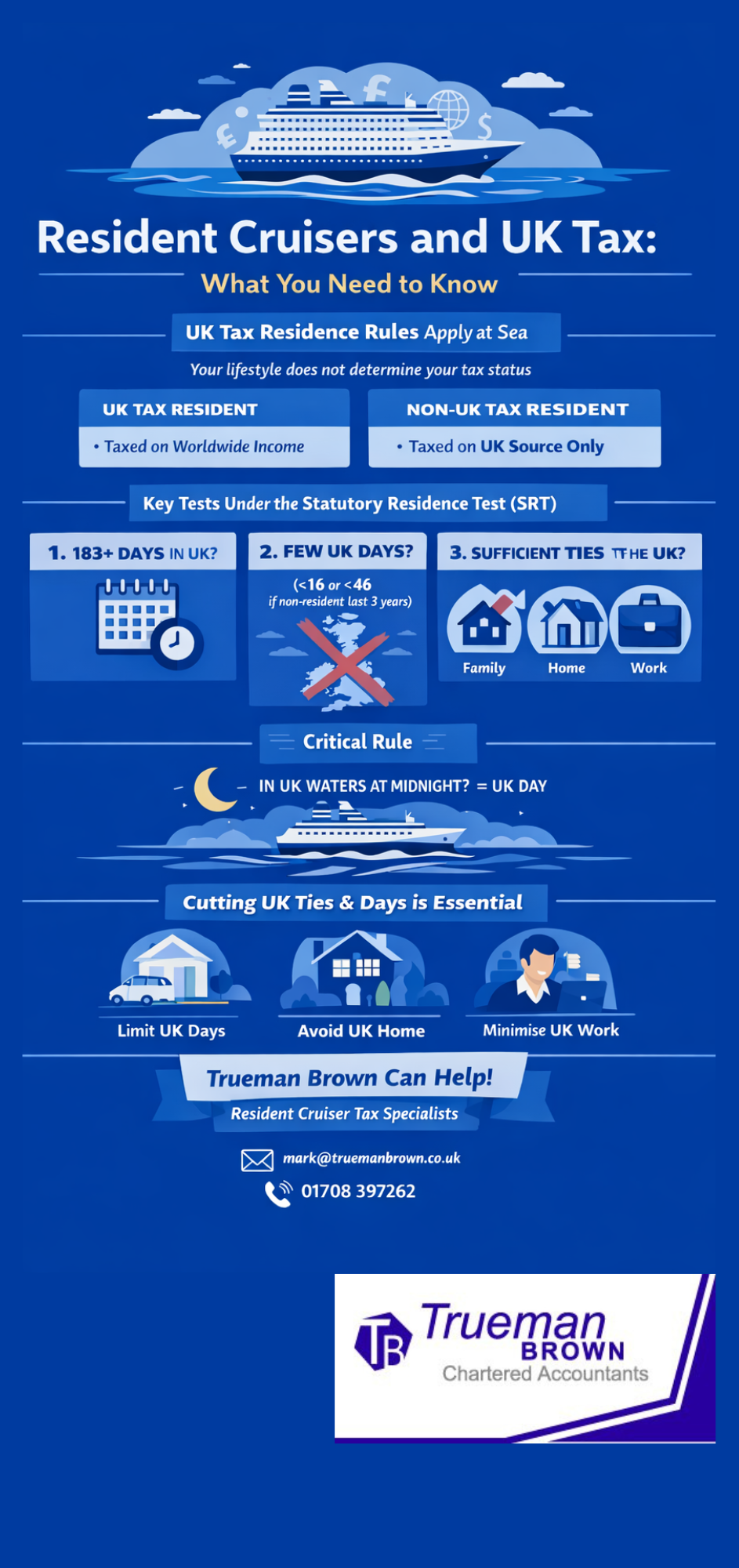

But while the lifestyle may feel offshore, the tax position often is not. For resident cruisers, UK income tax liability is determined not by lifestyle, but by tax residence under HMRC residence rules.

As a result, someone can live almost entirely on a cruise ship and still remain subject to UK tax.

The UK tax system and resident cruisers

For resident cruisers, understanding the UK tax system is critical. Once an individual is classified as UK tax resident, they are taxed on their worldwide income and gains, regardless of where they live or travel.

By contrast, individuals who achieve non-UK tax residence are generally taxed only on:

-

UK-source income (such as UK rental income, dividends or bank interest), and

Foreign income and overseas investment gains are usually outside the scope of UK tax for non-residents.

This distinction makes cruise ship tax residence planning essential.

The Statutory Residence Test (SRT)

The UK uses the UK Statutory Residence Test to determine whether an individual is UK tax resident in a given tax year. The SRT applies equally to land-based residents and resident cruisers.

Living on a cruise ship may help support a claim of non-UK tax residence, but only if the SRT conditions are not met. The test operates in four sequential steps.

Step one: automatic UK residence and resident cruisers

A resident cruiser will be automatically UK tax resident if either of the following applies:

-

They spend 183 days or more in the UK during the tax year; or

-

They have at least one period of 91 consecutive days where their only home is in the UK, with at least 30 of those days falling in the relevant tax year, and they spend sufficient time in that home.

Selling a UK home helps, but does not guarantee this test is failed if another UK property is still considered “available accommodation”.

Step two: automatic non-UK residence for resident cruisers

If automatic UK residence does not apply, resident cruisers move on to the automatic overseas tests. An individual will be automatically non-UK resident if any one of the following applies:

-

They spend fewer than 16 days in the UK in the tax year; or

-

They spend fewer than 46 days in the UK and were non-UK resident in all of the previous three tax years; or

-

They work full-time overseas and spend limited days working in the UK.

For many people living on cruise ships, this is the most reliable route to non-UK tax residence, but it requires strict control of UK travel.

Step three: further automatic UK tests and resident cruisers

If the automatic overseas tests are not met, HMRC considers further automatic UK tests. A resident cruiser may still be UK resident if they:

-

Have a UK home and spend sufficient time there; or

-

Work full-time in the UK.

This is particularly relevant for individuals who continue consultancy work or board-level roles while living at sea.

Step four: the sufficient ties test for resident cruisers

If none of the earlier steps give a clear answer, the sufficient ties test applies. This combines the number of UK days spent in the tax year with existing UK connections.

Key UK ties under HMRC residence rules include:

-

Family tie – a spouse, civil partner, cohabiting partner or minor child resident in the UK

-

Accommodation tie – UK accommodation available for at least 91 consecutive days, including a relative’s home if used frequently

-

Work tie – more than 40 UK workdays (over three hours per day)

-

90-day tie – spending more than 90 midnights in the UK in either of the previous two tax years

-

Country tie – the UK being the country where the individual spends the greatest number of days

For resident cruisers, the more UK ties that exist, the fewer UK days are permitted before UK tax residence is triggered.

Practical tax issues for resident cruisers in 2025/26

A critical issue for living on a cruise ship tax planning is how HMRC counts days.

Time spent aboard a cruise ship does not count as time outside the UK if the vessel is in UK territorial waters at midnight. This means:

-

UK port stops

-

Coastal cruises

-

Overnight docking in UK waters

may all count as UK days.

Updated 2025/26 guidance confirms HMRC’s continued focus on midnight location and enhanced data-matching using passenger manifests and travel records. Accurate record-keeping is therefore more important than ever for UK tax for expats at sea.

Where possible, resident cruisers should consider cruises that start and end outside the UK (for example, itineraries based in the USA or Southern Hemisphere) to reduce UK tax exposure.

How Trueman Brown can help

Tax residence is one of the most complex areas of UK taxation, and mistakes can be extremely costly.

Resident cruisers often assume that selling their home and living at sea automatically removes UK tax obligations—but this is rarely the case.

Trueman Brown specialises in advising internationally mobile individuals, including those living on cruise ships. We can help you:

-

Assess your UK tax residence position under the Statutory Residence Test

-

Plan UK day counts and reduce UK ties

-

Review the tax treatment of pensions, investments and rental income

-

Liaise with HMRC and provide ongoing compliance support

To discuss your circumstances in confidence, contact us at:

📧 mark@truemanbrown.co.uk

📞 01708 397262

Early advice is essential—especially before selling property, starting long-term cruising, or changing travel patterns.

FAQ

Do resident cruisers automatically become non-UK tax resident?

No. Living on a cruise ship does not override the UK Statutory Residence Test.

Do UK port days count for cruise ship tax residence?

Yes. If the ship is in UK territorial waters at midnight, the day usually counts as a UK day.

Can resident cruisers still pay UK tax on pensions?

Yes. UK pensions are often taxable in the UK even if you are non-UK resident, depending on the pension type and treaty position.

Is selling my UK home enough to avoid UK tax?

No. Accommodation ties, family ties and UK work can still result in UK tax residence.

Should resident cruisers get professional advice?

Absolutely. UK tax residence errors can lead to unexpected tax bills, penalties and HMRC enquiries.

Recent Comments