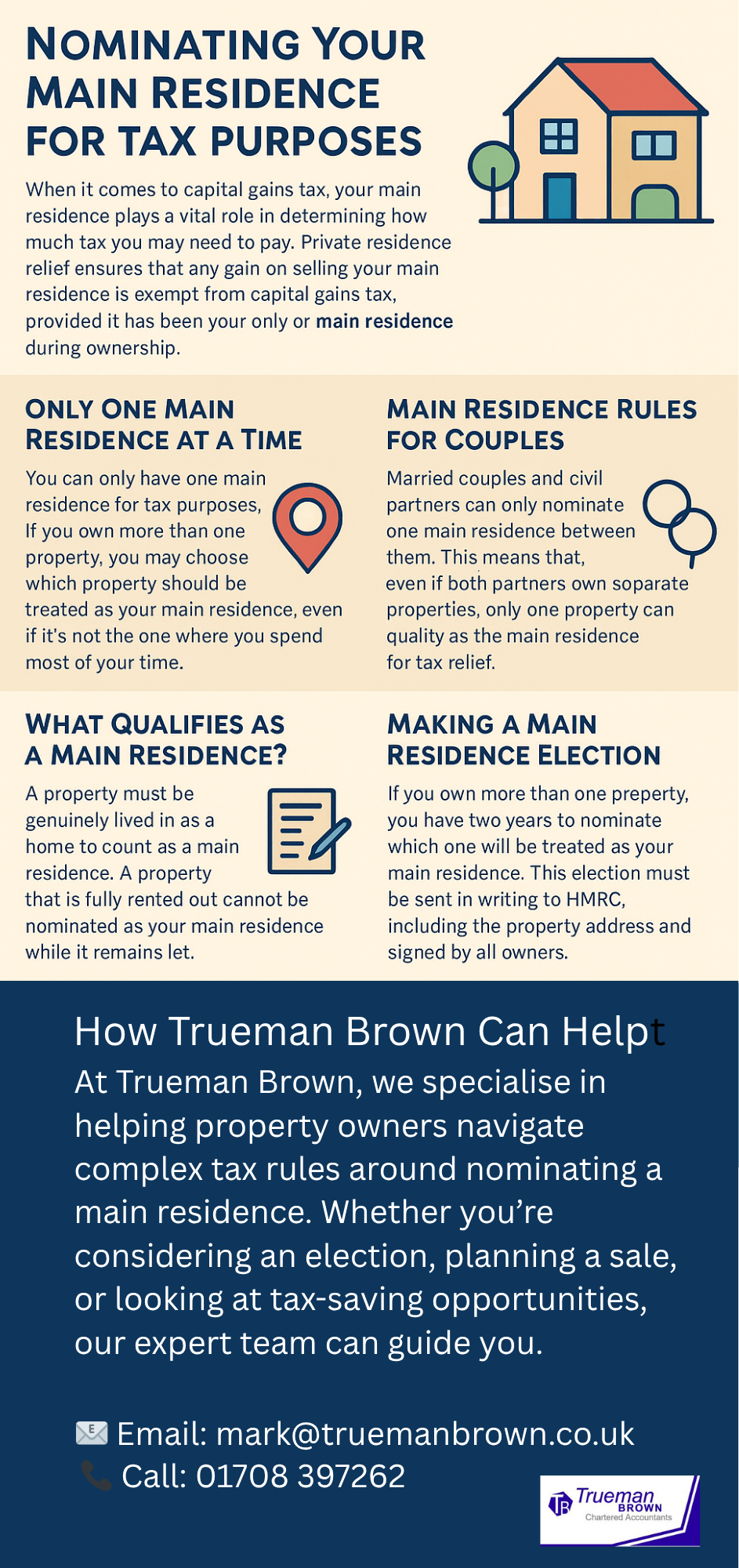

Nominating Your Main Residence for Tax Purposes

When it comes to capital gains tax, your main residence or private principal residence plays a vital role in determining how much tax you may need to pay.

Private residence relief ensures that any gain on selling your main residence is exempt from capital gains tax, provided it has been your only or main residence during ownership.

Only One Main Residence at a Time

You can only have one private principal residence for tax purposes.

If you own more than one property, you may choose which property should be treated as your main residence, even if it’s not the one where you spend most of your time.

Main Residence Rules for Couples

Married couples and civil partners can only nominate one main residence between them.

This means that, even if both partners own separate properties, only one property can qualify as the main residence for tax relief.

What Qualifies as a Main Residence?

A property must be genuinely lived in as a home to count as a private principal residence.

A property that is fully rented out cannot be nominated as your main residence while it remains let.

Making a Main Residence Election

If you own more than one property, you have two years to nominate which one will be treated as your main residence.

This election must be sent in writing to HMRC, including the property address and signed by all owners.

Importantly, you can change your election at any time, allowing flexibility.

No Election – What Happens?

If no election is made, HMRC will decide which property is your main residence based on the facts, usually the property where you spend the most time.

Tax Planning and Flipping Main Residence Status

Changing (or “flipping”) your nominated main residence can be a smart tax planning move.

Any period a property qualifies as your main residence is exempt from capital gains tax.

The final nine months of ownership also benefit from relief.

Strategically nominating or varying your private principal residence election can help minimise tax when selling multiple properties.

However, as long as certain conditions are met, the taxpayer is free to choose which property is classed as the ‘main’ residence for capital gains tax purposes – it does not have to be the one in which the owner spends the majority of his or her time.

How Trueman Brown Can Help

At Trueman Brown, we specialise in helping property owners navigate complex tax rules around nominating a main residence.

Whether you’re considering an election, planning a sale, or looking at tax-saving opportunities, our expert team can guide you.

📧 Email: mark@truemanbrown.co.uk

📞 Call: 01708 397262

FAQs About Your Main Residence

Q: Can I have more than one main residence?

A: No, you can only nominate one property as your main residence at any given time.

Q: Do I need to live full-time in my main residence?

A: Not necessarily. The key factor is that the property is genuinely used as a home.

Q: How often can I change my main residence election?

A: You can vary it as often as you like, provided you follow HMRC’s rules.

Q: What if I don’t make an election?

A: HMRC will determine your main residence based on factual occupation, usually where you spend the most time.

Q: Can a rented property be my main residence?

A: No. A property cannot qualify as a main residence during periods it is let out.

Recent Comments