Can you claim tax allowable clothing? What the rules say

If you’re wondering whether you can claim for tax allowable clothing, you’re not alone.

Many workers and the self-employed ask whether their work clothes or uniforms can be deducted against taxable income.

The key test is whether the clothing qualifies under HMRC rules as expenses wholly and exclusively for the trade (or, for employees, wholly, exclusively and necessarily for employment).

In practice, most “ordinary” clothing fails those tests, so understanding when tax allowable clothing is permitted (for uniforms, protective items, etc.) is essential.

In this article we’ll go through:

-

The basic statutory tests

-

Which items may constitute tax allowable clothing (protective gear, uniforms, specialist clothing)

-

Practical examples and pitfalls

-

Recent HMRC updates

-

How Trueman Brown can help

The statutory tests: “wholly, exclusively and necessarily” for tax allowable clothing

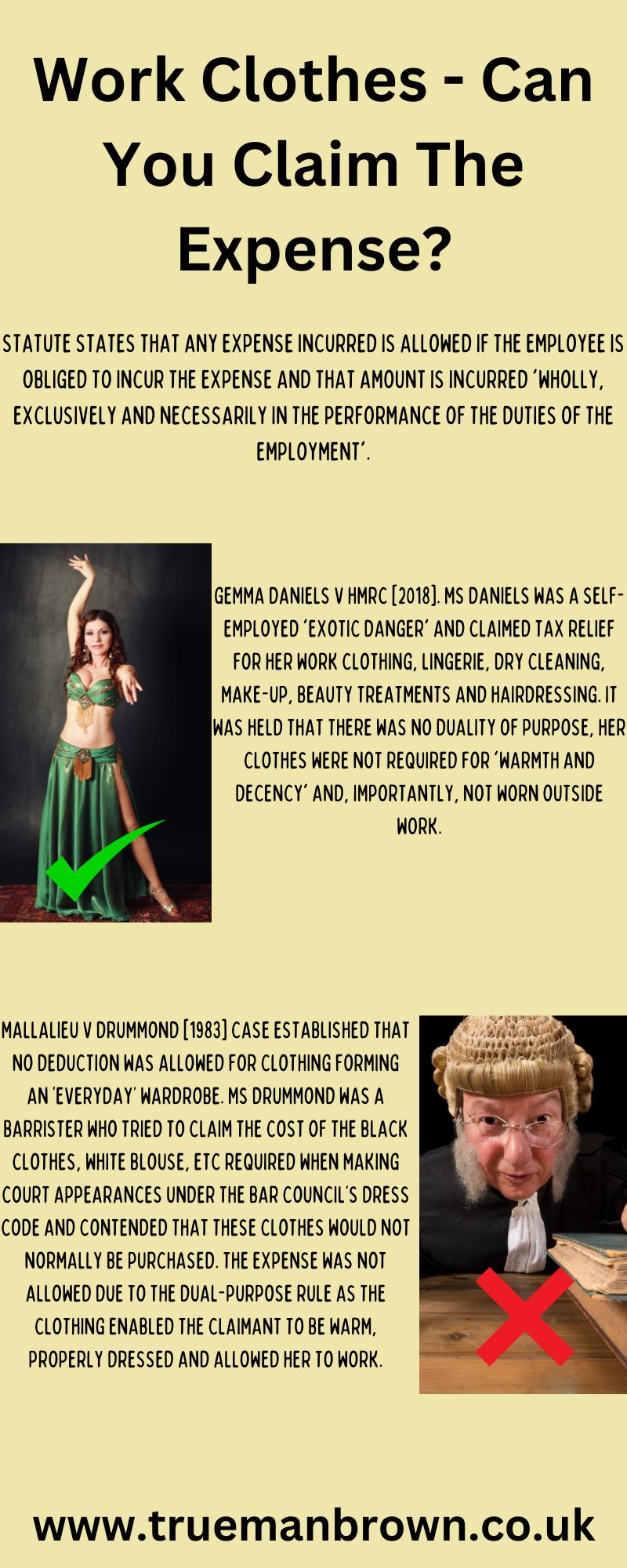

All expense claims (including clothing) must meet statutory tests.

For employees, that test is that the expense is incurred wholly, exclusively and necessarily in the course of employment.

For the self-employed, the requirement is slightly less strict, namely that the expense is incurred wholly and

exclusively for the purposes of the trade (i.e. the underlying business) (though in practice “exclusively” is rigorous).

Because everyone needs clothes generally, HMRC will usually view such expenditure as having a dual purpose (personal wear plus work use), disqualifying the deduction.

The principle was established in cases like Mallalieu v Drummond (1983), which held that court dress (black clothes, white blouse) could not be relieved because it formed part of an everyday wardrobe. (That case is still often cited.)

However, tax allowable clothing may be possible in limited circumstances when the clothing is a uniform, protective, or otherwise non-personal item.

Uniforms and employer-supplied clothing

One of the more common categories of tax allowable clothing is uniforms.

HMRC generally accepts that clothing clearly identifiable with an employer (for example by logo) may qualify, if the clothing is not one normally worn outside work. Some key points:

-

The garment should bear a fixed badge, name, or logo permanently sewn or printed. A detachable badge is often not sufficient to convert a regular item into qualifying uniform.

-

The uniform must not be something that would have a use outside work (i.e. not simply a standard shirt or trousers).

-

Employer-provided uniform or reimbursement is the safer route: if your employer gives you the uniform or reimburses the cost, it is much easier to justify as tax allowable clothing.

In short, uniforms are one of the more acceptable categories — but each case always depends on facts, and HMRC retains the right to challenge.

Protective clothing as tax allowable clothing

Another category where tax allowable clothing is more likely to be accepted is protective gear: clothing or equipment needed for safety or to avoid damage in your job.

Examples include:

-

Safety boots, hard hats, safety goggles, overalls, hi-visibility jackets

-

Aprons, gloves, coveralls used in processes where ordinary clothes would be ruined

-

Specialist protective clothing required by legislation (e.g. in chemical works, construction, laboratories)

If your occupation demands protective clothing (e.g. to prevent injury or damage), those items are more likely to pass the “exclusively for work” test, because they serve a safety function beyond mere decency or warmth.

Some protective clothing may also be tax-free to supply or reimburse under HMRC rules.

Specialist clothing and costumes as tax allowable clothing

In some unusual trades, clothing is part of the “tool of trade” itself, and may count as tax allowable clothing.

For example:

-

Costumes worn by actors, entertainers or performers

-

Stage uniforms or theatrical attire

-

Certain specialist artistry outfits not usable outside the performance

There have been tribunal decisions allowing deductions in those circumstances, on the basis that the clothing cannot reasonably be used in private life, and its sole purpose is for trade performance.

But be cautious — these cases are fact-sensitive, and claims may provoke scrutiny.

Practical pitfalls and limitations for tax allowable clothing

Even when your clothing seems to fit one of the acceptable categories, there are several pitfalls to watch out for:

-

Dual usage: If there is any private use (e.g. wearing a uniform to the shops), HMRC may argue against exclusivity.

-

Laundry and cleaning: The cost to wash, repair or dry-clean the clothing may be separately claimable (or via flat rate deductions), but that does not necessarily make the clothing cost itself allowable.

-

Apportionment issues: If clothing is partly personal and partly work, you may need to apportion, which HMRC rarely accepts for clothing.

-

Detached badges or logo patches: If the logo is detachable, HMRC may argue the clothing is not sufficiently distinct from ordinary clothing.

-

Record keeping and justification: Documentation is crucial — receipts, invoices, the requirement for the clothing, usage logs etc should be retained.

In addition, some older flat rate deductions negotiated by trade unions may still apply to certain occupations for laundry or uniform costs — but these are limited and do not cover all situations.

Also note: during the COVID-19 pandemic HMRC confirmed that personal protective equipment (PPE) supplied or reimbursed by the employer is tax-free, but that is distinct from general clothing. (This remains in place.)

Recent HMRC updates affecting tax allowable clothing

Since the original post, a few rule clarifications are worth noting:

-

Employer reimbursement and payroll treatment

Employers may reimburse qualifying uniform or protective clothing without classifying it as a taxable benefit, provided it meets certain HMRC criteria (i.e. is necessary, identifiable, not for personal use). -

More scrutiny and audits

HMRC continues to focus on expenses prone to misuse, and clothing claims are among those frequently questioned. Claimants should expect HMRC to request supporting evidence. -

Digital record requirements

With Making Tax Digital (MTD) and newer digital requirements, claimants should maintain digital records and audit trails of any claim for tax allowable clothing. -

Updated tribunal precedents

Recent tribunal cases reaffirm the strict approach: mere requirement to “dress smartly” is not enough; clothing must be wholly for work use, not general wear.

All this means that, while tax allowable clothing claims are possible in narrow cases, claims that appear generous or borderline are at risk of challenge.

How to assess whether your clothing qualifies as tax allowable clothing

When deciding whether to claim, ask:

-

Is the clothing a uniform, protective gear, or specialist outfit that cannot be worn usefully in private life?

-

Is the logo or identifier fixed and integral to the garment? (Not detachable)

-

Would ordinary clothing suffice for private or non-work use?

-

Is there any potential private use?

-

Do you have documentary evidence (receipts, employer requirement, etc.)?

-

Is laundry or cleaning a separate reasonable claim?

If you lean toward “yes” on these factors, you may have a valid claim; if not, it may be safer to avoid claiming the clothing cost itself.

How Trueman Brown can help you

If you’re uncertain whether your work clothing qualifies as tax allowable clothing, we can help.

At Trueman Brown, we have expertise in HMRC rules, case law and audit defence, and we can guide you to make legitimate claims while minimising the risk of dispute.

-

Email: mark@truemanbrown.co.uk

-

Phone: 01708 397262

We’ll review your situation, assist with documentation, help structure reimbursements or employer arrangements, and support any HMRC queries. You don’t have to face the complexity alone — contact us for tailored advice.

FAQ

Q: Can I claim everyday work clothes (e.g. suit, shirt, shoes)?

A: Generally not. Ordinary clothes that you could wear privately or outside work are not accepted as tax allowable clothing, because they fail the “exclusively for work” test.

Q: What about laundry and cleaning costs?

A: In some cases you may separately claim cleaning, washing or repair costs for qualifying uniforms or protective clothing. But that does not mean the clothing cost is automatically allowable; you still need the garment to qualify.

Q: Can my employer provide the uniform and avoid tax issues?

A: Yes — employer provision or reimbursement of qualifying uniform is often safer. If the uniform meets HMRC requirements, the employer may provide it tax-free.

Q: If I work from home and wear protective clothing, is it allowable?

A: Only if the clothing is a qualifying item (e.g. protective gear) and you can show it is used wholly for trade purposes. Simply wearing ordinary clothes at home fails the exclusivity test.

Q: What if HMRC challenges my claim?

A: If your claim is well documented, clearly justified, and within HMRC rules, you stand a better chance. That’s why expert review (e.g. from Trueman Brown) is valuable — we can help you respond to HMRC scrutiny or tribunal risk.

Q: Does the flat rate deduction scheme still apply?

A: Yes, for certain employees in specified occupations (e.g. uniformed trades) there are flat rate deductions for uniform/cleaning costs, but these only apply to roles listed by HMRC and may not cover every item.

Q: How do I keep evidence?

A: Retain invoices, proof of purchase, employer instructions on required clothing, logs of usage, cleaning receipts, and digital records under MTD rules.

If you’d like us to review your clothing claim or advise whether you have a valid tax allowable clothing claim, just get in touch at mark@truemanbrown.co.uk or call 01708 397262.

Recent Comments