Tax Benefits for Hiring Ex-Military Personnel UK: 2025/26 Employer Guide

Employers across the UK can access tax benefits for hiring ex-military personnel under HMRC’s continuing initiative.

This relief provides National Insurance savings for businesses that employ veterans transitioning into civilian roles — a key incentive for supporting our armed forces community while reducing staffing costs.

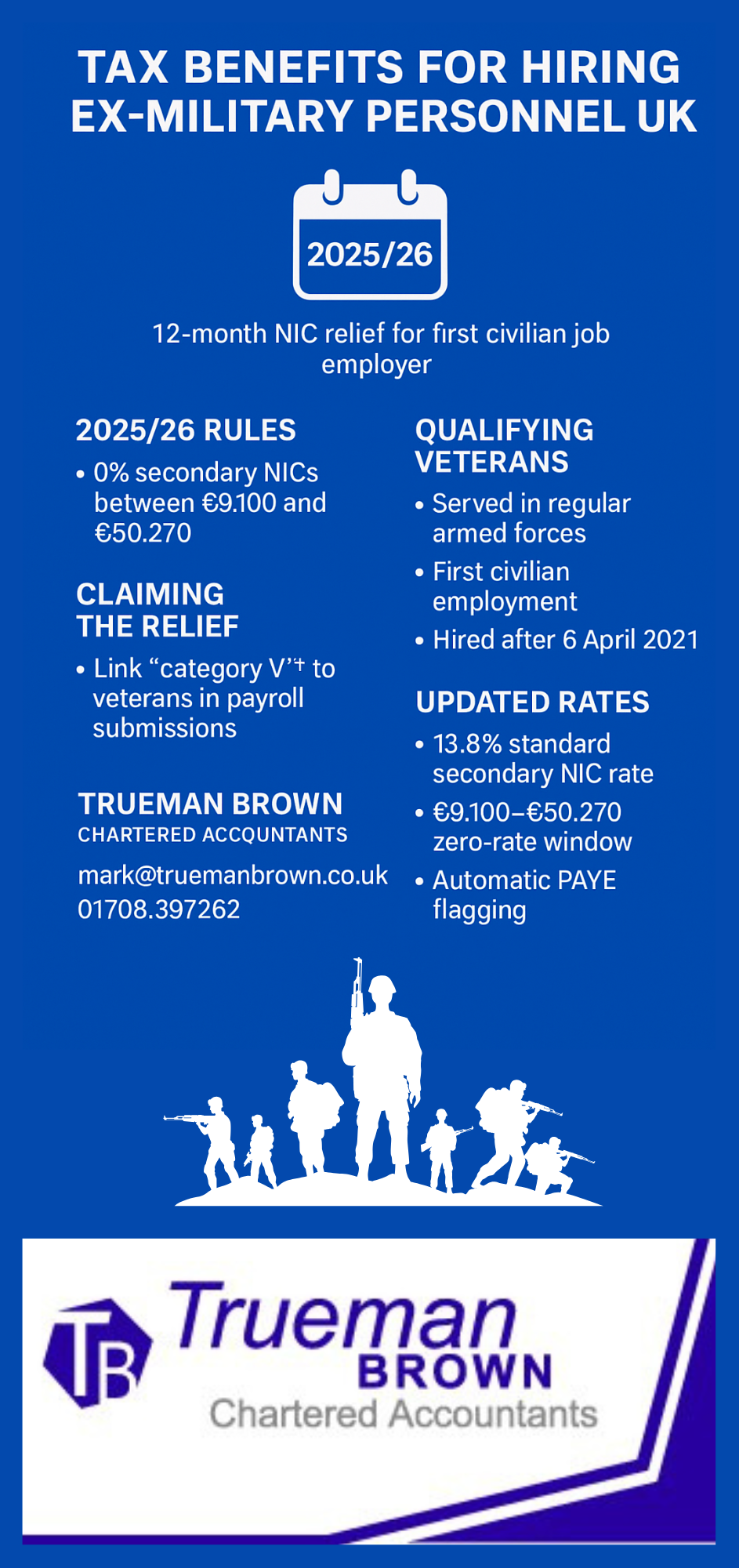

Understanding the 2025/26 Veteran Employer Relief

For 2025/26, employers hiring veterans in their first civilian job can continue to claim relief on secondary Class 1 National Insurance contributions (NICs) for 12 months from the veteran’s start date.

Employers pay 0% NICs on earnings between the secondary threshold (£9,100) and the upper secondary threshold (£50,270) during that period. Above this, the standard 13.8% rate applies.

Who Qualifies for the Tax Benefits for Hiring Ex-Military Personnel UK

To qualify, the employee must:

-

Have served at least one day in the regular armed forces (basic training counts).

-

Be in their first civilian employment since leaving service.

-

Be employed after 6 April 2021 (relief applies for one year from their start date).

Multiple employers can benefit if the veteran changes jobs within their first year of civilian work.

How to Claim the Relief

Employers should use category letter V in their payroll submissions through Real Time Information (RTI) for eligible veterans.

For earlier claims or adjustments, employers can submit an amended FPS or contact HMRC directly. Claims can now be processed automatically for tax years 2023/24 onwards — a simplification added in 2025/26.

Updated 2025/26 Rules and Rates

For 2025/26, HMRC confirmed the continuation of the scheme with:

-

Standard secondary NIC rate: 13.8%

-

Zero-rate threshold window: £9,100 – £50,270

-

Relief eligibility: First 12 months of civilian employment only

HMRC now automatically flags eligible veteran employees in PAYE submissions, reducing manual errors and ensuring compliance.

Why the Tax Benefits for Hiring Ex-Military Personnel UK Matter

Beyond financial savings, employing ex-military staff brings resilience, leadership, and teamwork to your organisation.

The tax benefits for hiring ex-military personnel UK serve as both a financial and social incentive for employers.

How Trueman Brown Can Help

At Trueman Brown Chartered Accountants, we specialise in helping employers access available tax benefits for hiring ex-military personnel UK efficiently.

Our expert accountants ensure your payroll and submissions comply with HMRC’s veteran relief requirements while optimising overall tax efficiency.

📧 Email: mark@truemanbrown.co.uk

📞 Call: 01708 397262

We’ll handle the details — you enjoy the rewards of supporting veterans and saving on National Insurance.

FAQs: Tax Benefits for Hiring Ex-Military Personnel UK

1. How long does the NIC relief last?

The relief applies for 12 months from the veteran’s start date in civilian employment.

2. Can I claim if the veteran changes jobs?

Yes. Each employer within the first year of civilian work can claim relief.

3. What if I missed claiming in previous years?

Employers can still submit amended payroll reports or contact HMRC to backdate eligible claims.

4. Does the relief apply to reservists?

No. It only applies to those who served at least one day in the regular armed forces.

5. How can Trueman Brown assist?

We provide end-to-end support — from identifying eligible hires to filing compliant claims — ensuring your business receives full relief entitlements.

Recent Comments