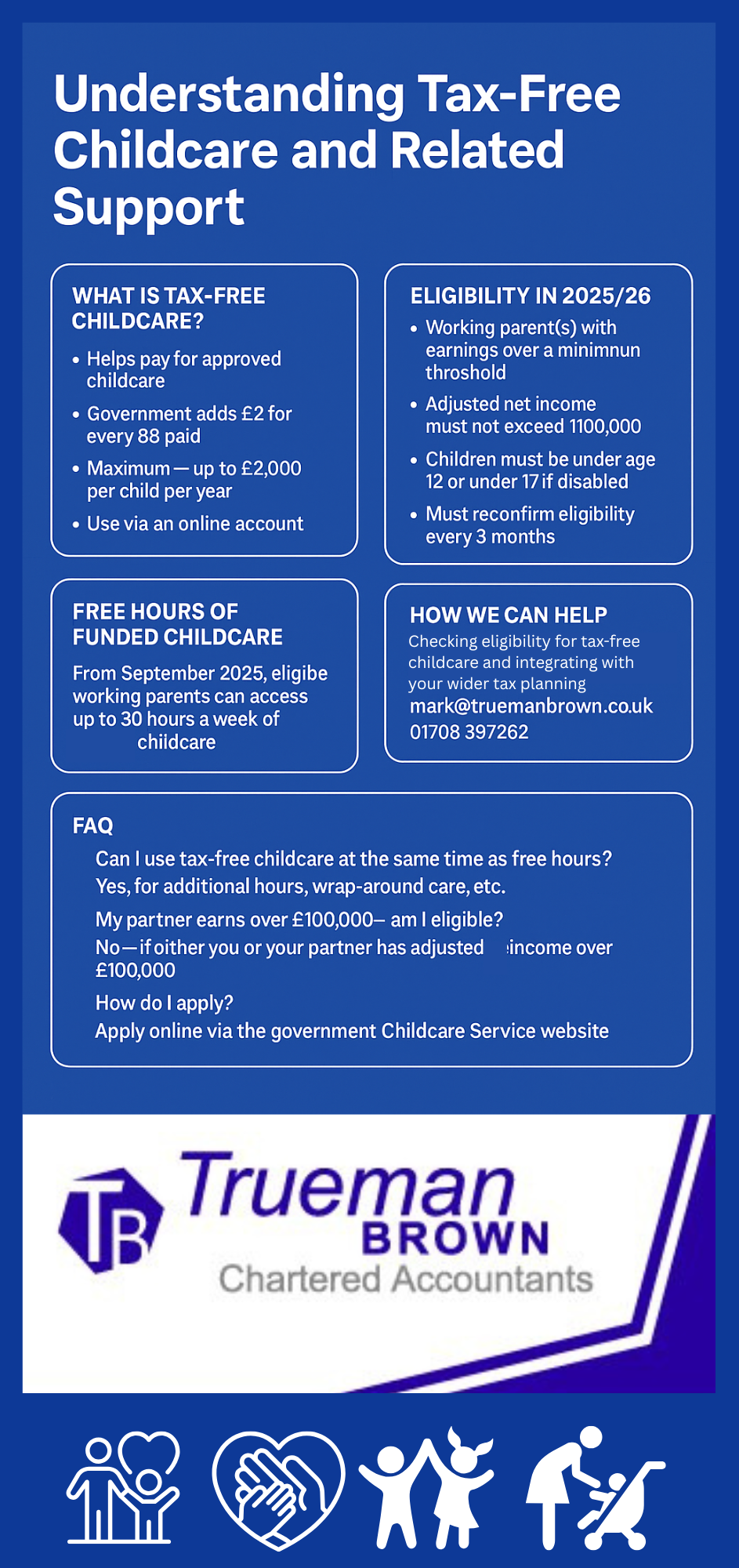

Understanding Tax-Free Childcare and Related Support

If you’re exploring how to manage childcare costs, one of the key schemes to consider is tax-free childcare — the government-backed help that enables working families to receive a boost towards registered childcare costs.

Under the scheme, for every £8 you pay into your childcare account, the government adds £2 (up to a limit).

Below we outline how this interacts with free hours funding, what’s available in the Upminster, Hornchurch & Grays area and how Trueman Brown can help you make sense of your options for 2025/26.

What is tax-free childcare?

It is a scheme that helps you pay for approved childcare – such as nurseries, childminders, nannies, after-school clubs – by topping up your payments with a government contribution.

The maximum is up to £2,000 per child per year (or up to £4,000 if the child is disabled).

You use an online childcare account and your provider must be registered to accept the payments.

Eligibility depends on earnings, working status and your child’s age.

Who qualifies for tax-free childcare in 2025/26?

To be eligible:

-

You (and your partner, if applicable) must usually be working (employed or self-employed).

-

Each partner must expect to earn at least the equivalent of 16 hours at National Minimum Wage (or Living Wage) per week on average over the next three months.

-

Neither you nor your partner can have adjusted net income over £100,000. (If one partner earns more than £100,000 you may lose eligibility for tax-free childcare and free hours.)

-

Your child must be under age 12 (or under age 17 if disabled).

How tax-free childcare works alongside funded hours

It’s important to note how the scheme works in conjunction with the free hours of funded childcare that the government has expanded.

From September 2025, eligible working parents will be able to access up to 30 hours per week of funded childcare (over 38 weeks) from the term after the child turns 9 months old, until they reach school age.

So you may be eligible for both: the free hours funding and tax-free childcare.

For example, you might use your tax-free childcare account to pay for additional hours, wrap-around care, or outside term-time.

Always check with your chosen provider whether they accept tax-free childcare payments.

Location-based support: Upminster & Hornchurch

For families in the Upminster, Hornchurch (and surrounding) areas, we at Trueman Brown provide advice tailored to local accountants and tax advisers markets.

Whether you’re employing staff, running a business or simply navigating how to claim tax-free childcare as parents, we can help you integrate it into your wider tax and accounting planning.

Employer-related childcare schemes and tax-free childcare

If you are an employer (or run a business) you may also consider employer-provided childcare schemes.

While the older “childcare voucher” scheme is closed to new entrants (it ended for new joiners in 2018) you can still use scheme alongside other employer-supported options, subject to the rules.

Understanding how employer childcare support interacts with tax-free childcare (+ funded hours) is important to maximise benefit and avoid unintended tax consequences.

Our update for 2025/26: key changes you need to know

-

From September 2025 the expanded entitlement means eligible working parents can access up to 30 hours of funded childcare per week (for children from 9 months old).

-

The minimum earnings requirement for tax-free childcare remains at roughly the equivalent of 16 hours/week at NMW.

-

The upper adjusted net income threshold remains at £100,000 for eligibility for tax-free childcare.

-

Parents must still reconfirm their eligibility for the scheme every three months.

How Trueman Brown can help

At Trueman Brown we specialise in helping families, business owners and professionals in the Upminster, Hornchurch, Grays and wider region to make sense of the tax-free childcare scheme alongside other accounting and tax issues.

For example, we can assist you with:

-

Checking eligibility for tax-free childcare and integrating with your wider tax planning

-

Advising business owners on employer-childcare support, salary sacrifice, and how this interacts with personal eligibility

-

Fine-tuning your personal tax position given your earnings, adjusted net income, and how that impacts benefits/childcare support

If you’d like help, please get in touch: mark@truemanbrown.co.uk or call 01708 397262. We’ll be happy to review your situation and chart the best way forward for 2025/26 and beyond.

FAQ

Q: Can I use tax-free childcare at the same time as receiving the 30 hours funded childcare hours?

A: Yes — you may use tax-free childcare to pay for additional childcare hours, wrap-around care, holiday clubs etc even when you are accessing funded 30 hours (for eligible children). The funded hours cover specific term-time hours and a registered provider must deliver the entitlement. The tax-free childcare account gives you additional flexibility to pay for registered childcare costs.

Q: My partner earns £105,000 and I earn £30,000 — am I still eligible for tax-free childcare?

A: No — if either you or your partner has adjusted net income over £100,000 you will not be eligible for tax-free childcare (and you may lose access to the 30 hours funded entitlement for younger children). It’s important to check how “adjusted net income” is calculated.

Q: How many children can I claim tax-free childcare for?

A: You can open a tax-free childcare account for each eligible child (under 12 or under 17 if disabled) and each account has the same maximum contributions (up to £2,000/year per child or £4,000 for disabled children).

Q: What happens if I stop working or reduce my hours?

A: If your working status changes you must reconfirm your eligibility for tax-free childcare. If you stop working and no longer meet the working requirement, your eligibility may be withdrawn. It’s important to update your details promptly.

Q: My child is 2 years old and I’m a working parent — what funded hours apply in 2025/26?

A: From April 2024 and through to September 2025 and beyond, eligible working parents of 2-year-olds have access to funded hours, and from September 2025 there will be up to 30 hours for children from 9 months old.

Q: How do I apply for tax-free childcare?

A: You apply online via the government “Childcare Service” website. You’ll need your Government Gateway ID, your National Insurance number, your child’s details and the details of your provider. Once approved you’ll receive a code to give to your provider and open your account.

Q: Do all childcare providers accept tax-free childcare?

A: No — the provider must be registered with the scheme. Before you commit, check that your nursery, childminder or after-school club accepts tax-free childcare payments.

Recent Comments