The Gamble of the Gift of Property: CGT, IHT or Both? (2024/25 Edition)

When considering the gift of property under the UK tax rules for 2024/25, many people underestimate the latest changes.

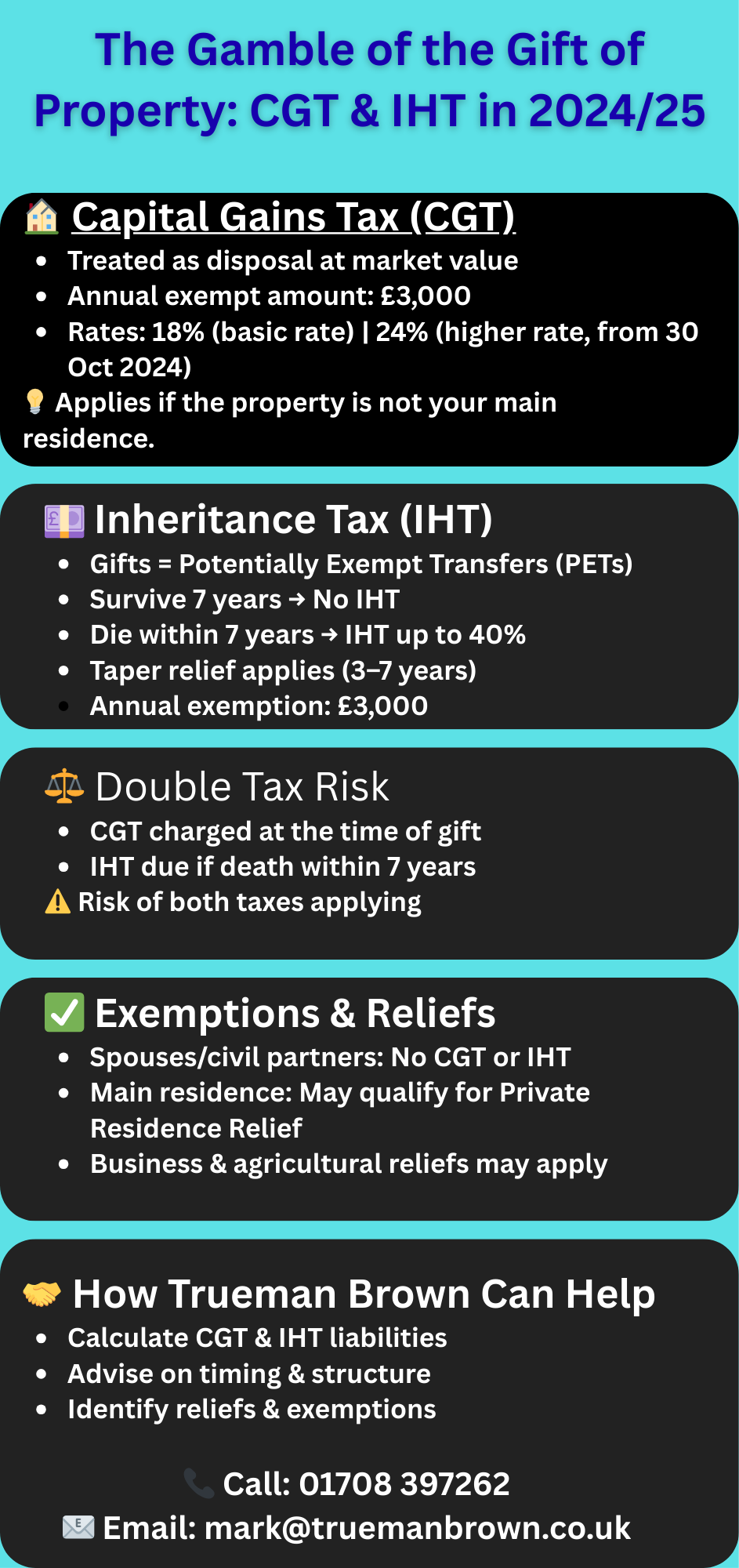

Passing a property to loved ones is more than just a legal deed—it has both Capital Gains Tax (CGT) and Inheritance Tax (IHT) implications, especially under the current rules.

Understanding these changes is essential to avoid surprises.

What Happens with the Gift of Property and Capital Gains Tax (CGT) in 2024/25

Under the 2024/25 rules:

-

If you make a gift of property (that isn’t your main home, or isn’t fully covered by reliefs such as Private Residence Relief), HMRC treats it as a disposal at market value. Thus, even though you haven’t sold it or received money, you’re liable for CGT as if you had.

-

The annual exempt amount (formerly known as the CGT allowance) for individuals in 2024/25 is £3,000.

-

The rates for gains on residential property (or residential property assets) are 18% for gains that fall within the basic rate band of your income, and 24% for gains above that band, for disposals on or after 30 October 2024.

-

For disposals or gifts before 30 October 2024, earlier rates (lower rate bands) apply.

So if you are declaring a gift of property, you need to calculate the gain (market value at the time of gift minus original cost plus allowed improvements/costs) subtract the £3,000 exempt amount, then apply 18% or 24% depending on whether your total taxable income + gain falls into basic rate or higher rate.

The Gift of Property and Inheritance Tax (IHT) in 2024/25

For the 2024/25 fiscal year, the IHT rules relevant to the gift of property are:

-

Gifts made during your lifetime to individuals (except those exempt) are classed as Potentially Exempt Transfers (PETs). If you survive seven years from the date of making the gift, the gift becomes fully exempt from IHT.

-

If you die within seven years, the gift is brought back into your estate (i.e. “fails” as a PET) and may be subject to IHT at up to 40% on that portion, depending on whether the value of your total estate exceeds your nil-rate bands.

-

Taper relief applies if death occurs between 3–7 years after the gift. This means the IHT rate on that gift reduces gradually the longer you survive after making the gift.

-

There is an annual exemption: in 2024/25 you can gift up to £3,000 per tax year free of IHT (without it counting toward PETs if under that limit) per individual donor.

-

Certain gifts are outright exempt: gifts between spouses or civil partners are exempt; gifts to charities, political parties also exempt.

Double Trouble: Paying Both CGT and IHT on the Gift of Property

Putting together the rules:

-

If you make a gift of property in 2024/25, you may incur CGT immediately (on the gain at market value) unless you’re exempt (e.g. spouse/civil partner rules apply).

-

At the same time, that same gift could be subject to IHT if you die within seven years, depending on whether it exceeds IHT thresholds or nil-rate bands.

-

Thus there is a risk of double taxation—CGT on the gift now, plus IHT later—if timing and planning are not considered carefully.

Exemptions and Reliefs for Spouses, Partners, and Key Reliefs

-

Gifts between spouses or civil partners are generally exempt from both CGT and IHT. This means that a gift of property to your spouse/civil partner typically avoids both taxes under the 2024/25 rules.

-

Private Residence Relief may apply if part (or all) of the property has been your main home. If it qualifies, portions of gains can be relieved from CGT. (Relief depends on how long you lived there, whether parts were let out etc.)

-

Business Property Relief or Agricultural Property Relief may apply in certain circumstances, reducing the value of the gift for IHT purposes. These are specialised reliefs.

Example: Gift of Property in 2024/25

Scenario:

-

Donor bought a holiday cottage in 2004 for £200,000.

-

Current market value (2024/25): £500,000.

-

Gain: £300,000 (£500,000 – £200,000).

-

Donor’s annual income = £60,000 (so they are a higher-rate taxpayer).

-

Annual CGT exemption (2024/25): £3,000.

-

Nil-rate band for IHT: £325,000.

CGT Now (on gift in 2024/25)

-

Gain = £300,000 – £3,000 exemption = £297,000 taxable gain.

-

CGT rate for residential property (higher-rate taxpayer, after 30 Oct 2024) = 24%.

-

CGT liability = £297,000 × 24% = £71,280.

So, gifting the property now means paying about £71,280 in CGT immediately.

IHT Later (if donor dies within 7 years)

-

The gift is a Potentially Exempt Transfer (PET).

-

If donor dies within 3 years, the full value (£500,000) is chargeable.

-

Deduct nil-rate band (£325,000). Taxable = £175,000.

-

IHT at 40% = £70,000.

➡️ Total tax (CGT + IHT) = £71,280 + £70,000 = £141,280.

If donor survives 7 years

-

PET becomes fully exempt from IHT.

-

Only CGT applies = £71,280.

If donor survives 4 years (taper relief applies)

-

Gift brought into estate, but IHT reduced.

-

Taper relief after 4 years = 60% of full rate.

-

IHT = £70,000 × 60% = £42,000.

-

Total = £71,280 (CGT) + £42,000 (IHT) = £113,280.

Summary Table

| Scenario | CGT (2024/25) | IHT | Total Tax |

|---|---|---|---|

| Gift now, die <3 yrs | £71,280 | £70,000 | £141,280 |

| Gift now, die 4 yrs | £71,280 | £42,000 | £113,280 |

| Gift now, survive 7 yrs | £71,280 | £0 | £71,280 |

👉 Insight:

-

If the donor dies soon after gifting, the family could face both CGT and IHT, costing £141k.

-

Surviving 7 years saves £70k in IHT.

-

Planning (timing, reliefs, spouse transfers) can make a big difference.

How Trueman Brown Can Help

At Trueman Brown, we have up-to-date expertise in dealing with the gift of property under the 2024/25 CGT & IHT rules. Specifically we can:

-

Work out the CGT implications of gifting which property, when, and how—calculating gains, timing, exemptions, reliefs.

-

Assess the IHT exposure for your estate: whether gifts are PETs, if you meet the 7-year survival period, how taper relief might reduce IHT.

-

Identify planning opportunities to reduce both CGT and IHT: for example timing, partial gifts, spouses/partner transfers, structuring ownership, using reliefs.

For a personalised consultation about the gift of property and your tax situation under the current 2024/25 rules, contact us at 01708 397262 or email mark@truemanbrown.co.uk.

Frequently Asked Questions (FAQ)

1. What is my CGT rate on a gift of property in 2024/25?

If the property isn’t your main home (or covered by reliefs), after the £3,000 annual exempt amount, the gain is taxed at 18% if the gain + your income remains in the basic rate band; if it exceeds into higher rate, the portion above is taxed at 24%.

2. Do I need to survive seven years after a gift of property to avoid IHT?

Yes—under current rules, a gift to an individual (not exempt) becomes fully exempt from IHT only if you survive for seven years. If you die sooner, IHT may become payable (with potential taper relief if between 3-7 years).

3. What is the nil-rate band/exemption for IHT?

The nil-rate band is £325,000 per person; gifts and the value of your estate above that threshold may be subject to IHT at up to 40%. Certain reliefs may reduce what counts. GOV.UK+1

4. If I gift property to my spouse, do I avoid both CGT and IHT?

Yes—gifts between spouses or civil partners are generally exempt from both CGT and IHT under the 2024/25 rules.

5. Can I use the CGT allowance more than once or carry it forward?

No, the annual exempt amount is £3,000 for each individual in 2024/25, and you cannot carry over unused allowance (except certain trust-specific rules). CGT must be declared appropriately especially for disposals on or after 30 October 2024 when rate changes came into effect.

Recent Comments