What is an unclaimed child trust fund?

If you were born between 1 September 2002 and 2 January 2011, there’s a chance you may have an unclaimed child trust fund waiting for you.

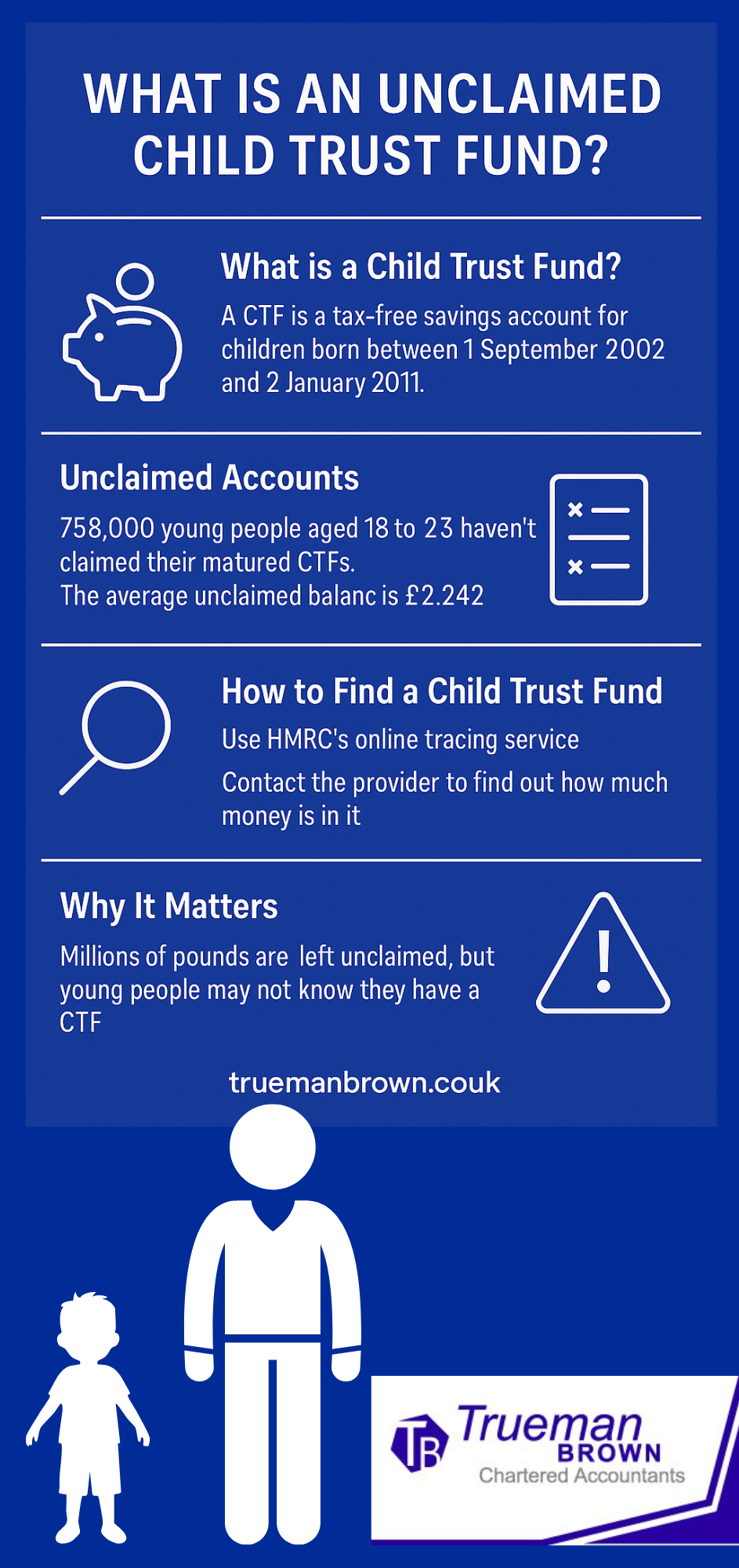

A Child Trust Fund (CTF) was a tax-free savings or investment account set up by the government for children born in that timeframe.

Many young people now aged 18–23 are unaware their account has matured and remains unclaimed.

Why so many unclaimed child trust fund accounts exist

There are a number of reasons why an unclaimed child trust fund may still be lying dormant:

-

The child (now adult) may not realise the account exists.

-

The provider may have changed or the address may be outdated.

-

The account matured at age 18, and the beneficiary did not take action.

-

The account may still be in a “protected account” status with the provider.

According to recent figures, millions of pounds remain in matured CTFs that have never been claimed.

The key rules for 2025/26 regarding child trust funds

Here are the main rule-updates that matter for anyone with an unclaimed child trust fund:

-

The annual subscription/allowance for a CTF (and for a Junior ISA if transferring) remains at up to £9,000 for the tax year 2025/26.

-

Although the scheme is closed to new accounts (since January 2011), existing accounts remain valid.

-

The HM Revenue & Customs (HMRC)-published regulations in July 2025 extend the period during which certain investments remain “qualifying investments” in a CTF until 31 December 2026.

Why you should check your unclaimed child trust fund now

If you have an unclaimed child trust fund, checking it now is wise.

Many accounts have an average value over £2,000.

Leaving the account dormant could mean you miss investment growth, or pay higher fees if the provider’s terms are poor.

Also, taking control gives you flexibility — you could withdraw, transfer to an adult ISA, or reinvest according to your goals.

How to locate your unclaimed child trust fund

Here’s the step-by-step for reclaiming your unclaimed child trust fund:

-

Gather your full name, address, date of birth and National Insurance number (if known). If adopted, you’ll need adoption details.

-

Visit HMRC’s online tracing service (on gov.uk) and input the details. HMRC will tell you which provider holds your account (but not the balance).

-

Contact the provider and ask for the account balance, current investments, fee structure and options for withdrawal or transfer.

-

When you turn 18, you can withdraw the funds or move them into an adult ISA.

How Trueman Brown can help you

When dealing with an unclaimed child trust fund, expert help can make the process smoother.

At Trueman Brown, we assist individuals in tracing, reviewing and optimising these funds.

Here’s how we can support you:

-

We help you navigate the HMRC online service to locate your account.

-

We review your account provider’s terms, investment performance and fees, and advise on whether a transfer is beneficial.

-

We guide you through the withdrawal or transfer process so you make the right decision for your circumstances.

Contact us today:

📧 mark@truemanbrown.co.uk

📞 01708 397 262

With our help, you don’t have to worry about missing out on your funds or making a sub-optimal decision. Let us take the leg-work so you can focus on what you’ll do with your money.

FAQ – Unclaimed Child Trust Fund

Q1: What is an “unclaimed child trust fund”?

A: It’s a CTF that has matured (i.e., the account holder has turned 18) but the funds have not been withdrawn or transferred and the owner may not be aware of it.

Q2: Who is eligible for a child trust fund?

A: Children born between 1 September 2002 and 2 January 2011 were eligible for a CTF.

Q3: Can I still contribute to a child trust fund now?

A: No new accounts can be opened. But if an existing CTF is held, contributions (up to the allowance) could still have been made until the child turned 18.

Q4: What is the annual allowance for 2025/26?

A: The annual subscription limit remains £9,000 for 2025/26.

Q5: What happens when the account holder turns 18?

A: The CTF matures. The account holder can either withdraw the money, leave it invested, or transfer into an adult ISA. Until action is taken, the account may be categorised as an unclaimed child trust fund.

Q6: How can I find out if I have an unclaimed child trust fund?

A: Use HMRC’s online tracing service. Input your details and they’ll tell you which provider holds the account (not the balance). Then contact the provider directly.

Q7: Do I need to pay any fee to trace my CTF?

A: No — the tracing service is provided free by HMRC. You should avoid paying third-party services that charge fees to locate your unclaimed child trust fund.

Q8: What about tax on the funds?

A: Funds in a CTF are tax-free (income tax and capital gains tax) both before and after maturity.

Q9: Should I transfer my CTF to a Junior ISA or adult ISA?

A: It depends on your age and the account terms. For younger children (<18) transferring to a Junior ISA may give better investment options or lower fees. If you’re 18 or over, moving to an adult ISA may be sensible. Review your account’s terms and performance.

Q10: What are the key rule changes for 2025/26?

A: While the core CTF rules remain, notable changes include the extension of qualifying investment status for certain assets until 31 December 2026 under the 2025 Amendment Regulations.

Recent Comments