VAT on Business Car Purchase: What You Need to Know

Claiming VAT on business car purchase can be a minefield for UK businesses. HMRC’s rules are strict—input VAT is generally blocked unless the car is used exclusively for business and not available for private use.

This blog breaks down the latest guidance, real-world case law, and how to avoid common pitfalls when reclaiming VAT on vehicles.

When Can You Claim VAT on Business Car Purchase?

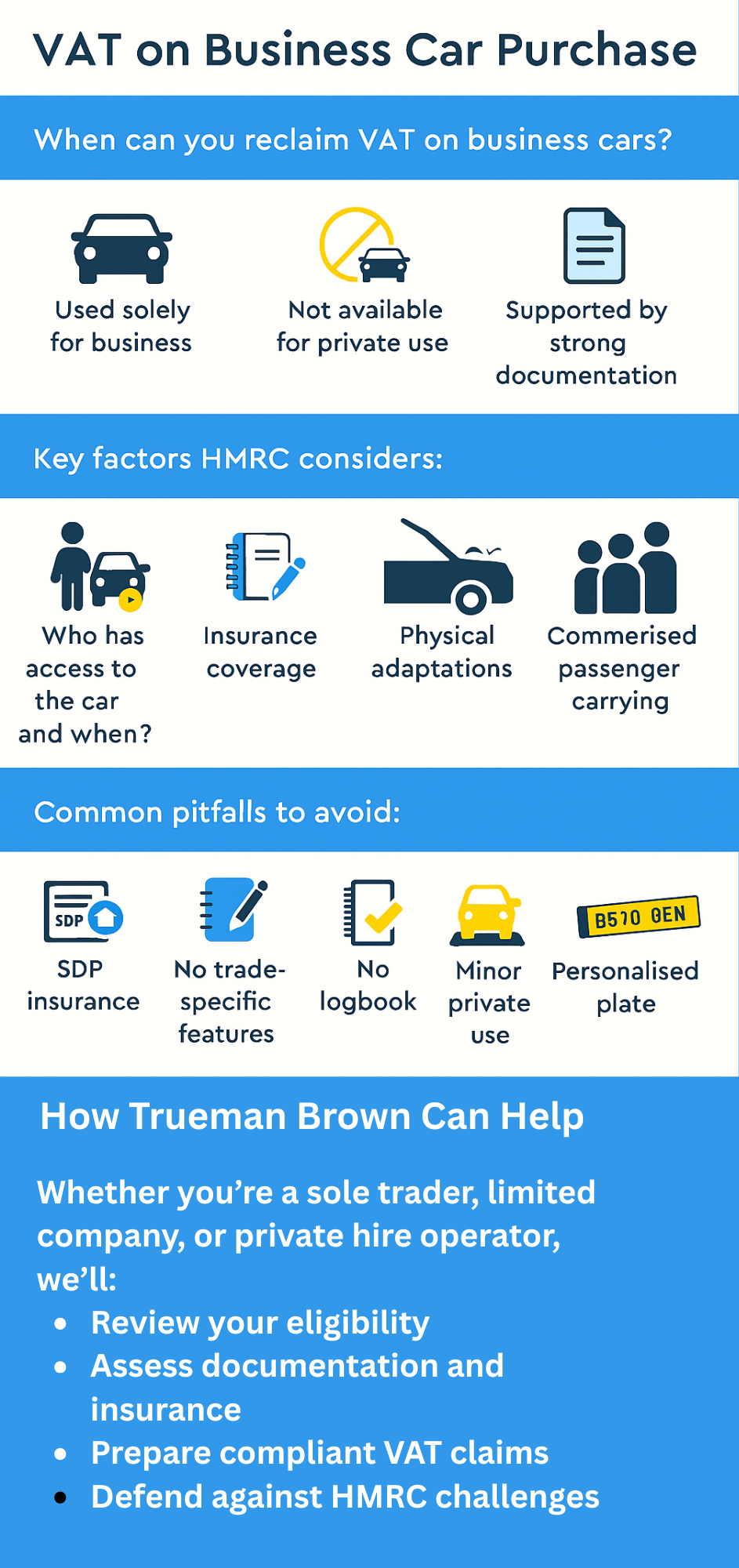

HMRC allows input VAT recovery only if the car is:

- Used solely for business

- Not available for private use

- Supported by strong documentation

Examples of qualifying use include driving schools, taxi firms, and private hire businesses.

Even minor private use can invalidate the claim.

Case Study: Church Farm v HMRC

In the case of Maddison and Ben Firth T/A Church Farm v HMRC (2002), the business claimed VAT on business car purchase for two vehicles used in wedding and event planning.

HMRC rejected the claim due to:

- Insurance policies covering “Social, Domestic and Pleasure”

- Lack of evidence proving exclusive business use

- No adaptations or features indicating trade-specific use

The Tribunal ruled that the cars were available for private use, and therefore input VAT could not be reclaimed.

Key Factors HMRC Considers

To successfully claim VAT on business car purchase, HMRC will assess:

- Who has access to the car and when

- Whether a logbook is maintained

- Insurance coverage (business-only vs SDP)

- Physical adaptations for business use

- Evidence of commercial passenger carrying (for hire)

Even a valid operator licence won’t override private-use indicators like SDP insurance or impractical vehicle choice.

Common Mistakes to Avoid

- Claiming VAT on cars with SDP insurance

- Using vehicles with no trade-specific features

- Failing to keep journey logs

- Assuming minor private use is acceptable

- Claiming VAT on personalised number plates (e.g. “BS70 BEN”) not linked to the business name

HMRC has rejected claims where the number plate was deemed personal branding rather than business advertising.

How Trueman Brown Can Help with VAT on Business Car Purchase

At Trueman Brown, we help businesses across South Ockendon, Thurrock, and Essex navigate the complexities of VAT on business car purchase. Whether you’re a sole trader, limited company, or private hire operator, we’ll:

-

Review your eligibility

-

Assess documentation and insurance

-

Prepare compliant VAT claims

-

Defend against HMRC challenges

📧 Email: 📞 Call: 01708 397262

We’ll make sure your claim is watertight and your business stays compliant.

FAQs on VAT on Business Car Purchase

Q: Can I claim VAT on a car used partly for personal errands?

A: No. HMRC requires exclusive business use with no availability for private use.

Q: Does SDP insurance automatically block VAT recovery?

A: Yes. Even if private use doesn’t occur, the availability implied by SDP insurance is enough to deny the claim.

Q: What if I use the car for private hire?

A: You may qualify if the car is insured for commercial passenger use and meets HMRC’s criteria.

Q: Can I claim VAT on a personalised number plate?

A: Only if it clearly advertises the business. Personal names or initials are unlikely to qualify.

Q: Is a logbook mandatory?

A: While not legally required, a detailed logbook strengthens your case and is highly recommended.

Recent Comments