When Do You Need to Complete VAT Registration and How to Do It?

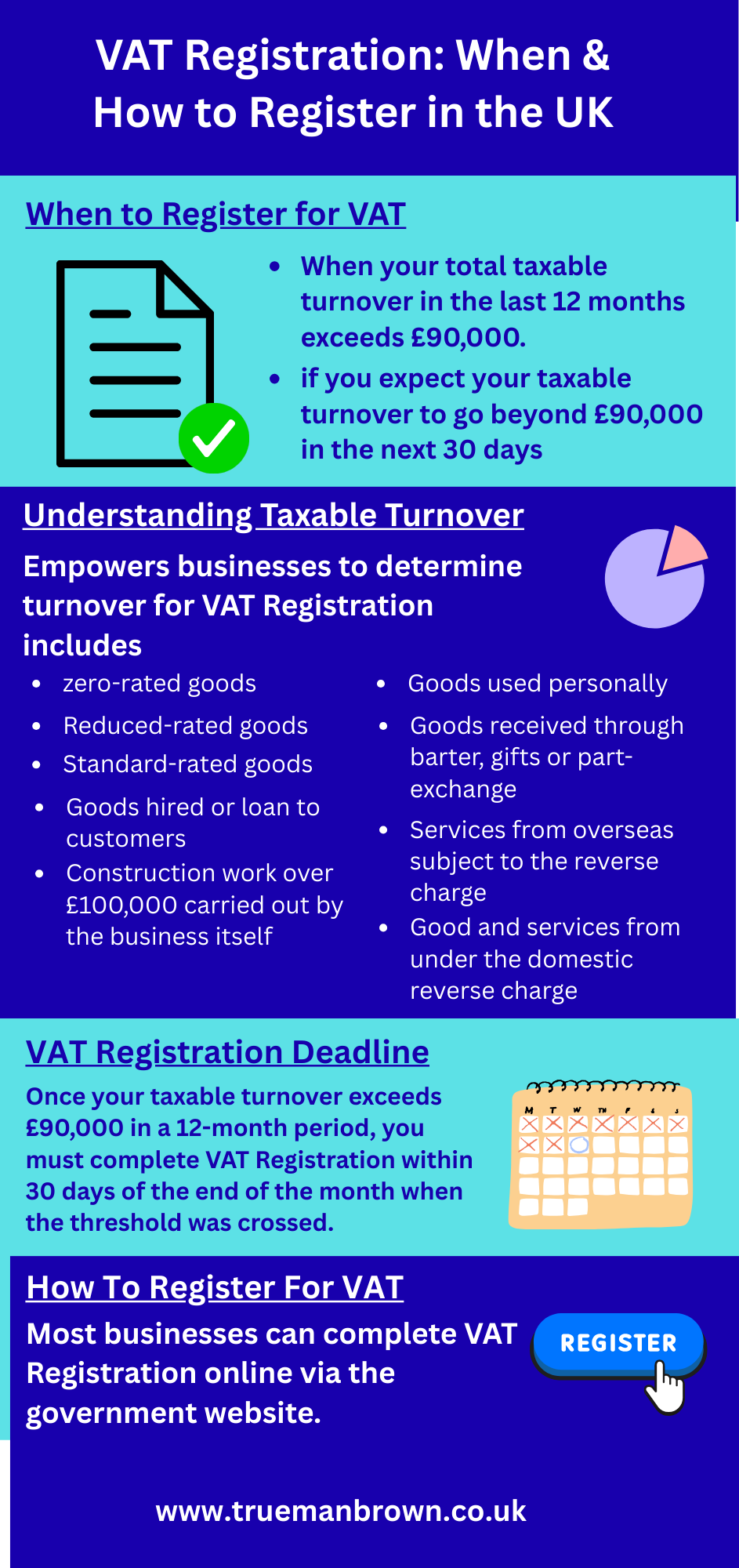

If you’re running a business in the UK, whether as a sole trader, partnership, or limited company, VAT Registration is a legal requirement once your total taxable turnover in the last 12 months exceeds £90,000.

Similarly, if you expect your taxable turnover to go beyond £90,000 in the next 30 days, you must register promptly.

Even if both you and your business are based outside the UK, you are still required to complete VAT Registration if you supply goods or services to UK customers.

Understanding Taxable Turnover

The key trigger for VAT Registration is your taxable turnover.

This includes almost everything you sell that isn’t exempt from VAT. Examples of what must be included in your calculation are:

-

Goods that are zero-rated, reduced-rate, or standard-rate

-

Goods hired or loaned to customers

-

Business goods used personally

-

Goods or services received through barter, part-exchange, or gifts

-

Services from overseas subject to the reverse charge

-

Goods and services under the domestic reverse charge

-

Construction work over £100,000 carried out by the business itself

Deadlines

Once your taxable turnover exceeds £90,000 in a 12-month period, you must complete VAT Registration within 30 days of the end of the month when the threshold was crossed.

-

Example 1: Bella, a sole trader, exceeded the VAT threshold on 7 July 2025. She must complete VAT Registration by 30 August 2025, with an effective date of 1 September 2025.

-

Example 2: Cameron signs a contract on 17 July 2025 worth £102,000. He must register by 16 August 2025. His VAT Registration takes effect immediately from 17 July, meaning he must charge VAT on the goods delivered.

Failure to register on time can result in having to pay VAT retroactively and may also lead to penalties. Businesses whose turnover exceeds the threshold only temporarily can apply for an exemption from registration.

How to Complete VAT Registration

Most businesses can complete VAT Registration online via the government website. The documents and details required will depend on the type of business structure.

-

Individuals or partnerships: National Insurance Number, ID (passport), bank account details, UTR, annual turnover, and projected turnover for the next 12 months.

-

Companies: Company registration number, bank account details, UTR, annual turnover, and estimated turnover.

Some businesses cannot register online and must use a postal application—for example, those joining the agricultural flat rate scheme.

Voluntary VAT Registration

Even if your business turnover is below the threshold, you may opt for voluntary registration.

Doing so means you must charge VAT on taxable sales, but you’ll also be able to reclaim VAT on purchases.

This can be particularly beneficial if you sell zero-rated goods but regularly incur VAT on business expenses.

How Trueman Brown Can Help with VAT Registration

At Trueman Brown, we understand that VAT Registration can feel complex and time-consuming. Our expert advisors can guide you through the entire process—from calculating taxable turnover to submitting your application correctly and on time. We also provide advice on voluntary registration and ensure you avoid costly mistakes such as late registration penalties.

📧 Contact us today at mark@truemanbrown.co.uk

📞 Or call us directly on 01708 397262

VAT Registration FAQs

1. What is the VAT Registration threshold in the UK?

The current threshold is £90,000 in taxable turnover over 12 months or in the next 30 days.

2. Can I register for VAT voluntarily?

Yes. Voluntary VAT Registration allows you to reclaim VAT on expenses, which can be advantageous for some businesses.

3. What happens if I register late?

You may need to pay VAT from the date you should have registered and could face penalties.

4. How long does VAT Registration take?

Online applications are usually processed within a few weeks, but postal applications may take longer.

5. Can overseas businesses register for VAT in the UK?

Yes. If you supply goods or services in the UK, VAT Registration is required regardless of your turnover.

Recent Comments