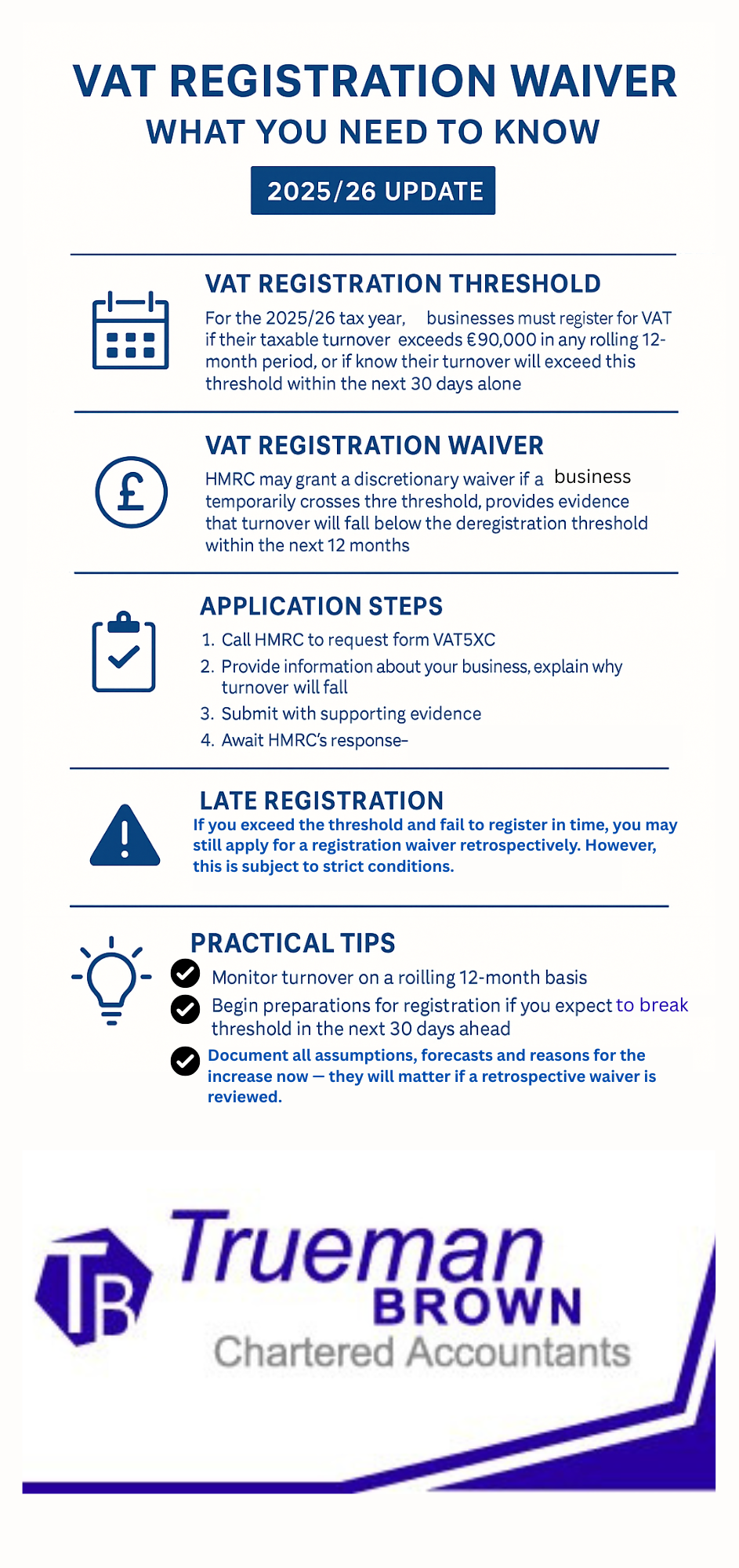

VAT Registration and Exceptions – Key Summary

1. Registration Requirement

-

Threshold: VAT registration is compulsory when taxable turnover exceeds £90,000 in any 12-month rolling period, or is expected to exceed that amount in the next 30 days alone.

-

Deadline: Registration must occur within 30 days of the end of the month in which the limit is exceeded (or within the 30-day forecast period).

-

Consequences of delay: Late registration can result in penalties, interest, and retrospective VAT liabilities.

2. HMRC Discretion – VAT Registration Exception

HMRC may waive the requirement to register if the business can demonstrate that the breach of the threshold is temporary.

Example:

A business generally has a turnover below £90,000 but temporarily exceeds it due to a one-off sale or short-term event.

If the business expects turnover to drop below the deregistration threshold (£88,000) in the following 12 months, it can apply for a registration exception.

3. When might a VAT registration waiver apply?

Some common scenarios where you might seek a VAT registration waiver:

-

A business that consistently turns over, say, £70,000-£80,000, has one large contract that pushes the 12-month total above £90,000, but expects to revert to normal levels the next year.

-

A seasonal or sporadic increase in sales (for example, an event-based business) that is not expected to repeat.

-

A business that makes mostly zero-rated supplies and therefore would be in a net refund position, but unexpectedly crosses the threshold and wishes to avoid the burden of registration.

In all these cases the key test is future expectation: does the business reasonably expect turnover to fall and stay below the deregistration threshold? If yes, a waiver may be granted.

4. How to apply for a VAT registration waiver

To apply for a VAT registration waiver, you should follow these steps:

-

Contact HMRC by telephone to request the waiver (exception) form – VAT 5EXC. At the same time you may need the standard registration form VAT1 if registration is still required or being initiated.

-

Complete the forms, providing details of your business, nature of supplies, turnover history, and importantly a projection of your taxable turnover for the next 12 months showing you expect to fall below the deregistration threshold.

-

On the VAT 5EXC you must answer the key question:

“Please explain why you thought, at the time your turnover went over the registration limit, your turnover would be back below the deregistration limit within the next 12 months.”

Your answer must clearly explain the why and the how of the drop in turnover — not merely an intention to reduce workload or slow business. -

Submit any supporting evidence (e.g., contract documentation, market analysis, forecasts).

-

HMRC will reply (typically within ~40 working days) confirming whether the waiver is accepted.

-

If the waiver is granted, continue monitoring turnover monthly so you know when you may again breach the threshold and be obliged to register.

5. Late registration, waiver and retrospective issues

If you exceed the threshold and fail to register in time, you may still apply for a registration waiver retrospectively.

However, this is subject to strict conditions:

-

HMRC will evaluate whether, at the time you exceeded the limit, the information you had would have justified granting an exception.

-

If you expect to exceed the limit again in the next 30 days, or your turnover is likely to stay above the threshold, a waiver will almost certainly be refused.

-

If the waiver is refused, you will be treated as having been required to register from the effective date of breach, and you may owe back-dated VAT, plus interest and potential penalties.

A case that underscores the importance of the form answer is Dawn Kaffel v HMRC.

In that 2025 decision, the tribunal rejected the waiver because the taxpayer indicated future plans to reduce workload rather than demonstrating a genuine temporary spike in turnover — meaning the turnover was likely to remain high.

6. Practical implications for your business

-

Regularly monitor your taxable turnover on a rolling 12-month basis and watch for when you approach the £90,000 threshold.

-

If you foresee breaching the threshold in the next 30 days, begin preparations for registration immediately.

-

If a temporary increase pushes you just over the threshold and you believe turnover will return below £88,000, consider applying for a VAT registration waiver.

-

Document all assumptions, forecasts and reasons for the increase now — they will matter if a retrospective waiver is reviewed.

-

Be aware that once registered, you must charge VAT, submit returns (usually quarterly under the standard regime), keep digital records under Making Tax Digital (MTD) requirements and monitor turnover to deregister when eligible.

-

Failure to act can lead to back payments, interest charges, and penalties.

🤝7. How Trueman Brown can help

At Trueman Brown we regularly assist businesses with VAT registration, monitoring turnover, and applications for a VAT registration waiver.

If you’re nearing the threshold, facing a one-off turnover spike, or want to ensure you comply with the 2025/26 rules around the £90,000 threshold and £88,000 deregistration limit, we can help you:

-

Prepare the necessary forms (VAT1 and VAT5EXC).

-

Analyze your turnover trends and projections.

-

Draft the key explanation required on VAT5EXC to support your waiver case.

-

Establish ongoing monitoring procedures so you remain compliant.

Please contact us at mark@truemanbrown.co.uk or call 01708 397 262 to discuss how we can assist your business.

8. FAQs – VAT Registration Waiver

Q: What is the registration threshold I must watch for in 2025/26?

A: The threshold for compulsory VAT registration is £90,000 taxable turnover in any rolling 12-month period.

Q: What is the deregistration threshold relevant for a waiver?

A: The deregistration threshold (below which turnover must fall to justify a waiver) is currently £88,000.

Q: Can I apply for a waiver if my turnover will exceed the threshold again?

A: No — if you reasonably expect to exceed the threshold again in the next 12 months (or next 30 days), HMRC is extremely unlikely to grant a waiver.

Q: What happens if I don’t apply and exceed the threshold?

A: You must register within 30 days of the month end in which you exceeded the threshold (or expected to within 30 days). Failure may lead to retrospective VAT liabilities, interest, and penalties.

Q: Is a waiver guaranteed if I apply?

A: No — HMRC will assess the facts, your projections and whether your turnover spike was genuinely temporary. Evidence matters.

Q: Do I still have to apply digital record-keeping under MTD even if I’m applying for a waiver?

A: Yes — if you are required to register for VAT under the standard rules or become registered, you must comply with MTD for VAT (digital records and submissions).

Q: Can I voluntarily register for VAT to avoid tracking thresholds?

A: Yes — businesses whose turnover is below the threshold can register voluntarily. This may be advantageous (for reclaiming input VAT, dealing with VAT-registered customers, or improving business credibility) but it also means additional admin and compliance.

If you’d like a customised briefing note for your business regarding the VAT registration waiver and how it might apply to your specific turnover profile, I’d be happy to prepare one.

Recent Comments