Should you pay voluntary National Insurance contributions?

If you’re wondering whether it’s worth paying voluntary National Insurance contributions, this article from Trueman Brown (01708 397262, mark@truemanbrown.co.uk) explains the current rules, costs, benefits and how to decide.

Contributions into your National Insurance record help build up entitlement to the state pension and certain contributory benefits.

Making voluntary National Insurance contributions can sometimes fill gaps in your record and increase your pension — but only if it makes financial sense.

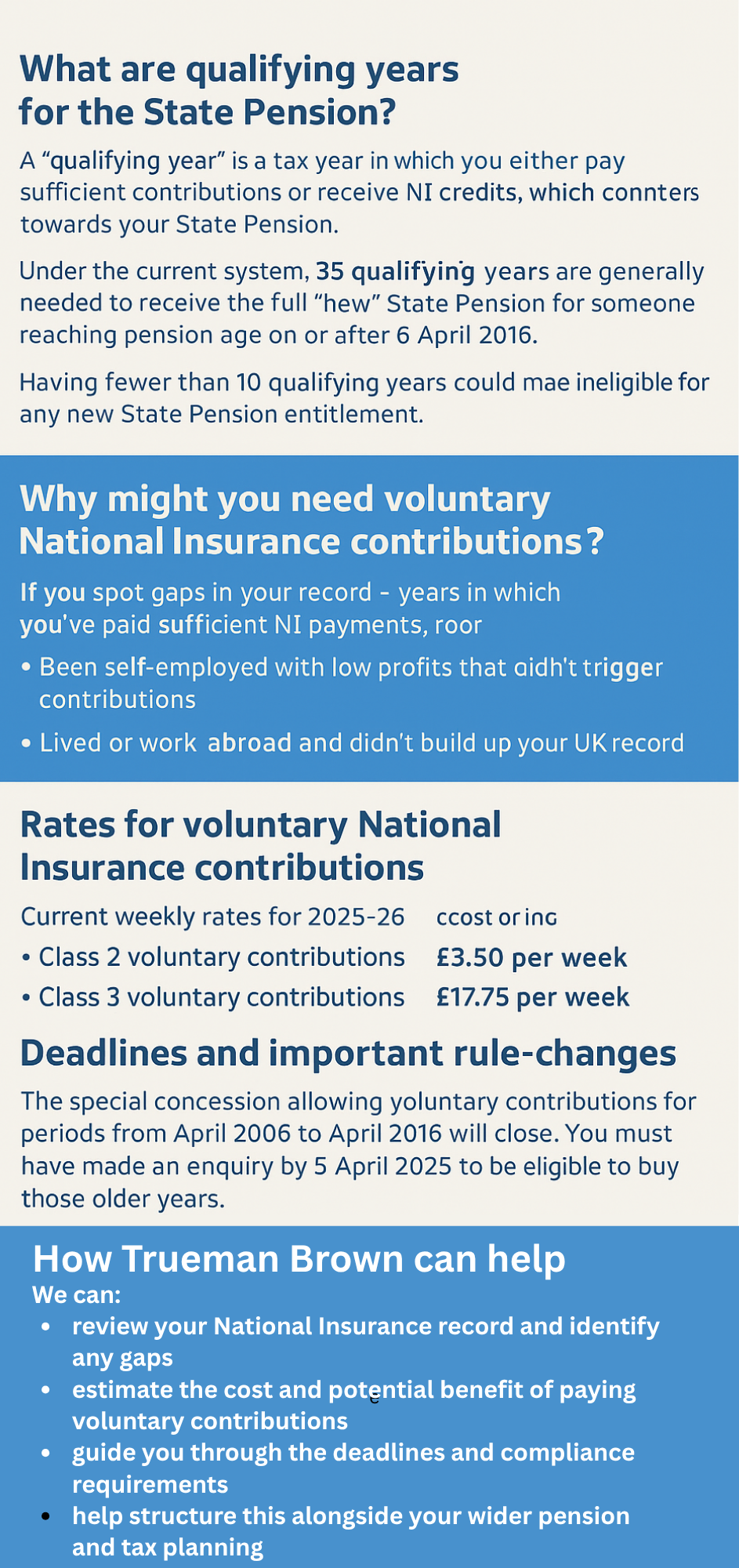

What are qualifying years for the State Pension?

A “qualifying year” is a tax year in which you’ve either paid sufficient contributions or received National Insurance credits.

Without enough qualifying years, your pension or benefits could be reduced.

Under the current system, you generally need 35 qualifying years to receive the full “new” State Pension for someone reaching pension age on or after 6 April 2016.

If you have fewer than 10 qualifying years, you may be ineligible for any new State Pension entitlement.

Why might you need voluntary National Insurance contributions?

If you spot gaps in your record — years in which you neither paid nor received NI credits — you may consider paying voluntary National Insurance contributions to convert those years into qualifying years.

This is particularly relevant if you’ve:

-

been out of work and didn’t claim the relevant credits

-

been self-employed with low profits that didn’t trigger contributions

-

lived or worked abroad and didn’t build up your UK record fully

Filling gaps can increase your State Pension entitlement.

Rates for voluntary National Insurance contributions

Here are the current weekly rates for voluntary National Insurance contributions:

-

Class 2 voluntary contributions: £3.50 per week for 2025-26.

-

Class 3 voluntary contributions: £17.75 per week for 2025-26.

Do note: if you are making up contributions for earlier years, you may need to pay the rate applicable in the year you are “buying back”, or in many cases the current year’s rate will apply.

Deadlines and important rule-changes

Until now you could back-date voluntary National Insurance contributions for many years in the past. However the rules are changing:

-

The special concession allowing voluntary contributions for periods from April 2006 to April 2016 will close. You must have made an enquiry by 5 April 2025 to be eligible to buy those older years.

-

From 6 April 2025 onwards, you will generally only be able to make voluntary contributions to make up gaps covering the last six tax years.

-

The “new” full State Pension rate will increase — for 2025-26 it is £230.25 per week.

So if you have gaps earlier than the last six years, you’ll need to act promptly if you want to “top up” those years.

How to decide if it’s worth paying voluntary National Insurance contributions

Before you decide to pay voluntary contributions, consider the following steps:

-

Check your National Insurance record via your personal tax account on GOV.UK to identify gaps and see your estimated State Pension.

-

Compare the cost of paying voluntary contributions with the additional pension benefit you expect to receive. For example, with Class 3 at £17.75 a week (2025-26) — about £923 a year – you’ll want to know how long you’d live in retirement to recoup that cost.

-

Consider other options first: could you get free National Insurance credits for caring, unemployment, etc?

-

If you’re already on track to get full qualifying years (35), paying extra may not add value. Remember after 35 years you don’t increase your pension further just by adding years.

Key changes you need to be aware of

-

From 6 April 2025 the window for back-dating voluntary contributions is restricted to six years. So timing is critical.

-

Rates have increased: for voluntary contributions Class 2 rises to £3.50/week, Class 3 to £17.75/week for 2025-26.

-

Full new State Pension is now £230.25/week (2025-26).

-

If you already have 35 qualifying years you may not benefit from further voluntary contributions.

-

Be careful not to pay upfront without checking that you will actually benefit.

How Trueman Brown can help

If you’d like help analysing whether voluntary National Insurance contributions are right for you, Trueman Brown can support you.

We can:

-

review your National Insurance record and identify any gaps

-

estimate the cost and potential benefit of paying voluntary contributions

-

guide you through the deadlines and compliance requirements

-

help structure this alongside your wider pension and tax planning

Feel free to get in touch: mark@truemanbrown.co.uk or call us on 01708 397262.

We’re here to support you to make the right decision about your State Pension and NI record.

Frequently Asked Questions (FAQ)

Q: What is a qualifying year?

A qualifying year is a tax year in which you either pay sufficient National Insurance contributions or receive NI credits, which contributes towards your State Pension entitlement.

Q: How many qualifying years do I need to get the full State Pension?

You generally need 35 qualifying years to secure the full new State Pension if you reach pension age on or after 6 April 2016.

Q: What is the deadline for paying voluntary National Insurance contributions?

If you are making up gaps from more than six years ago (e.g., 2006-2016), you needed to make an enquiry by 5 April 2025. From 6 April 2025 you will generally only be able to make voluntary contributions for the previous six tax years.

Q: How much will voluntary National Insurance contributions cost?

For tax year 2025-26 the rates are: Class 2 £3.50/week, Class 3 £17.75/week. For missing years you’ll often pay the current rate or possibly the rate for that year.

Q: Will paying voluntary contributions always increase my pension?

Not always. It depends on how many qualifying years you already have, how many gaps remain, your age (how many years you’ll receive pension), and whether you can instead obtain free NI credits. It’s important to calculate whether the cost of paying is outweighed by the additional pension.

Q: Can I use voluntary contributions if I am already receiving the State Pension?

If you’ve already reached State Pension age and you’re already in receipt of the full new State Pension, it’s very unlikely voluntary contributions will increase it. Check carefully with your forecast.

Q: What happens if I miss the deadline?

If you’re past the deadline for older years, you may no longer be able to buy those years back and thus could lose the chance to secure those additional qualifying years. From 6 April 2025, only the last six tax years will generally be available for topping up.

Recent Comments